Major Changes for United MileagePlus Program

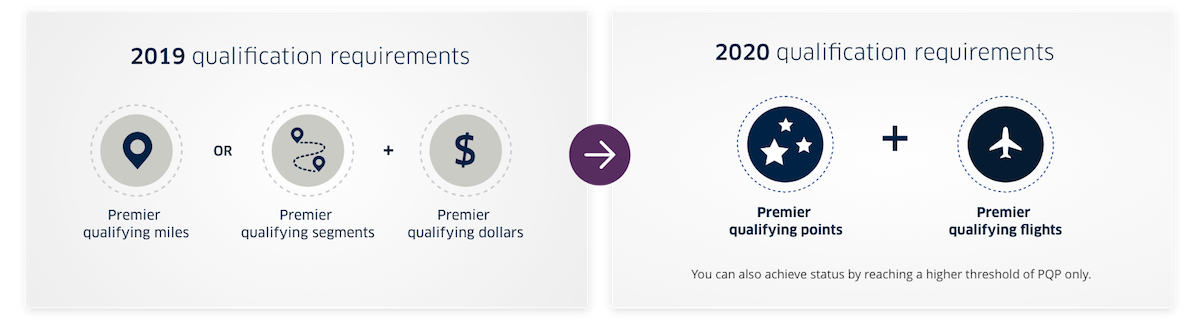

United Airlines announced major changes today to the way most frequent fliers earn Premier status in the MileagePlus program. Starting in January, the basis for earning Premier status will be based solely on two things, how much you spend with United and how many flights you take. Mileage will no longer matter in the MileagePlus program.

United says that the new program should make it “more transparent and easier to understand how to earn and track progress toward Premier status”.

New Qualification Requirements

Starting in 2020, MileagePlus elite qualification will be based on Premier Qualifying Points and Premier Qualifying Flights.

A qualifying flights means one takeoff and landing. It doesn’t matter on what class you’re flying, as long as it is not Basic Economy. Those don’t count.

Premier Qualifying Points will be based on how much you spend. Spending on these items will still count, the same as before:

- Base fare plus surcharges

- Economy Plus seating or subscriptions

- Preferred seat purchases

But with the changes, spend also counts on:

- MileagePlus Upgrade Award co-pays

- Paid upgrades

- Flights ticketed and operated by Star Alliance partners

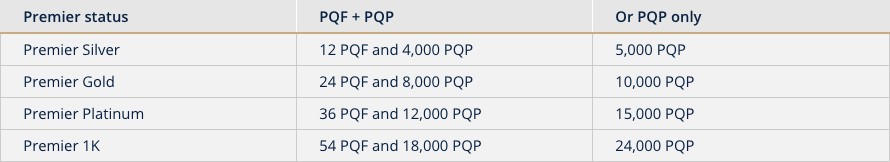

Here’s how much you need to qualify for each tier:

Earning On Partner Airlines

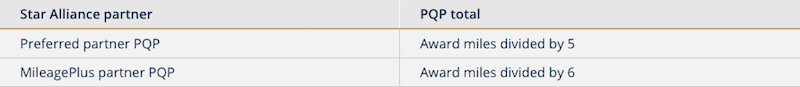

This is a positive change. Beginning January 1st, partner flights will earn PQPs, even if they are not ticketed by United. Here’s how much you can earn:

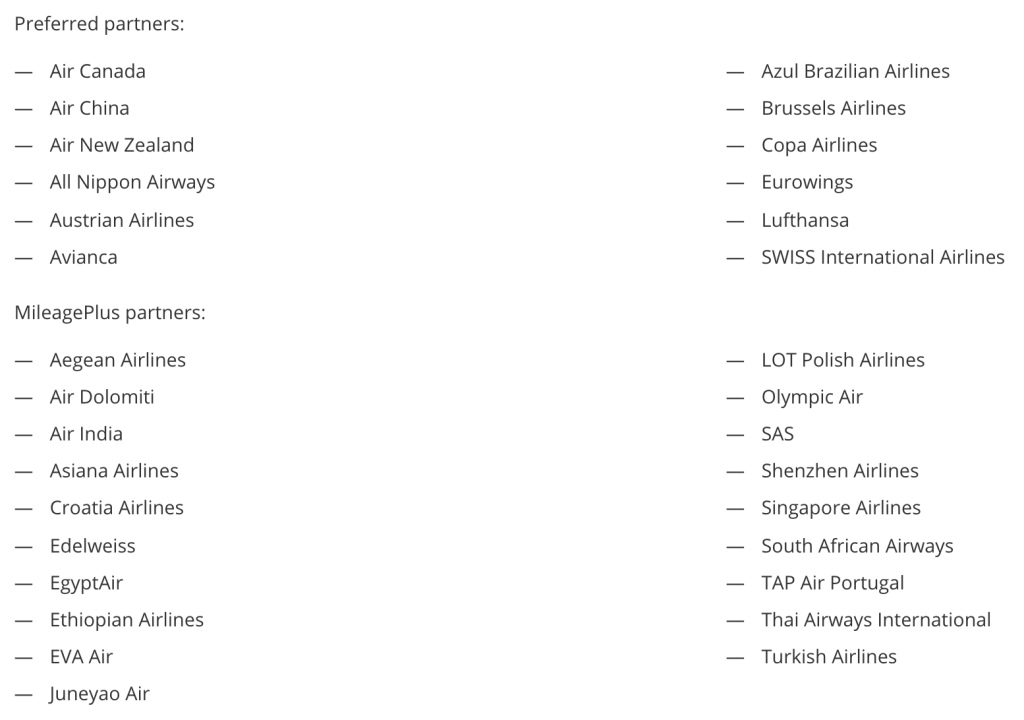

Here’s the list of partners:

United Airlines Credit Cards

Currently, members spending at least $25,000 per year on a United credit card are able to waive the spend requirement to rise to elite levels. That will change.

Moving forward, cardmembers will earn 500 PQPs toward status by spending $12,000, and an additional 500 or more PQPs when they spend an additional $12,000. Here’s how much you can earn with each card:

- The United Explorer Business Card, United Club Card, United Explorer Business Card, United Club Business Card, United MileagePlus Awards Card, United MileagePlus Card, and United MileagePlus Business Card, will earn 500 PQP for every $12,000 in spending, up to a maximum of 1,000 PQP in a calendar year, which can be applied up to Platinum status

- The United MileagePlus Select Card and United MileagePlus Platinum Class Visa Card will earn 500 PQP for every $12,000 in spending, up to a maximum of 3,000 PQP in a calendar year, which can be applied up to 1K status

- The United Presidential Plus Card and United Presidential Plus Business Card earn will earn 500 PQP for every $12,000 in spending, up to 10,000 PQPs in a calendar year, which can be applied up to 1K status

Conclusion

If you’re not a frequent short-haul fliers or very big spender, then you’re likely not very happy with these changes. The main thing that stands out is that the amount of miles you fly no longer matters. No more mileage runs. Plus if you live near a United hub and often fly non-stop, you’ll find it harder to achieve Premier status.

HT: TPG