Note: We have a direct business relationship with Bilt Rewards and may receive compensation if you apply via links in this post.

Bilt Rewards Mastercard Launched

Rent is a big monthly expense for many Americans. In February 2021 for example, the average monthly rent for an apartment in the United States was 1,124 U.S. dollars. That amount varies widely between states, and is much higher in larger cities. Now a new card want to make it easier for you to earn rewards on those rent payments, something that’s not normally possible for most people.

This new product is called the Bilt Rewards Mastercard and it also comes with its own Bilt Rewards loyalty program. Cardholders can earn as much a 2 points per $1 spent on rent payment, and you can then transfer points to programs like World of Hyatt and American Airlines AAdvantage. There are no fees to pay your rent. However, the earning system is not straightforward, and you need to put non-bonused spend on your Bilt Rewards Mastercard in order to move up the tiers and earn 2X rewards.

Let’s see how this new product works, and whether the numbers actually work in your favor.

Bilt Rewards

Anyone can sign up for a Bilt Rewards account and remember, there are never fees to earn Bilt Points. Bilt Rewards loyalty program members can immediately earn a minimum of 250 Bilt Points per month by paying rent through the Bilt Rewards app. It doesn’t matter how much your monthly rent costs.

Click here & use code MTM4BILT to bypass Bilt Rewards waitlist

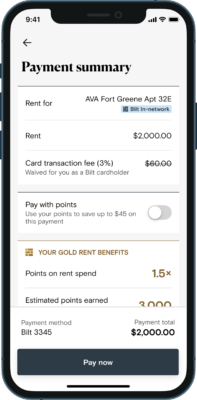

You link link your bank account in the Bilt Rewards app and payment to your landlord will be seamless. If your landlord is a member of the Bilt Rewards Alliance, they will be paid electronically through the Bilt Rewards app. If your landlord is not a member of the Bilt Rewards app, your landlord will receive a paper check via USPS First Class mail. You should plan for 5-7 business days for the check to reach your landlord.

If you live in a building that is a member of the Bilt Rewards Alliance, your landlord may offer periodic incentive points and/or Bilt status to sign a lease, refer a friend to move-in, offer points for consecutive months paying rent on time and other building specific promotions.

From time to time, Bilt Rewards will offer different opportunities to earn bonus points so make sure to regularly check the Bilt Rewards app.

Bilt Rewads Mastercard

Update: Bilt has made some exciting enhancements to the Bilt Rewards Mastercard. You can find the updated Bilt Rewards Mastercard information here.

The Bilt Mastercard lets you earn 4,000 points on your monthly rent and unlimited points anytime you use your card anywhere Mastercard is accepted.

As a welcome offer, you’ll earn 3X points on your first month’s rent up to 10,000 points as a new Bilt Mastercard holder. You will also earn 2X points on all non-rent spend for the first 30 days. After your first month, the amount of points you earn on rent will be determined by the amount of non-rent spend you put on your Bilt Mastercard.

The Bilt Mastercard also gets you all the Mastercard World Elite benefits such as cell phone insurance, merchant discounts with brands like Lyft, Doordash and Shoprunner and more.

Earning Rewards with Your Card

How much you earn on rent payment with your Bilt Mastercard, depends on which tier you are in. Here’s how that works:

- Blue Status: Once you spend $250 in qualifying non-rent purchases in a calendar month, you’ll earn 1 point per $2 on your next rent payment.

- Silver Status: Once you spend $1000 in qualifying non-rent purchases in a calendar month you’ll earn 1 point per $1 on your next rent payment.

- Gold Status: Once you spend $2000 in qualifying non-rent purchases in a calendar month you’ll earn 1.5 points per $1 on your next rent payment.

- Platinum Status: Once you spend $3500 in qualifying non-rent purchases in a calendar month you’ll earn 2 points per $1 on your next rent payment.

So for example, a Bilt Mastercard holder who spends $3,500 in non-rent spend in a month will obtain Platinum status. If they have a $2,000 rent payment they will earn 4,000 Bilt points on their next month’s rent as well as 3,500 points for their non-rent spend for a total of 7,500 Bilt Points for the month.

If you pay your rent through the Bilt Rewards app, you will never be charged a fee. However, if you inadvertently attempt to pay your rent through your landlord’s website or other payment portal using your Bilt Mastercard, the transaction will be declined and you will be notified that it was declined (to save you the fees your landlord may charge for credit card payments).

Redeeming Your Points

Bilt Rewards offers several redemption options. One of the obvious uses is to cover all or part of your next month’s rent. But there are also travel partners that could make these rewards more valuable.

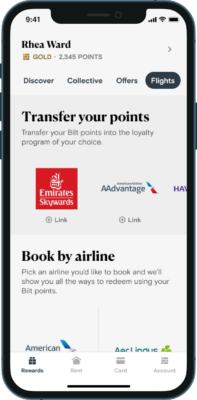

You can transfer your points at a 1:1 ratio to any of the seven airline partners or the lone hotel partner, World of Hyatt. Click the flights and hotels tabs in the Bilt Rewards app to learn about the power of points transfers and to link your loyalty accounts and transfer Bilt Points. Airline partners include American AAdvantage, Aeroplan, Emirates Skywards, Flying Blue, Turkish Miles&Smiles, HawaiianMiles or Virgin Atlantic Flying Club.

There are also some other redemption opportunities such as exclusive seasonal collection of artwork, and classes with Rumble, SoulCycle and Y7.

Conclusion

Earning 2X points on rent payments and not paying any fees sounds pretty sweet. However, lets take a look at the math by going over the example we mentioned above.

A Bilt Mastercard holder spends $3,500 in non-rent spend in a month to earn 2x on rent payment. With a $2,000 monthly rent payment they will earn 4,000 Bilt points on their next month’s rent as well as 3,500 points for their non-rent spend for a total of 7,500 Bilt Points. But, that requires a total spend of $5,500. So the actual earning rate is just 1.36X. It gets gets worse if you have a more affordable rent payment. And that’s without taking into consideration that you should earn at least 2% in that $3,500 in non-rent spend.

This is an interesting concept, and it could make sense for some people that can maximize the 4,000 monthly points for rent payments. But it is probably not a product that will work for most readers.

This is aiming for the financially challenged newbies who don’t know much better about rewards. The founders know this market and I wish them luck. Zzzzzzzzz…

It would seem that paying rent at 1 point is the real value because normally you get 0 points for rent, and assuming you pay $2000/mo, that would be 24,000 points more than you’d ordinary get.

Would this make any sense to pay your mortgage through plastiq? It is a MasterCard and could be of use to get Hyatt points through mortgage spend.

The fees would normally make it not worth it for Plastiq