Citi AAdvantage Executive Card Changes

Update: Citi has confirmed these changes by email, and also revealed that there’s a new bonus coming on July 23 (that’s the actual launch date for the card refresh):

For a limited time, from July 23, 2023 to September, 6, 2023, customers who apply and are approved for the Citi/AAdvantage Executive Card, can earn 100K AAdvantage Miles after spending $10,000 within the first three months of account opening.

They also revealed that the Admiral Club membership fee will increase to $850 on the same date.

We have already heard rumors that the Citi AAdvantage Executive Card annual fee is going up, and that a fee will be added for authorized users. While the annual fee increase is less than expected, the new fee for authorized users is confirmed. We also have a list of some of the new benefits, and the date when all the changes are expected to happen.

The new information comes from JonNYC on Twitter with screenshots that show a date of July 24, 2023.

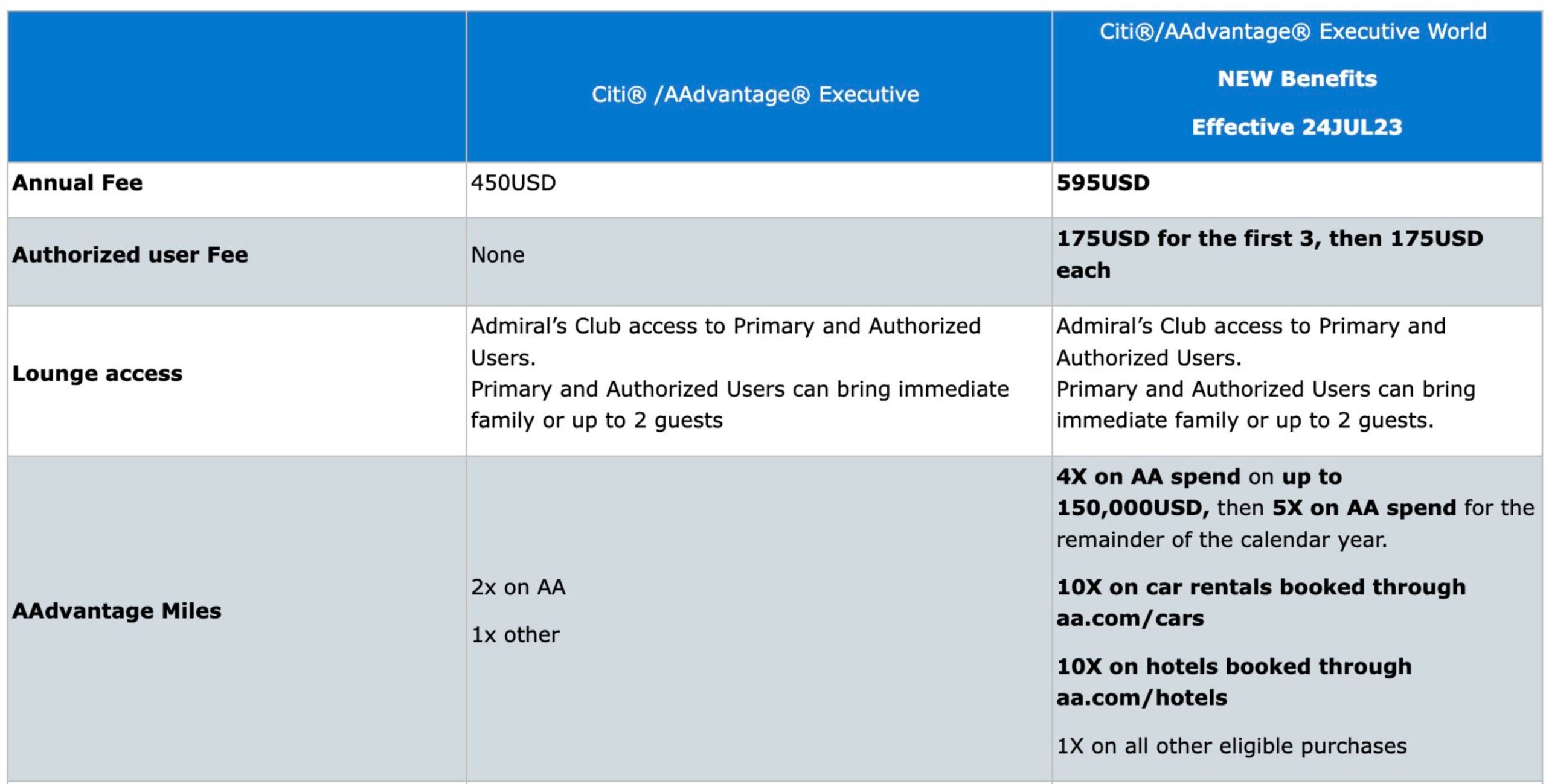

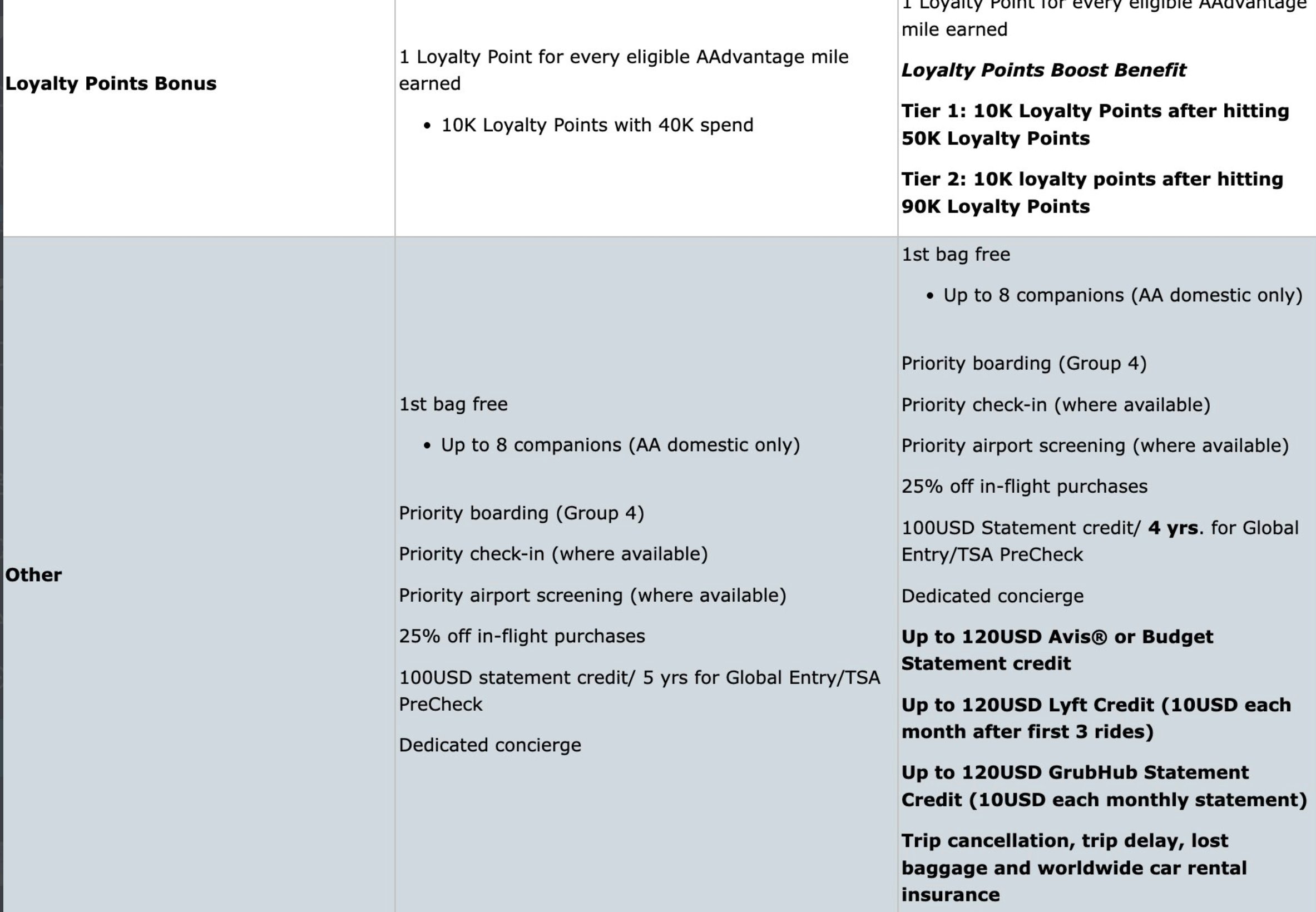

Annual Fee Increase

The annual fee is going up to $595, instead of the previously rumored $650. As for authorized users who were previously free, there’s now a $175 fee for the first three, and then $175 each after that.

Adding free authorized users to the card was one of the best perks as they get Admiral’s Club access. Now you have to pay for those users, with a pricing structure similar to Amex Platinum.

