Update: This offer is now expired.

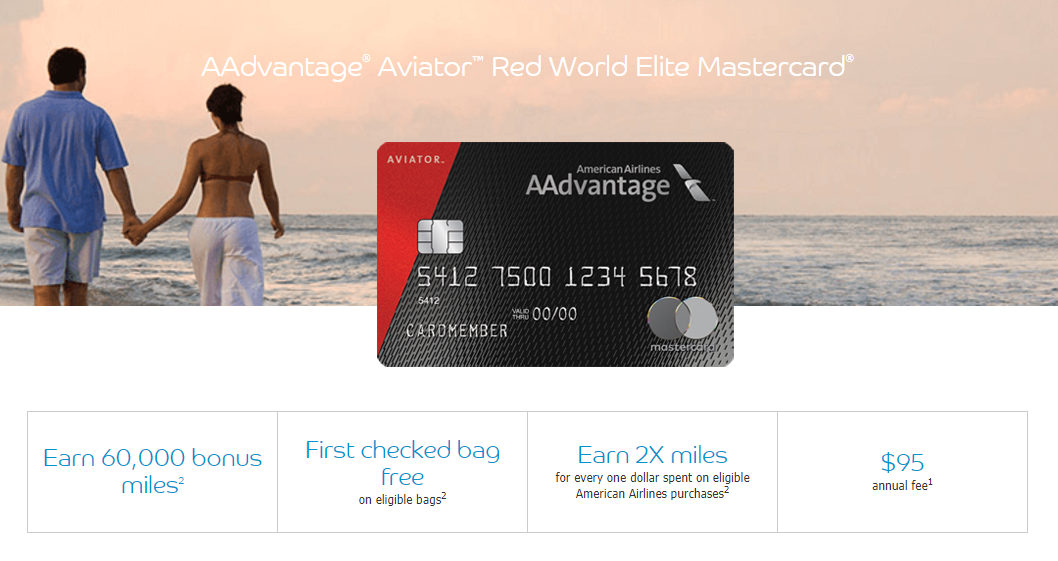

Increased Bonus on Barclaycard AAdvantage Aviator Red, Earn 60K Miles

Barclaycard has an increased bonus for its AAdvantage Aviator Red World Elite credit card. Let’s take a look at this highest ever offer.

The Offer

Earn 60,000 bonus miles when you make your first purchase in the first 90 days and pay the annual fee of $95.

Card Benefits

- First checked bag free for the primary cardmember and up to 4 companions

- Earn 2X miles for every one dollar spent on eligible American Airlines purchases

- Earn 1X miles on all other purchases

- 10% of your redeemed miles back (10,000 miles maximum per calendar year)

- Earn $3,000 Elite Qualifying Dollars (“EQDs”) after spending $25,000 in Net Purchases

- $100 American Airlines Flight Discount (the “Flight Discount”) after you spend $30,000 or more in Purchases on your Account during your cardmembership year

- No foreign transaction fees

Eligibility

You must be at least 18 years of age. This offer is available only to applicants who are residents of the United States, with the exception of Puerto Rico and the US territories.

Existing cardmembers, existing accounts, and previous cardmember with accounts closed in the past 24 months may not be eligible for this offer.

Conclusion

This is a great offer and the highest we have seen on this card. The only requirement to earn the 60K bonus is to make a purchase and pay for the annual fee of $95 which is not waived the first year. The previous highest offer was for 50K so this is significantly better. If you recently applied for the lesser bonus, send a message to ask to be matched to this increased offer.

HT: Slickdeals

[…] your first purchase. You must also pay the $95 annual fee. That is all it takes, just like the personal version (which is currently at 60,000 miles for it’s sign up […]

Can I close my Barclays Aviator Red that was originally a US Airways card and automatically became an AA Aviator card with the merger and apply in 24 months and get a bonus for this card as I did not get the bonus when it changed due to the merger. I did get a US Airways bonus in 2012 and one in 2013 (I have 2 of these cards)?

Based on Barclay’s rules you should be able to get the bonus.

I was approved for the card last week under old bonus 50k. I will send a msg asking for a match once I get the card

Let us know how it goes!

I think the data points have come out that if you applied after July 28th they will match the offer – you should be good!

Thank you Mark.!

No problem!

@Sam: Barclay is kind of strict on the number of cards they will approve. With that said, some people have approved for more than one card in a day even. The first card may be auto-approved by the system but you will probably need to call in for the second one or any after that. It’s recommended to do one application with them every 6 months but this card has been known to be churnable in the past.

@Christian: You are most likely referring to the old US Airways Mastercard. If that’s the case then yes, this will be considered a new product.

I read on a blog (sorry, forget which one) that this is not the same type of Mastercard as the prior Barclay AA cards, so you can be approved if you have the card from an earlier application. Have you heard anything similar?

Will Barclay approve a new card within 30 days of approving another one of their cards? Is there a standard that they use on how many cards can be approved or applied for?

Thanks

Have they said how long the offer will last? I am trying to hold out until end of September before I apply for a few cards.

Not AFAIK. The past few Barclaycard increases have stuck around awhile.