Chase Sends Out Chase AARP Spending Offer

After Citibank and Chase messed the bed with their authorized user and increased spending offer Chase finally got it right! I received a spending offer via the snail mail for my Chase AARP card.

I had signed up for the card a year ago for the $200 bonus after $500 in spend. The card offers some decent cash back rates for a no annual fee card.

The Chase AARP card earns 3% cash back at gas stations and restaurants. The Chase AARP card does not fall under Chase’s 5/24 rule so it was always a good “throw in” card when you were signing up for something else to combine the hard pulls. That was before Chase started cracking down on things like that!

Details of the Offer

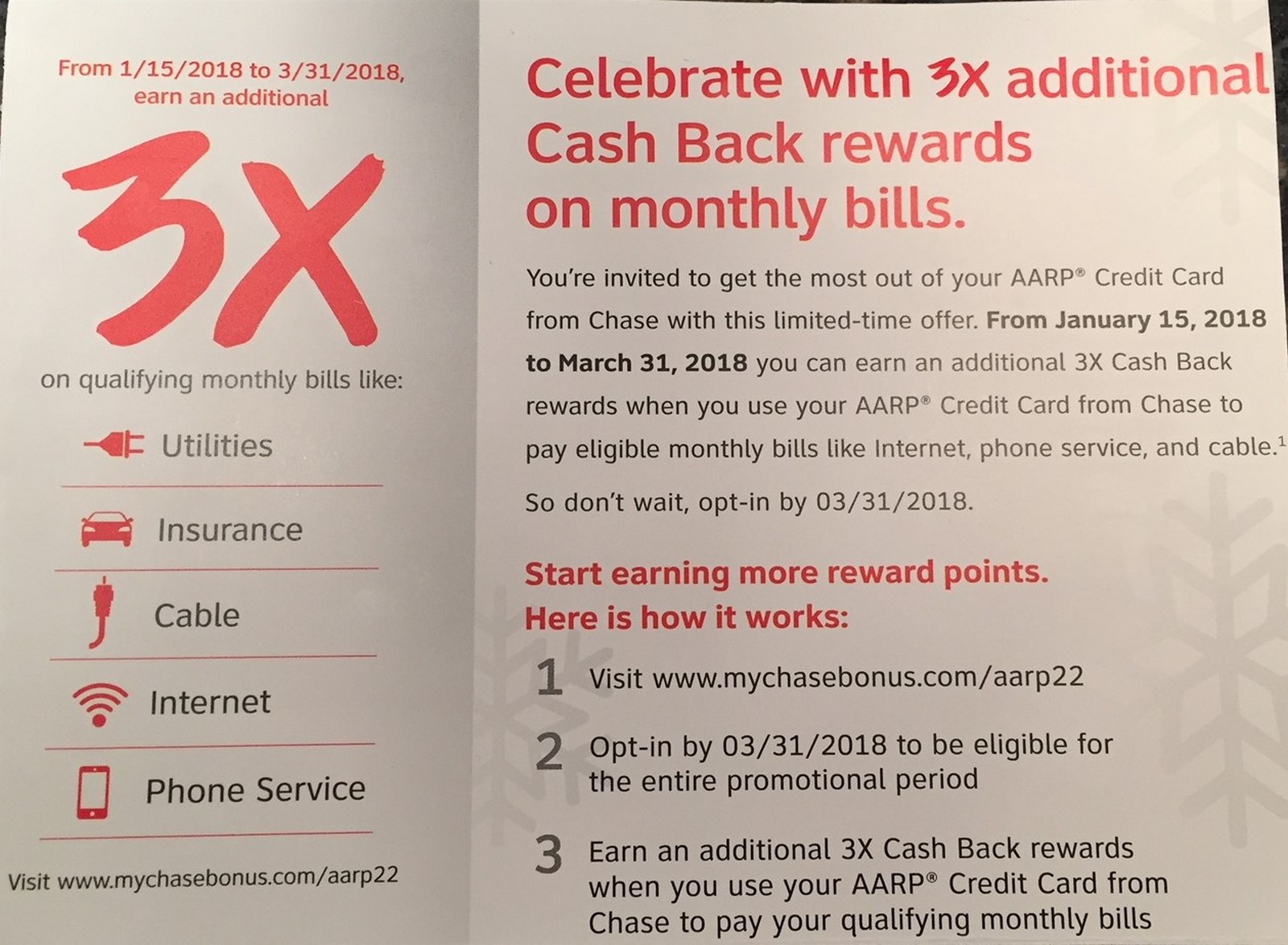

The offer details are as follows:

- Active from January 15 – March 31, 2018

- Earn an additional 3% back (4% total) on

- Utilities (household fuel, water, sanitation)

- Insurance (health, automobile, homeowners, medical, and life)

- Cable (satellite television)

- Internet

- Phone Service

- Visit www.mychasebonus.com/aarp22 to activate the offer

- Opt in by March 31, 2018 to be eligible for the entire promotional period

- Allow up to 8 weeks for the bonus points to post

Conclusion

As far as I can tell there doesn’t seem to be a maximum on your earnings. This is a pretty wide sweeping offer that hits on a lot of people’s high spend areas. You may want to consider prepaying some of these items to really maximize the benefit.

There is always the risk that the merchant will not code properly. And some of these categories are already covered by the Chase Ink Plus/Bold/Cash cards.

The insurance category is the one that really stands out to me.

Did you get the offer on your card? Are you planning on taking advantage of it?

[…] 2. Chase Sent Out a Very Compelling AARP Spending Offer […]

[…] Finally A Decent Spending Offer! The Chase AARP Card Comes Out With A Home Run!! […]

Nice! Insurance & Utilities are really good spend areas for this offer

Yup a big spend area for most and not a category that gets bonus points anywhere else that I know of.

Both Wyndham Rewards Visa cards offer standard double points on utilities, worth 2.4 cents/$ charged.

AMEX Offers also has had $ or % off various insurance charges.

Nice tip on the Wyndham cards Pam! Thanks.

Yeah, AMEX offer had a $30 limit and it was a while back.