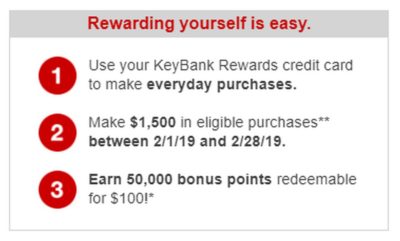

KeyBank Rewards Credit Card 50,000 Point Spending Bonus

I had a reader email me a spending offer they received for their KeyBank Rewards credit card, thanks Phil! If I am being honest I had never hear of the card before but the offer was decent so I decided to share it. It may be a card that is more popular than I know.

Details of the Offer

KeyBank contacted Phil via email to let him know of the spending offer. The terms for the offer are as follows:

- Make $1,500 in purchases in the month of February

- Earn a 50,000 point bonus

- 50,000 points seems to be worth $100 according to KeyBank

Let’s get past the pesos size value that KeyBank gives it’s points and look at the offer. $100 for $1500 in spend is a return of 6.6% on every purchases. That is a great return and doesn’t include whatever the card normally earns.

The card earns 5 points per dollar and Phil would get a 25% bonus on that for spending over $1000 within a month. That is an additional 6.25 points per dollar or 9,375 points for spending the $1500. Points are worth $0.002, yes we have finally found something lower than Hilton Honors points. That would put the value of the 9,375 points at $18.75 bringing the return on spend up to $118.75 or 7.9% on the $1,500. That is pretty hard to beat!

Conclusion

This card comes with a 50,000 point welcome offer, worth $100, which is not that enticing. But if they regularly send out spending offers like this it could be something kind of interesting. It would be similar to the Sears card with their spending bonus offers.

Does anyone else have this card? Where you also targeted for the spending offer?

Thanks again Phil for sharing this with us!

The Key Bank card has had a 100,000 point bonus in the past few months. I’ve seen the promotion on several occasions. If you plan to go for the card, wait for the larger sign-up bonus.

Good to know – thanks Don!

Is that the stingiest bank point value ever?

It has to be close if it isn’t. I know PNC’s is pretty bad too but I don’t know if it is this bad.