Big Chase Sapphire Reserve Changes Coming?

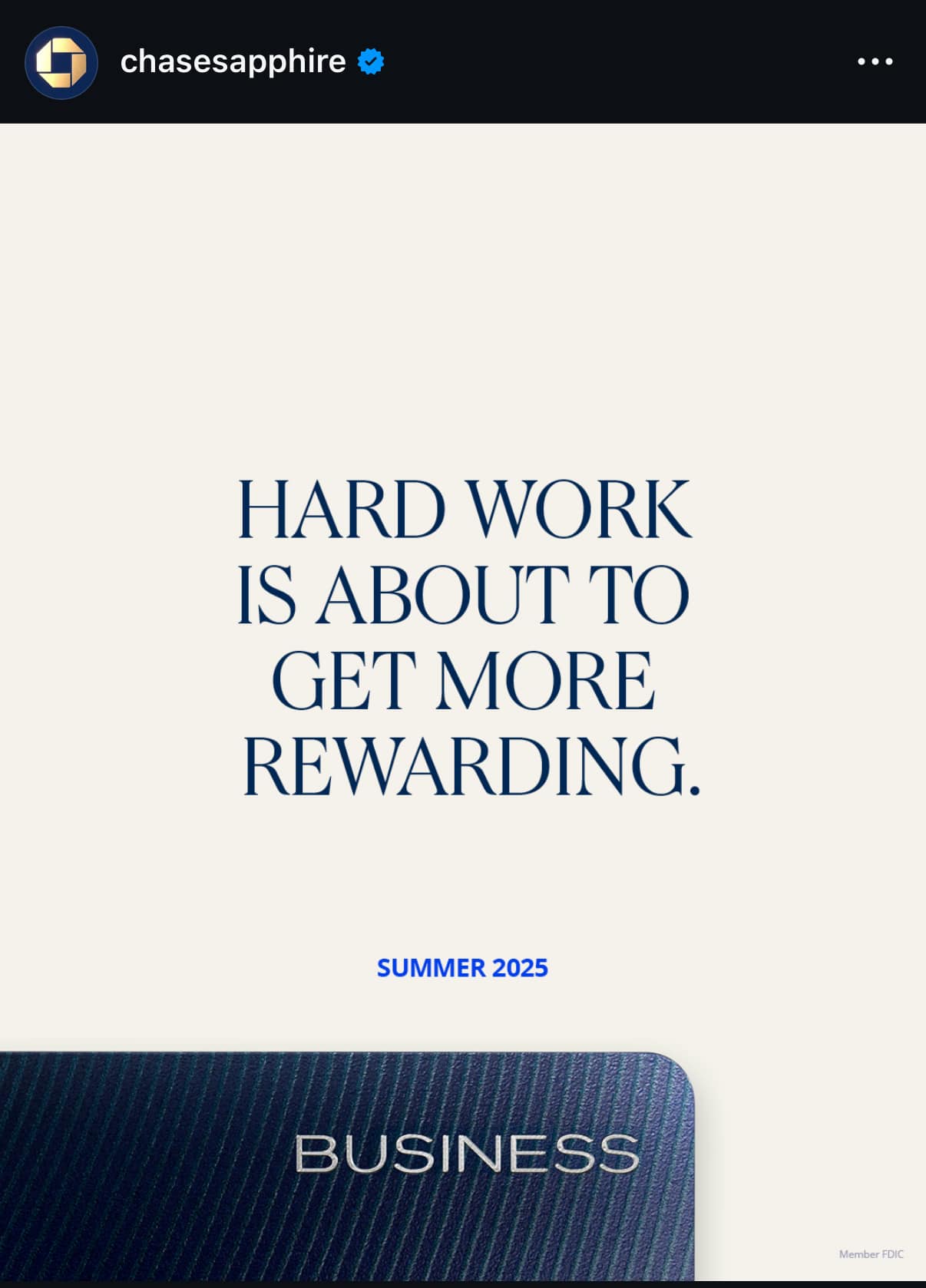

Update: Chase Sapphire has shared an Instagram port that seems to confirm the upcoming changes for the Chase Sapphire Reserve card. They also show a new design for the card. There’s also another post about the Business version of the card, with both products expected in the Summer of 2025.

Rumors are swirling on reddit about big upcoming changes to the Chase Sapphire Reserve credit card. In a now deleted post, a redditor posted a screenshot of an internal document that mentions that this product is changing, and they also shared most of the details that we should expect. Another redditor also reported that a phone rep mentioned the higher annual fee and more credits.

This is still a rumor for now, but the information seems credible. There’s no information about when these changes will happen, and we also do not know what kind of bonus to expect. Check out what we do know below.

Annual Fee

- Primary cardholder: $795 annual fee (up from $550)

- Authorized users: $195 annual fee (up from $75)

Earning Rates

- 8x Chase Travel hotel and cars

- 8x Chase Travel flights

- 4x Direct flights and hotel

- 3x on dining

- 1x on other purchases.

No more 3X on all travel purchases.

New Benefits

-

- $500 Edit Credit ($250 semi-annual) for booking select hotels and resorts around the world

- $300 Dining credit via Sapphire Reserve Tables ($150 semi-annual)

- $300 StubHub credit ($150 semi-annual)

- $300 DoorDash credit via $25/month

- $120 DoorDash membership

- $250 towards Apple TV+ and Apple Music

- $120 Lyft credit via 5% $10/month

- $120 Peloton credit via 10x $10/month

- Points Boost Program: Points will have a value of 2 cents through frequent promotions.

The card will still have the $300 Travel Credit, TSA/Global Entry (up to $120 every 4 years), and Global Lounge Network Access.

