Bask Bank, Earn American Airlines Miles with a Savings Account

Bask Bank offers an interesting savings account geared toward frequent flyers. Instead of interest, it earns AAdvantage miles instead of interest. Every dollar you save earns one AAdvantage mile annually plus there’s limited time bonuses to earn more. Let’s see how it works.

The Offer

With Bask Bank you earn one AAdvantage mile for every $1 saved annually. But they also have limited time offers that earn you even more. It is easy to get started:

- Open an account and provide app feedback to get 1,000 AAdvantage miles

- Deposit $1,000 and maintain that minimum deposit for 30 consecutive days within 60 days of account opening and get 5,000 AAdvantage miles

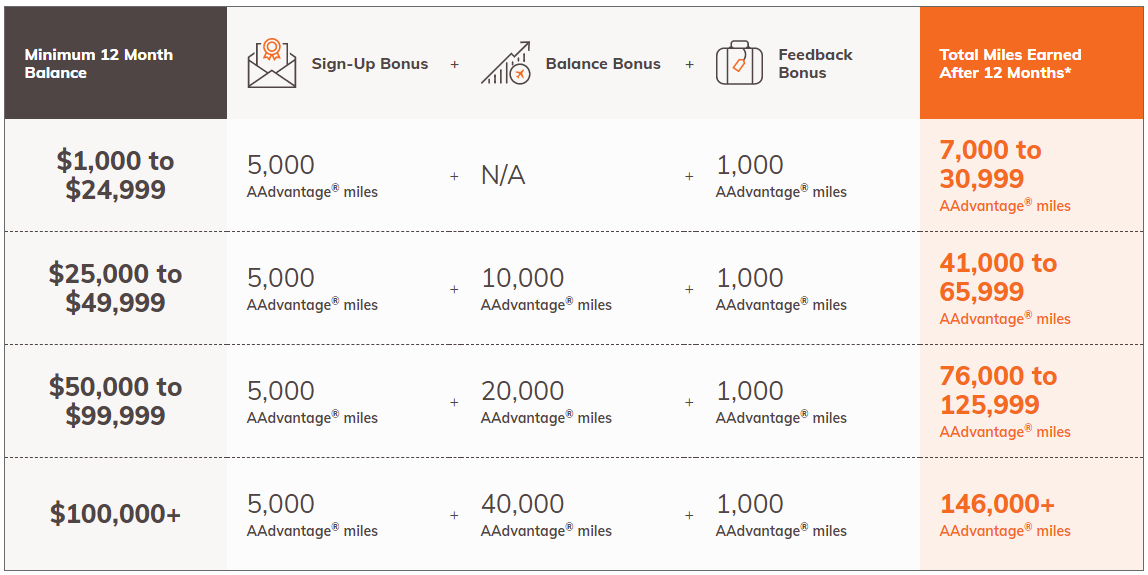

Then there’s more bonuses depending on the amount of money you add to your account within 60 days and and maintain for 360 days

- Fund and maintain $25,000 for 360 days and get 10,000 bonus miles

- Fund and maintain $50,000 for 360 days and get 20,000 bonus miles

- Fund and maintain $100,000 for 360 days and get 40,000 bonus miles

The bonus miles listed above are in addition to the one AAdvantage mile for every $1 you already get. here’s an explanation on how the normal mileage earning works:

- The Bask Savings Account awards one AAdvantage® mile for each dollar saved annually. Miles are accrued daily and awarded monthly based on your average monthly balance. For example, if the account’s average monthly balance for January is $60K, you will earn 5,096 AAdvantage® miles for that month ($60K ÷ 365 × 31). If that same balance is maintained in February, you will earn 4,603 AAdvantage® miles. After one year of maintaining an average balance of $60,000, the customer will have earned 60,000 AAdvantage® miles.

Conclusion

It is not the most straightforward offer. They complicated the earning a bit, but it is a good deal for those that value American Airlines miles. You should still do your own calculations and compare the value you can get out of the miles to the interest rates you are already earning at your current bank.

No hard pull is required, but you do need to pay taxes on miles earned through bank accounts. Miles are currently valued at 0.42 cents per mile.

I posted the comment below at Frequent Miler and Doctor of Credit. So sad…

This was first reported at veteran Gary Steiger’s site.

VFTW does not link to Gary S.

You link to VFTW.

And it goes on…

When I first saw this…I yawned. My threshold for adding mental real estate these days is much higher. I am staying with my high yield savings account.

Good luck y’all.

This bank will likely hit you on the way out imho.