End of Year Checklist For Credit Cards and Loyalty Programs

It’s December! This means you only have a month to maximize your Calendar Year Benefits and finish any spending/stay requirements. I’m talking about things like your Citi Prestige and Amex Platinum Travel Credits as well as the Ritz Carlton 75K Spend for automatic Platinum Status. As always, if I leave something out, feel free to comment below, holler at me on Twitter @bethanyatM2M or message me in the facebook group.

Checklist

- Use Your Travel Credits

- Apply Now To Get Double Credits

- Meet you spending thresholds

- Last Chance to leverage your valuable Elite Status

- Finish stay or flight requirements

Calendar Year Travel Credits

Many cards offer yearly travel credits for each calendar year. Make sure you cash in on those if you haven’t already. Also, keep in mind some require that the qualifying charges post to your December billing cycle. It’s better to use your credits now to ensure there aren’t any issues with them not posting in time. We have a pretty thorough list of Travel Credits and how and when to use them– I recommend you check it out if you have any premium cards. Also, check out this article for strategy if you have a bunch and need a little guidance.

Examples of Cards With Yearly Travel Credits- Full List

- American Express Platinum Card- $200 Airline Fee Credit

- Citi Prestige- $250 Airfare Credit

- Chase Ritz Carlton- $300 Travel Credit

Apply Now To Get Double Travel Credits

If you are considering applying for a premium card like those discussed in the last section with the yearly travel credits- now is a great time to do so. By applying NOW (definitely don’t wait because you may run out of time or be delayed in receiving your card) you may be able to double dip the travel credit and get it for 2017 and 2018 but still only pay one annual fee.

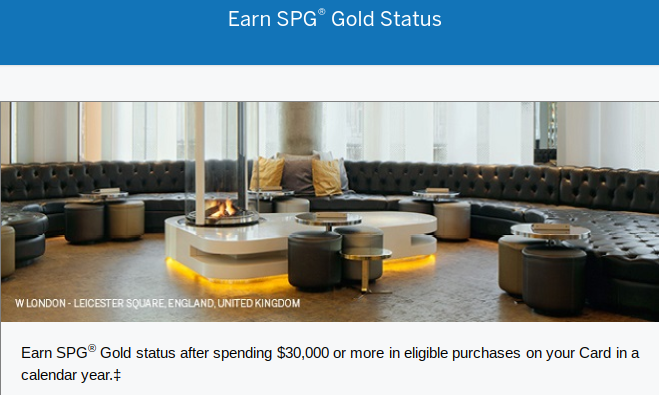

Yearly Spending Requirements

Certain cards have minimum spending thresholds that’ll get you bonus points, status or other perks like free companion airfare. For example, if you spend 30k on a British Airways Visa Signature Card in the calendar year, you’ll get a Travel Together Pass (basically a companion ticket to bring someone else on an award flight).

You should check your accounts to see if there are any spending requirements that you are close to hitting for the year. To check total spending, log in to your online accounts and select activity for 2017 or “Year to Date”. If you’re close, you might as well concentrate your spending for the rest of the year on that card to make sure you don’t miss out.

Other Examples

- Marriott Rewards Credit Card- Earn one qualifying night toward elite status for every $3,000 of spend in a year.

- Virgin Atlantic World Elite Mastercard- Spend $25,000 in a calendar year and get 15,000 Bonus Miles

- Starwood Preferred Guest Business Credit Card- Earn Gold Elite status when you spend $30,000 in a calendar year.

Status Match Opportunities

If you’re in a situation where you are going to lose elite status, you should see if there any status match promotions you can take advantage of. Statusmatcher.com is a great site to find examples and data points for current status match opportunities. If you’re lucky, you’ll be able to match and receive elite status through 2019.

Of course, we never know when or if programs will offer matching opportunities, but we do know that it happens pretty regularly and the only way to get a match is to have some status. If we’re lucky, we can match back later in the year. This is a worth-while use of your time if Elite status is important to you.

Examples of Status Match opportunities

-

MileagePlus Premier Status Match Challenge- you must submit your request by December 31st. Your account will be upgraded for 90 days to Premier Silver, Premier Gold or Premier Platinum status based on the level you hold in your current frequent flyer program.

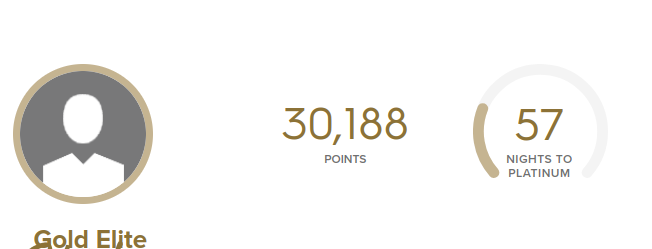

Elite Stay Requirements

Sometimes we don’t realize just how close we are to qualifying for elite status. You should check your most used loyalty programs now to see how close you are to qualifying for the next tier level. If you happen to see that you only need 1 or 2 more stays or flights to hit the next level, you still have time to make that happen! Don’t forget to make sure you’re also signed up for any year-end promotions before you make your qualifying travel plans! It would be a shame to miss the opportunity for bonus points or nights.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.