Earn 40,000 American Airlines Miles with Public Citi Checking Bonus

Citi has a new public offer for checking accounts. You can earn 40,000 American Airlines AAdvantage miles. We often see better targeted offers, but this is available to everyone. Let’s look at the details.

The Offer

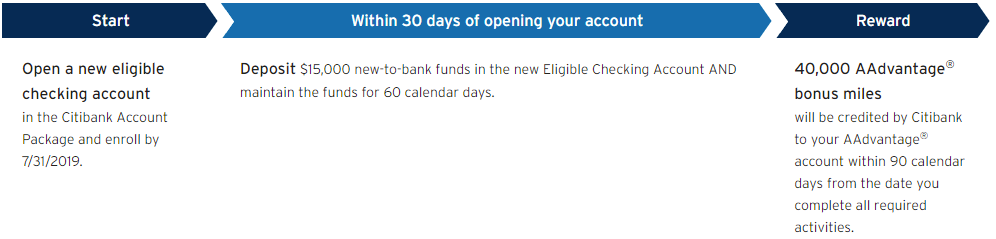

Here’s how the bonus works:

- Must have or open an AAdvantage customer account

- Enroll in the 40,000 AAdvantage® miles Offer.

- Open a new consumer regular or interest checking account in The Citibank® Account Package between the “Offer Period” of 6/1/2019 – 7/31/2019

- Within thirty (30) calendar days of opening the Eligible Checking Account, Eligible Customers must Deposit $15,000 in New-to-Bank Funds in the Eligible Checking Account and maintain the funds for sixty (60) calendar days.

Key Terms

- Must be at least eighteen (18) years of age

- Must have a valid W-9 or W-8BEN on file with Citibank

- Cannot be current owners of a Citibank consumer checking account or have been an owner on a Citibank® consumer checking account within the last 180 calendar days before enrollment.

- Citibank Account Package has a $25 fee waived with $10K balance.

Conclusion

We usually see better targeted bonuses for cash, ThankYou points or American Airlines AAdvantage miles. But this is a public bonus that anyone can go for. You need to deposit $15K in the account and keep it there for two months in order to get the 40K bonus miles. The account also comes with a $25 monthly fee that is waived with a $10K balance.

HT: Doctor of Credit

It seem like more and more banks are baiting folks into applying for cards with no intent of awarding miles or points. I wonder when the feds will start going after these thieves? Same thing happened to me with an AMEX offer. In my case, I didn’t have to fork over any funds but it did hit my credit report with a hard inquiry (ugh!). As soon as I found out I wouldn’t be getting the points, I cancelled the card but then it remained as an active account on my CR as well.

this is such a time consuming offer that I will not attempt again. I opened the account, did the required debits and never got the miles. Nobody can figure it out and my local bank where I opened the account has given up. I now call the Citi 1-800 and every time they open a promo dispute to look into it, the dispute gets closed without resolution or a reason why. This is the same exact thing that happened a few years ago with a B of A miles offer, which took more than a year of me being persistent and continually calling to finally get the bonus miles that they said they were crediting me as a ‘COURTESY’! I have spend counting hours on the phone and at the bank and it is such a waste of time. Still no AA miles.

Ya, the W-9 is the conduit for the value reporting interest and value of points, which to me is around 2 cents/pt. That’s at least tax on $800 worth of points or what?

Wonder how much the bonus is worth for tax purposes

Sounds like they intend to tax the bonus.