Marriott, SPG and Ritz Merger Details Announced

Today on Facebook Live, in a very odd award show like press conference, Marriott announced some details of a new program that will encompass Marriott Rewards, Ritz Carlton and Starwood Preferred Guest. These will become one program. Marriott has not chosen a name, so for now we’ll just call it Marriott. I’ve highlighted the key details and takeaways and you can definitely expect more detailed posts in the weeks to come, especially as more information is released. Unfortunately, until we know more about the way current properties will be transitioned into new categories, it seems nearly impossible to determine which changes are positive and which are negative. Check out the Official Page for all the available information.

Any outstanding SPG points will be transferred at a rate of 1 to 3 into the new program. Elite Status will also be granted based upon current tiers and the benefits seem to be similar for the most part. One interesting thing is that your stays in 2018 at any of the current brands will be combined to figure out how many elite nights you earn credit for. Among the changes are new elite levels, different earning structures, new credit cards and new award charts. We covered shared credit card issuer rights between American Express and Chase a few months ago.

The timing of changes seems to be all over the place. Some of the credit cards are expected to be available in May but the actual programs will merge in August. And then the rest of the changes will be rolled out in 2019, whatever that means.

New Earning Structure

One positive change that I can be confident is actually a good thing is that starting in August, you will earn the same amount of points across all brands on room rate and other incidentals that can be charged to your room, such as spa and dining. Previously, only select Rewards brands offered point earning on incidentals. (Element, Residence Inn and TownePlace Suites will earn differently, this is way less than the current exclusions and that’s a good thing!)

New Elite Levels and Changes to Earning Lifetime Status

For the most part the elite levels seem to be comparable. Here are the new levels and their benefits. Below you’ll find how the current levels will be transitioned into the new program. I noticed something interesting in the conversions, Marriott Gold Members will transition to Platinum in the new program but SPG Gold will only transition into Gold Elite. This is odd since you can match Marriott Gold Status to SPG. The new Elite Tiers and Benefits Chart can be found here

Marriott Members Elite Status Chart

SPG Chart

More Credit Cards

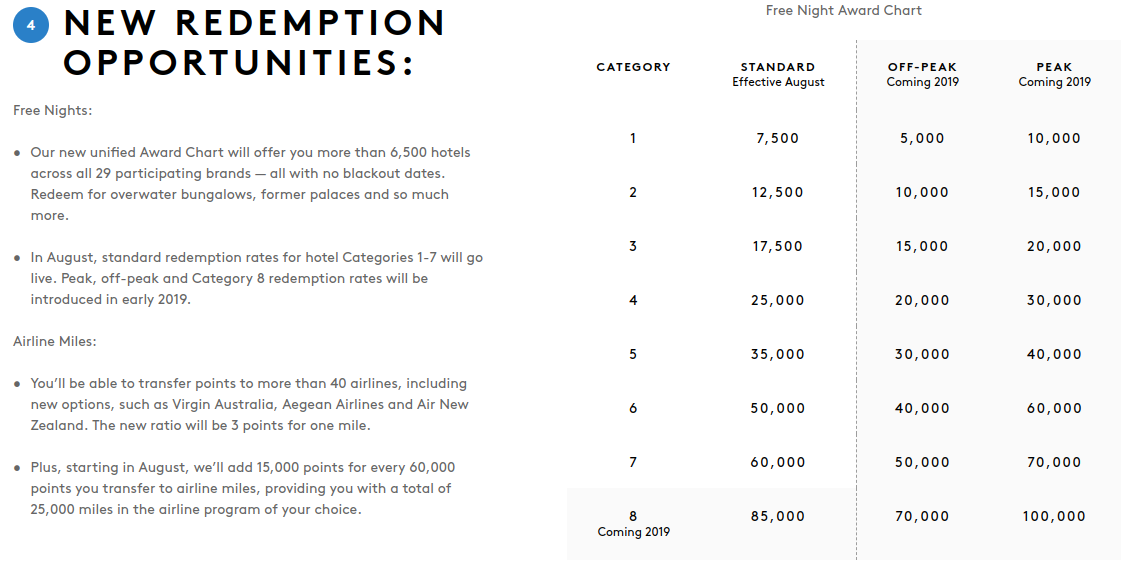

New Award Chart

Continuation and Expansion of SPG’s Airline Transfer Program

A few airline transfer options will be added including my personal favorite, Jetblue. The only thing that seems to be changing here is the actual numbers will be multiplied by 3, so for every 3 points you will get 1 mile and 15,000 points for every 60,000 points you transfer to airline miles, for a total of 25,000 miles in the airline program of your choice.

At least we will all be “elite” no matter what tier we end up in.. *rolls eyes haha

Love the “Program that Shall Not Be Named” title!

I can’t take credit for it, it was all Mark LOL

Does gold staus from the AmEx Platinum card change to Gold or Platinum? On the SPG chart it looks like gold and the Marriott chart looks like platinum.

Isn’t that so strange? I guess it effectively doesn’t matter since you can just match status but I thought it was weird too. Unless it’s a typo in their marketing materials.

As a 30+ year Marriott customer with nearly 800 nights and over 3MM points earned, and Platinum Lifetime, I feel I have been slapped and spit on by Marriott. Decent hotels at Marriott are now 50K, 60K, and 85K. I spent my working lifetime away from my wife and kids earning those nights and levels. Now retired, my wife and I looked forward to staying at some of the nice hotels and they have increased those points required by 1/3, in essence reducing my value by 1/3. This is truly a slap.

[…] Doctor of Credit, View from the Wing, One Mile at a Time, Frequent Miler, Award Travel 101, and Miles to Memories among […]

Can i get marrioit & SPG branded credit cards now (today) before the new cards come out?

It’s been a couple of years since I had a Marriott credit card and I’m under Chase’s 5/24 right now.

Would like to maximize before the new cards come out and double dip some bonus points.

I do have a personal SPG.

on another no – should we cancel current cards so they don’t automatically get rolled over into the new cards?? …and be able to apply for the new cards when they come out?

Yes the rumor is they should be around for another week or so. Might not be a bad idea to get them before the changes kick in.

Lots of good news, however, the 33% devaluation of SPG earning after 8/1/18 is horrendous. If Chase suddenly said Ink cards got 33% less points at office supply stores, I suspect there would be more backlash.

SO the new SPG card will earn 2X SPG points for any spend? Nice. That’s like 2.5x when converted to airline miles. I wonder how long SPG points will last by themselves.

No, it’s 2 Marriott points per dollar, not 2 SPG points 🙁

Doh! that’s plain dumb. Why would anyone still use that card. I wonder if the current cards get grandfathered or it’s all going to same earning in August.