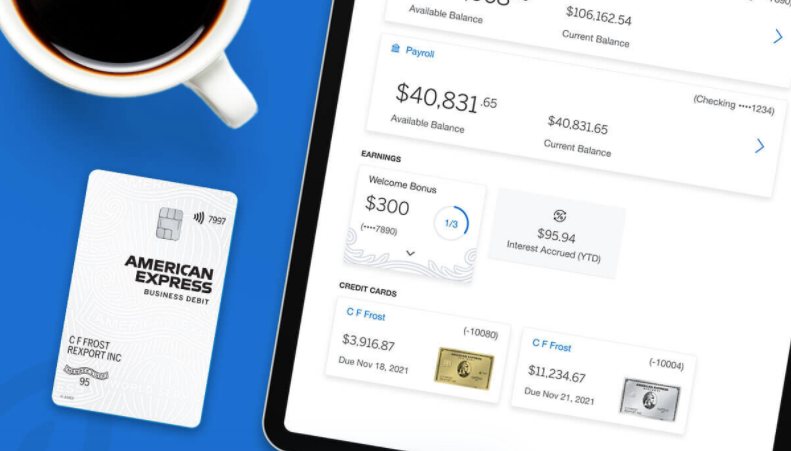

American Express Business Checking, $300 Bonus Available Nationwide

American Express has a new Business Checking account and a $300 bonus to go along with it. The account earns 1.1% and has no monthly maintenance fees. If it sounds quite similar to this Amex Kabbage account offer, you’re right.

The account seems to be the same, but marketed with a different name. The bonus is also $300, but the requirement are different. So let’s see how this Amex Business Checking bonus works.

The Offer

Open an American Express Business Checking account and earn a $300 bonus when you complete the following requirements:

- Deposit $5,000 within 10 days of opening your account, AND

- Maintain an average account balance of $5,000 for 60 days, AND

- Make 10 or more qualifying transactions within 60 days of opening your account.

After you have completed all the above Checking Account requirements, the $300 account opening deposit will be deposited into your American Express Business Checking account within 8-12 weeks.

Key Terms

- Accounts offered by American Express National Bank. Member FDIC. Funds deposited within American Express National Bank deposit accounts are insured by the Federal Deposit Insurance Corporation (FDIC) up to at least $250,000 per depositor.

- There is no cost to open an American Express® Business Checking account, and there are no monthly minimum balance requirements or maintenance fees.

- Qualifying transactions are mobile deposits, and electronic/online transactions including ACH, Wire, and Bill Payments.

- This $300 account opening deposit may be taxable income to you and may be reported on IRS Form 1099.

Conclusion

This is an easy $300 Amex Business Checking bonus that is available nationwide. But you should still go for the Amex Kabbage Checking bonus first, as that bonus only requires 5 debit card purchases within 45 days of account opening.

After getting that bonus you can then proceed to complete this one. You should be eligible for both $300 bonuses, but I’m not 100% sure on that. I already did the Amex Kabbage Checking offer and I plan on doing this one as well.

HT: Doctor of Credit

“The account seems to be the same, but marketed with a different name.”

The accounts look similar but they are NOT the same and are operated by different banks. Kabbage is an Amex company but uses Green Dot Bank and they offer a Mastercard debit card. Amex Biz Checking is run by American Express Bank and they offer an Amex debit card. In my experience Amex Biz Checking customer service is by far superior to Kabbage. You can reach an agent via chat 24/7. Kabbage only offers phone support M-F during daytime hours. Both accounts can be accessed with an existing Amex credit card login.