Bank of America Cash Rewards Card Will Let You Choose 3% Category

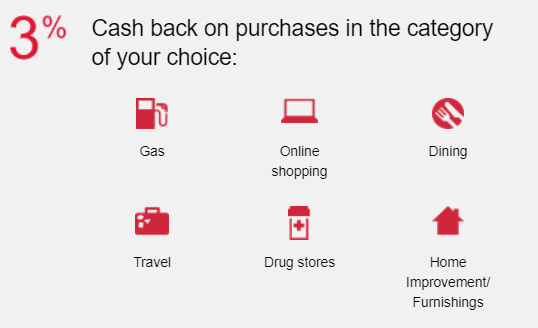

Bank of America is making some changes to its Cash Rewards card. Beginning the week of January 14, you’ll be able to choose the category where you want to earn 3% cash back with your Bank of America Cash Rewards card. You can choose your category in the Mobile Banking app or Online Banking. You’ll also have more flexible redemption options.

Choose Your 3% Category Each Month

Each calendar month, as you plan for future purchases, you can change your 3% choice category online. If you don’t make a change, the choice category will remain the same. At first, the choice category will be set to gas purchases.

The card will still earn 2% cash back at grocery stores and wholesale clubs and 1% unlimited cash back on all other purchases. 3% and 2% cash back are earned on up to $2,500 in combined choice category/grocery store/wholesale club purchases each quarter.

Preferred Rewards Programs Bonus

You’ll continue to receive a 10% customer bonus when you have an active Bank of America checking or savings account. You can increase that bonus to 25%-75% when you’re enrolled in the Preferred Rewards program. That could increase your rate to 5.25% cash back on the category of your choice, if you are a Platinum Honors customer.

Easier Redemptions

Bank of America is also adding more flexible redemption options, such as the ability to redeem for credit into an eligible 529 account or having no minimum requirement when making a one-time redemption into an eligible Bank of America account.

Conclusion

Picking your own 3% category is a huge benefit. It could make the Bank of America Cash Rewards card a great option for online shopping. If you’re a Platinum Honors customer, then it becomes one of the best cards on most of categories you can choose from with a 5.25% cash back rate. The new benefit is available for existing and new cardholders.