Cardless Launches New Orleans Pelicans Card

Zion fans rejoice! No he’s not playing yet this season, but there a New Orleans Pelicans credit card that can get you a $300 bonus and 4X earning on select categories. All for no annual fee. Let’s see the details of this card and if it makes sense for you.

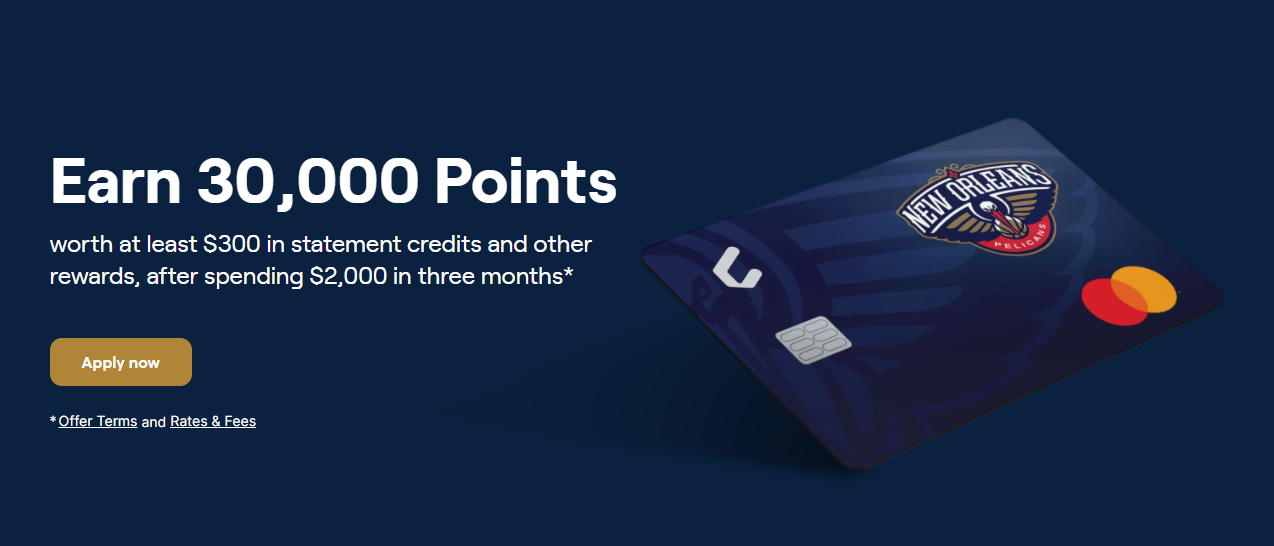

The Offer

Earn a $300 signup bonus!

To receive 30,000 bonus points (worth $300), you must be a new cardholder with no other open Cardless credit card accounts and you must complete $2,000 in Eligible Purchases within 3 months of account opening. Allow up to 2 statement cycles for the bonus to appear in your rewards account.

Card Details

- 4x points for gas, bars, and restaurants

- 4x points for New Orleans Pelicans game tickets purchased directly from the New Orleans Pelicans or seatgeek.com

- 10% statement credit for purchases of concessions at the Smoothie King Center, purchases at the in-venue Pelicans Team Store, and the online Pelicans Team Store.

- 1x points on everything else

- No annual fee

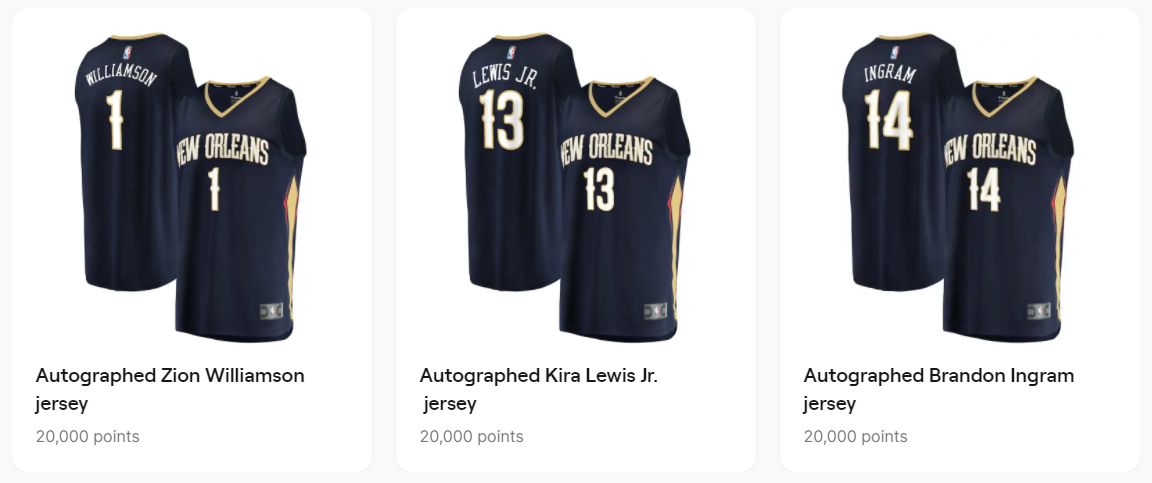

You can redeem points for premium items and experiences such as team-signed merchandise, meeting Pelicans legends, and more. You can also redeem for:

- Gift cards for Pelicans gear – 1 point is 1.25 cents

- Statement Credits – 1 point is 1 cent

Conclusion

This card is similar to the other Cardless products. The bonus is good for a no-fee card but we have seen offers up to 100,000 points in the past when Cardless cards were first coming out.

To receive the 30,000 bonus points, you must be a new cardholder with no other open Cardless credit card accounts. And even previously closed accounts could make you ineligible.

The Cardless New Orleans Pelicans Card also has earning categories such as 4X points for gas, bars, and restaurants. There’s no limit on the amount of points (or cash back) that you can earn for these purchases. Not bad for no annual fee.

Will this card still not pop up on your credit report because Cardless is still a fairly new creditor. I know when I got the Manchester card it never popped up on my credit report, still hasn’t.

I think it started to for some but they were able to get it removed after they closed the card.