Bank of America Shutdowns

If you have opened and closed too many Bank of America credit cards recently, you could be in trouble. What does “too many” or “recently” mean? It is not clear yet. But some customers have received letters stating those as the reasons for shutdowns.

Bank of America is shutting down all credit card accounts for some customers who have been opening and closing too many of them recently. Two people on r/churning report getting a letter from Bank of America notifying them of the account closures for this reason, also citing excessive accumulation of bonus miles.

One customer just opened its third Alaska Airlines business card within 8 months and the other had 10 business credit card accounts in five years and keeping each one for at least 13 months.

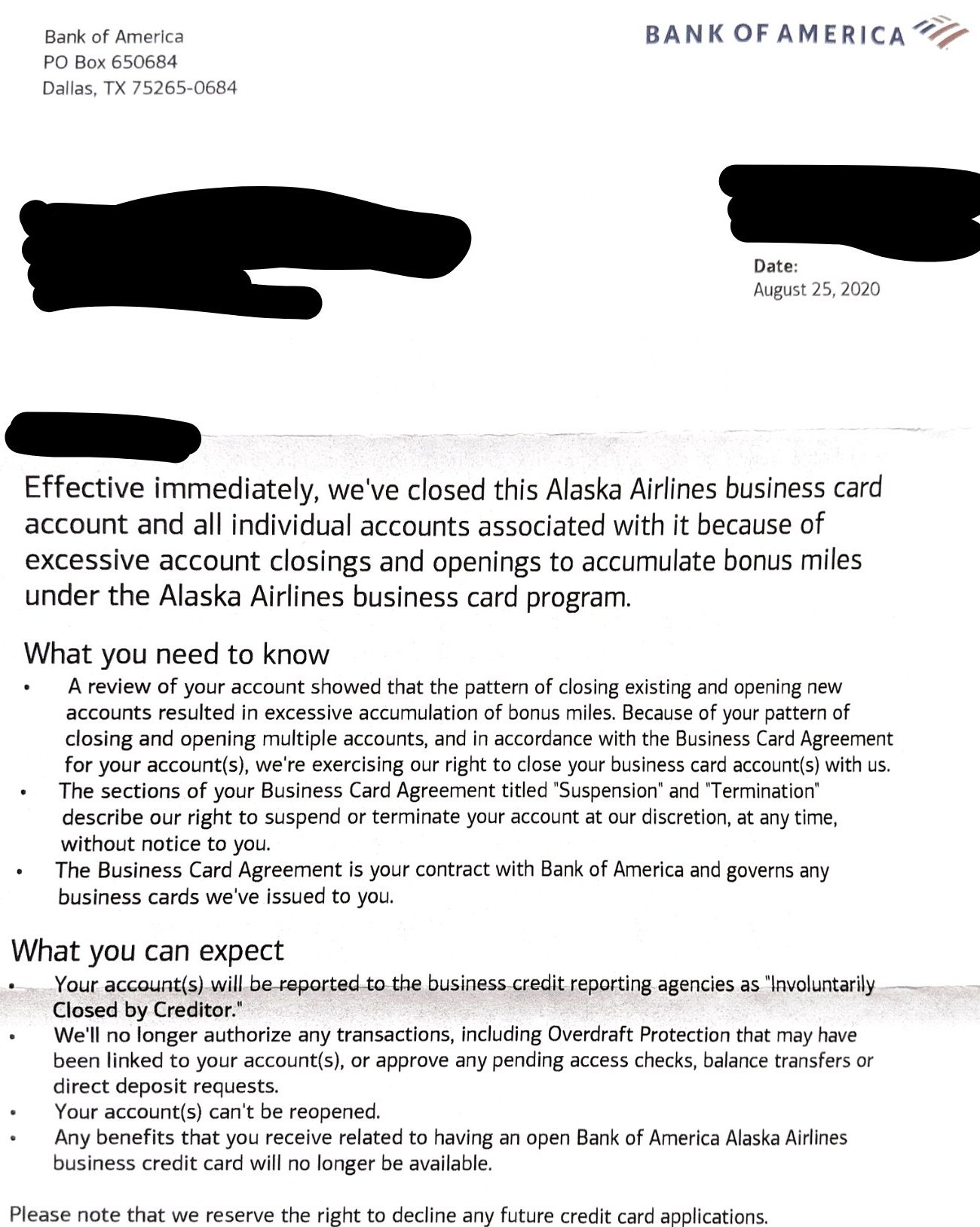

The letter states that “effective immediately, we have closed this Alaska Airlines business card account and all individual accounts associated with it because of excessive account closings and openings to accumulate bonus miles under the Alaska Airlines business card program.” You can read the full letter below:

Besides account closings, the letter also notes that future credit card applications might be declined.

