Morgan Stanley Platinum Card 125K Welcome Bonus

The Platinum Card from American Express exclusively for Morgan Stanley is one of three Amex Platinum cards available to consumers. All three cards, along with the plain Amex Platinum and Schwab Amex Platinum, are different products. That means that you can get the welcome bonus even if you’ve had, or have, one of the other Platinum cards.

Additionally, the Morgan Stanley Platinum Card has some extra perks, such as the option to waive the annual fee (that just got much harder), free authorized user, and redeeming points for 1 cent each. You can read all about the card here, and check out the details of the offer below.

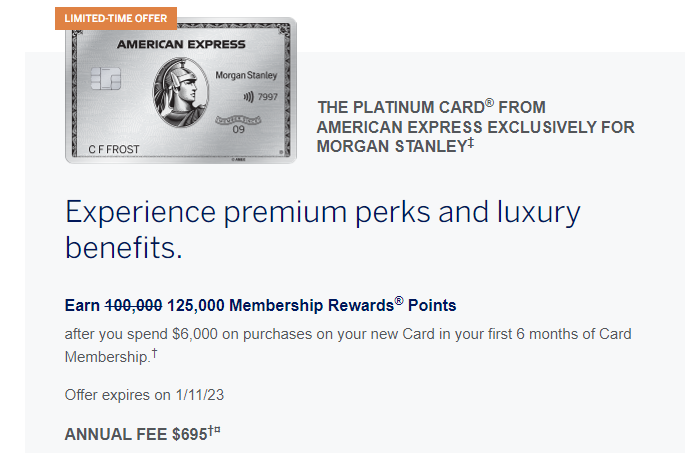

The Offer

- Earn 125,000 Membership Rewards® Points after you spend $6,000 on purchases on your new Card in your first 6 months of Card Membership.

- Annual Fee: $695

- Add an Additional Platinum Card to your Account for no annual fee. For the next 3 Additional Cards, the total annual fee is $175. Each Additional Card after the first 4 Cards, is $175.

- Offer expires on 1/11/23.

- DIRECT LINK

Card Highlights

- Earn

- 5X MR points on airfare booked directly with airlines or through Amex Travel

- 5X MR points on eligible hotels booked through Amex Travel

- $200 in annual Uber savings ($15 in Uber Cash for U.S. rides every month plus a bonus $20 in December)

- $200 annual Airline Fee Credit

- $200 Hotel Credit for prepaid bookings at Fine Hotels + Resorts(R) or The Hotel Collection bookings, which requires a minimum two-night stay, through American Express Travel.

- $100 in statement credits annually for purchases at Saks Fifth Avenue or Saks.com. That’s up to $50 on a semi-annual basis. Enrollment required.

- $240 Digital Entertainment Credit ($20/month) on eligible purchases or subscriptions: The Disney Bundle, Disney+, ESPN+, Hulu, Peacock, Audible, SiriusXM and The New York Times.

- Receive one Global Entry ($100) statement credit or one TSA Precheck ($85) statement credit

- $189 CLEAR Credit annually.

- Access to over 1,400+ airport lounges, including The Centurion lounge, Delta Sky Clubs, Airspace Lounges and Priority Pass Select membership

- Walmart+ Monthly Membership Credit ($12.95/month)

American Express Membership Rewards points are worth 1 cent each when they’re redeemed into an eligible Morgan Stanley account. You can also redeem points to cover charges on your card, but you only get a value of 0.6 cents per point.

Conclusion

With Morgan Stanley ending the Access Investing account, it is now harder to waive the annual fee on the Morgan Stanley Platinum Card. But even when paying the annual fee, this is a great deal and an option to get yet another bonus.

The bonus alone is worth $1,250, and you can add one free Platinum authorized user. You then get all the perks of Amex Platinum such as Uber credits, Walmart+, entertainment credits, $200 airline credit, $200 hotel credit, CLEAR and Global Entry credits and more.

The card also lets you redeem your Membership Rewards points at a value of 1 cent each. But the Schwab Platinum Card is a better option at 1.1 cents, and you can also get that same 1 cent value through the free Amex Business Checking account.

HT: Frequent Miler

So without that Access investing account thing, is there still a way to avoid the annual fee? Does having a brokerage account there at Morgan Stanley do the trick, or what does one have to do? Can you expound on that?