$300 Chase Savings Bonus

Over the past few years Chase has been the most generous of the big banks with bonuses for opening up checking/savings accounts. One drawback has been the fact that some of these bonuses are available in-branch only. But now there’s a public bonus for $300 for new savings accounts that can be done online.

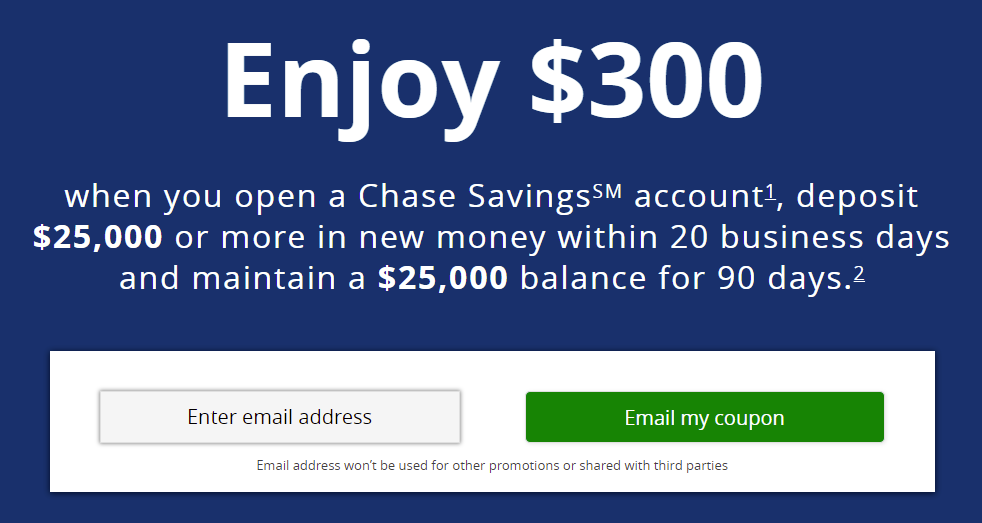

The Offer

Apply online now or enter your email address to get your coupon and bring it to any Chase branch.

- Open a new Chase Savings account by August 6, 2019

- Deposit $25,000 or more in new money within 10 business days

- Maintain a $25,000 balance for 90 days.

Key Terms

- Expiration Date: 8/6/2019

- Savings offer is not available to existing Chase savings customers or those whose accounts have been closed within 90 days or closed with a negative balance.

- You can only receive one new savings account opening related bonus every two years from the last enrollment date and only one bonus per account

- For savings bonus, deposit a total of $25,000 or more in new money into the new savings account within 10 business days of account opening and maintain at least a $25,000 balance for 90 days from the date of deposit. The new money cannot be funds held by Chase or its affiliates.

- If savings account is closed by the customer or Chase within six months after opening, we will deduct the bonus amount for that account at closing.

Getting the Offer

Normally offers like this one are targeted, either by mail or email. You can also purchases these coupons on eBay. However with this public link anyone can generate a unique coupon code to open account in-branch or just open it online. It’s probably best to do this now, just in case the offer gets pulled earlier as it’s been the case on few occasions.

Avoiding Fees

Chase Savings has a $5 fee per month. You can avoid the fee in the following ways:

- $300 or more minimum daily balance

- or at least one repeating automatic transfer of $25 or more from your personal Chase checking account (available only through Chase Online Banking)

- or when linked to a Chase Premier Plus Checking, Chase Premier Platinum Checking or Chase Private Client Checking account

Conclusion

If you aren’t a current Chase savings customer then this is about as good as it gets when it comes to bank bonuses. While the deposit requirement is a bit high, I think it’s still worth it if you have $25,000 to leave in the savings account for three months. If you’re undecided, get the coupon now anyway and then decide if it makes sense for you. You can do this bonus once every two years, and you must not have had a Chase account in last 90 days.

Chase often offers a $600 bonus as well, if you open a checking and savings account together.

HT: Doctor of Credit

Do you know if my husband qualify for the bonus if I have a Chase savings account? Wondering if there is a household restriction.

There is also a Chase offer (in Branch only via request to have them email u coupon….good until 1/18/17) for Savings $10K for 90 days=$150.00 promo bonus which pays in 10 bus days after meeting deposit which equals the Best APY. After 90 days can reduce balance to $300 and close in 6 mos without any fees. No other requirements. Must not have been a customer, I am thinking for previous 6 mos. [Apy=6% vs. 4.8% for $25K one vs 5.33333% for $15k one] Currently it’s pretty easy to get 1.55% on liquid money that is idol & who knows what they will be when interest rates go up in December.