More Benefits After Spending $75,000

- $500 Southwest credit

- Southwest A-List status

- IHG One Rewards Diamond Elite Status

- $250 The Shops credit

Conclusion

The annual fee on the Chase Sapphire Reserve card is rumored to go up by $245, from $550 to $795. That’s a massive increase that also comes with several new credits, which does add more coupons that need to be used monthly, semi-annually, or annually.

Leave a comment and let us know what you think!

HT: r/creditcards

For someone who wants Priority Pass on the cheap, the CSR will be the wrong card. For someone who really uses the CSR — if you are the type of person for whom the card was intended — you will get value out of it. (The same can be said about other cards.) If you are wringing your hands over the annual fee and coupons, you are not the type of person for whom the card is intended. Just accept it and move on.

Along the line of someone who really uses the card, for me, the rumored changes significantly outweigh the increased annual fee.

lol southwest ok slick.

Here’s a $795 premium credit card and we’ll give you a couple bucks toward a southwest flight if you crank thru 75K.

Ugh, they need to stop this “dueling weenies” nonsense with Amex Platinum.

Have the CSR since the beginning.

It’s been a great card.

Amex Plat is good competition; so far …

With that whopping $245 increase for the annual CSR fee, Amex Plat will become better (probably they’ll raise too after some time).

The 8 x points for ‘Chase travel flights’ and 4x points for ‘direct travel flights’ is BS ! Why …: Because if you book thru the Chase Travel Portal, then since a couple of years flights are often more expensive than when booked regularly, or you don’t have the same amount of choices. So, my suspicion is Chase is making the same mistake as many big companies …:

They make it appear as if the bonus list is incredible, when really the vast majority of people will end up losing more money if they keep the card.

At some point people do the math and they’ll ditch the card, which means: Chase’s crooked math won’t work in the long run. But until then, they’ve probably made enough money …

These supposed benefits are mostly junk. I would consider this a downgrade even if the price remained the same. I UA e liked the CSR but this would be a cancel and try another bank.

Venture X covers my premium card needs and the only thing I truly need to worry about is spending the $300 travel credit (used through their portal but still easy and often cheaper than alternatives). Everything else (lounge access, TSA, Hertz President’s Circle, 10k annual bonus, free authorized users, travel insurance) do not require me to go out of my way to use. At this point, a far better card for only $395 per year. If you are a heavy spender (I’m not as I’m always in the process of meeting spend requirements for big, fat sign up bonuses) and actually use these extra services regularly, CSR might work for you (same with AMEX Platinum), but for me, they are churn and burn candidates only.

For us point earning and PP access are the reasons we keep the card. Devaluing earning in travel means we probably cancel. All of these coupons are junk, DD is mostly fast food near us, we don’t use Lyft, we don’t use Peloton, we don’t subscribe to Apple TV. We book airfare with our primary airline card, hotels with our Hilton Aspire, get PP with Aspire as well. There would be really no reason left to keep this card after we spend down all of our points. Which we need to start doing.

This is to end people spending 15-20k getting 3x on cruises and then getting sock drawered. Stuff like this rewards repeat users and smacks the optimizers. The optimizers will leave which is what they want.

Wow, a $795 annual fee is a major jump! If the rumors are true, I’m curious to see if the new benefits will justify that increase. The 8x points on hotels and flights are definitely enticing, but I’d have to see how the rest of the perks line up with the higher fee. I’m also wondering if there will be a bigger sign-up bonus to sweeten the deal. Guess we’ll have to wait for official confirmation, but this definitely makes me rethink my strategy with Chase cards.

Would much prefer that they partnered up with UA instead of SWA. Oy.

Super disappointing. I use my CSR for travel. It is a travel card, yet, many of these credits are domestic. I just want a card with no coupons and solid multipliers. I recently upgraded from Green to Gold, and I am regretting it. I don’t use the offers and I don’t want to worry, how to game the system. Life is too short…

Personally, I think these coupons and raising the price are to stop the credit card gaming. Except it never works. The gamers figure out loopholes. It’s almost as if they want the gamers.

Won’t be happy with this as I don’t use most of those services, so just another nail in the CRS coffin…

Not terrible, actually. I’d absolutely ditch my authorized user card, but we’d keep my wife’s CSR with these changes. I’d probably get near-face value out of DoorDash and Reserve Tables (some decent restaurants included here in Chicago). And I’d find a way to use at least some of the Apple credits, and occasionally StubHub.

DoorDash credit will be easy to use and more than enough to cover the increased annual fee. AppleTV+ will add a bit too (I use it for a couple of months a year). Heck, since I have a teen who goes to shows, even StubHub credit might come into play. What is a “Points Boost Program”, how will that work? A value of 2 cents – for what? Pay Yourself Back? Or just on some random stores I’d never shop from?

I book some cruises and tours, and those have typically gotten the 3x points with CSR. I also liked the partial insurance coverage for those trips. It sounds as though those will no longer be 3x points, which is very disappointing. Now a jump ball between booking cruises and tours with CSR or AMEX Platinum, I guess.

Kinda bummed. Was thinking of getting CRS in a few months for P2 completes their 48 month Saphire reset. But, as typical, most of the credits are useless to me.

My only hope is that it launches with an absurd bonus – like 150,000. But I am guessing it will be more like 65,000

Horrible changes. I think people could stand the increase in annual fee by some fee, but increasing authorized users by a whopping $125 is crazy.

If this goes through I’ll cancel my card once I use up a bunch of points and just keep one of the Chase Freedom cards around and see if I can get the Sapphire preferred card.

I find it easier to get my money back on the Amex Plat than what you listed above for the CSR. Going through portals for credits/bookings usually is a bad idea, especially if something goes wrong..