Targeted Bonuses for Adding Authorized Users to Amex Cards

American Express has brought back a generous offer for adding Authorized Users to credit card accounts. These offers are sent by mail, email or show up online when you log into your accounts.

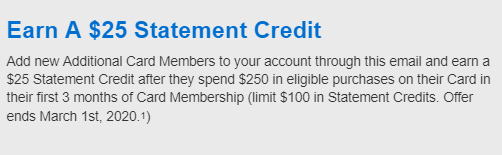

Cash Preferred

- Add new Additional Card Members to your account through this email and earn a $25 statement credit after they spend $250 in eligible purchases on their Card in their first 3 months of Card Membership (limit $199 in statement credits). Offer ends March 1st, 2020.

Key Terms

- Additional Card Members must be added all at once.

- Points will be posted to the Basic Card Member’s account within 8–12 weeks after an Additional Card Member makes required purchases.

- Your purchases as the Basic Card Member will not count toward the $500 spend requirement.

- The Additional Card Member’s Social Security Number and Date of Birth are not required to submit this request. However, this information must be provided by you or the Additional Card Member within 60 days after the Card is issued, or the Additional Card will be canceled.

Conclusion

A decent offer for adding a new user to your account. We often see similar offers for other cards as well. The only issue here is that you need to add Authorized Users and that would show up as another credit card on that person’s credit report. If that’s not a problem and you were targeted, then it is definitely worth it.

I would suggest completing spending requirement with organic spend. American Express has been getting much tougher on bonuses and rewards earned with cash equivalent purchases.

Please let us know if you were targeted for these or any other cards.