New Benefits

With the increased annual fees, there are also some new benefits:

- Better earning rates:

- 4X on AA spend on up to $150K annually, then 5X on AA spend for the remainder of the year.

- 10X on car rentals booked through aa.com/cars

- 10X on hotels booked through aa.com/hotels.

- Loyalty Points Boost:

- 10K Loyalty Points after reaching 50K Loyalty Points

- Another 10K Loyalty Points after reaching 90K Loyalty Points

- New Statement Credits:

- Up to $120 Avis or Budget Statement Credit

- Up to $120 Lyft Credit ($10 each month after first three rides)

- Up to $120 Grubhub Credit ($10 each month)

- Travel Insurance

- Trip Cancellation & Interruption Protection

- Trip Delay Protection

- Lost Baggage Protection

- Worldwide Car Rental Insurance Coverage

They shouldn’t even list the Lyft credit, that’s ridiculous. And I think that’s a Mastercard World Elite perk, not even a card-specific perk.

Hah Hah there go all the free loaders in American Clubs crushing their loyalists family and friends like cockroaches

All in the name of improved cuisine?Even their First class cabins are typically rubbish on board sadly

Hard pass !

Danny, if someone did a product change from the Mile Up card to the Executive card right now, when the annual fee is $450, the new benefits and earn rates would kick in on 24th July as any other pre-existing cardholder, correct?

I would assume so.

This is awful… I’ll drop this and return to the Venture X or Platinum. WTF is Up to 120USD Lyft Credit (10 USD each month after the first 3 rides)…

Chase Sapphire RESERVE – get 10x points for Lyft rides, Lyft Pink membership free for 1 year… then you can transfer out those chase points to other brands – Hyatt Hotels (1:1) and Hyatt points are worth their weight….

I don’t see how AA plans to compete with Amex Plat or even the Capital One Venture X given the near $600 Annual Fee. Unless someone lived in an American Airline hub (MIA, DFW, etc.), the increased AF seems wholly unjustified.

Though I am curious whether any prior authorized user would be grandfathered in.

Cheers,

Avi Kerendian

I wonder if free authorized user will be grandfathered in until your next annual fee comes up.

This is what Citi said about AF for existing cardholders: Citi will be notifying existing Citi / AAdvantage Executive cardmembers in the coming weeks if their annual membership fee is increasing, and, if so, when the change will take effect. New customers who apply for the Citi /AAdvantage Executive Card on or after July 23, 2023, will be charged the new annual membership fee of $595. Existing Citi / AAdvantage Executive cardmembers will be notified of the annual membership fee and authorized user fee changes at least 45 days before their accounts are charged the new fee.