Conclusion

It is not clear from the letter what is considered too many cards and whether this is a permanent ban. We also do not know how widespread these bans are and whether any other factors are in play.

Let us know in the comments if you have received such a letter from Bank of America.

This blog has just offended Italians with that black hand drawn on a Bank of America (nee Bank of Italy) letter. Offensive blogs should not be allowed to exist. Consider the blog cancelled by Black Hands Matter!

you brag that you can easily afford any travel expenses so you are not dependant on points /miles, thats like criticizing people for working two or three jobs to pay their bills while you brag about only having to working one, pretty self centered , the people applying for multiple cards are the ones who usually could not travel if they didnt because they don’t have the funds, does that make you better than them? I would say its just the opposite.

Yes but being less fortunate and unable to afford to travel doesn’t meant you have the right to abuse the system. That’s like saying if you are poor you are less guilty of robbing the bank than a rich guy. Big signup offers are intended to market and acquire new customers. Not to hand out free travel money. Appreciate the bonus, play by the rule and be a royal customer. They will treat to with more rewards. It has to be a balanced relationship or it won’t last and I too have zero sympathy for those getting shutdown by abusing the system.

Is 5 Alaska Airlines cards in one day considered excessive? Asking for a friend…

Sniff sniff, I smell hypocrisy from The Brain (probably just Pinky writing in under a pseudonym). Your wife has her own Amex card? If you didn’t care about bonuses you could have just put her as an AU account. But you chose not to. And the only reason why that would be the case would be to get the SUB. Go cry at the back of the bus and let the big fish eat your lunch

Good for B of A! I have ZERO sympathy for the pathetic people that simply churn cards to earn points or miles. Get a card and USE it. I appreciate the sign up bonuses but only have cards I actually use. BTW I currently have Amex Plat, DL Amex Plat, Hilton Amex Surpass, Chase Sapphire Reserve, Chase Bonvoy Boundless and Chase IHG Premier for points/miles. I’m lifetime DL and AA (still have around 1,000,000 AA miles so cancelled Citibank and Barclays AA cards years ago since AA Platinum earns better miles and not worried about accumulating miles or status anymore). I use all these as I stay at the 3 hotel chains and transfer Chase and Amex points. However, I’m really happy with these cards and don’t plan to open any more just to get a sign up bonus. Enough is enough and I can also easily afford any travel expenses I want so not dependent on points/miles.

With respect to Bank of America, my family has 3 of their cash back Visa cards (college daughter, my wife and one in my name I really got for my 16 year old daughter who is an authorized user). These work for my wife and daughters. Oh yeah my wife also has a DL gold Amex.

Bottom line get cards you want, use them, don’t try to game the system and you will likely not have problems. The whole cancel, reapply, downgrade, beg for renewal bonus, buy gift cards is, IMHO, pretty pathetic behavior.

you brag that you can easily afford any travel expenses so you are not dependant on points /miles, thats like criticizing people for working two or three jobs to pay their bills while you brag about only having to working one, pretty self centered , the people applying for multiple cards are the ones who usually could not travel if they didnt because they don’t have the funds, does that make you better than them? I would say its just the opposite.

you brag that you can easily afford any travel expenses so you are not dependant on points /miles, thats like criticizing people for working two or three jobs to pay their bills while you brag about only having to working one, pretty self centered , the people applying for multiple cards are the ones who usually could not travel if they didnt because they don’t have the funds, does that make you better than them? I would say its just the opposite.

The Brain. I disagree. It’s fair game for BofA to close the cards. There are two ways to look at it.

(1) contractual. as long as you are following the rules they promise to give you the bonus without asking you to keep the card after first year. By your contract you are entitled to the points and they may claim them back if they believe you are abusing the system.

(2) ethical. The argument is that the bank is giving you the points hoping that you use the cards so that they make money of interchange fees, annual fees, interest etc. However, you also need to consider the non ethical ways they make money off you like overdraft, high interest rates, bounced payment etc. The fees are much higher than what they should be. You are the judge for whether churning is ethical.