Citi Checking Bonus up to $500

Update: This bonus has been extended till 12/31/17.

Update: This bonus has been extended till 9/30/17.

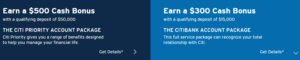

Citi is offering two new bonuses for checking accounts that are available nationwide. You can earn either $500 or $300 with these new offers, but the smaller bonus might the the best option. Let’s take a look.

The Offers

$500 Offer

- To qualify to earn a $500 cash bonus, you must open a new eligible consumer checking account in The Citi Priority Account Package between 4/15/17 – 6/30/17.

- Within thirty (30) days, make a qualifying deposit of $50,000 or more in new-to-Citibank funds into the new checking account or a new or existing Citibank Savings Plus Account or Citi Savings Account, and maintain a minimum balance of $50,000 for sixty (60) consecutive calendar days following the date when you made the qualifying deposit.AND

- Within thirty (30) days, 1 qualifying Direct Deposit must post to the new checking Account each month for 2 consecutive calendar months after opening the new checking account.

$300 Offer

- To qualify for a $300 cash bonus, open a new eligible consumer checking account in The Citibank Account Package by 6/30/2017.

- Within thirty (30) days, make a qualifying deposit of $15,000 or more in new-to-Citibank funds into the new checking account or a new or existing Citibank Savings Plus Account or Citi Savings Account, and maintain a minimum balance of $15,000 for sixty (60) consecutive calendar days following the date when you made the qualifying deposit.AND

- Within thirty (30) days, 1 qualifying Direct Deposit must post to the new checking Account each month for 2 consecutive calendar months after opening the new checking account.

Fees

Both accounts come with monthly fees and both can be waived but require large amounts.

- The Citi Priority Account Package – $30 monthly service fee waived when you maintain a balance of $50,000 or more in your eligible deposits, retirement accounts, and investments.

- The Citi Priority Account Package – $25 monthly service fee waived when you maintain a balance of $10,000 or more in your eligible deposits, retirement accounts, and investments.

Analysis

Both offers are similar, expect for the deposit requirement. The first offer give you $500 but requires a deposit of $50,000 within the first 30 days and you need to keep the money in the account for at least 60 days. You then need to have that same balance in your account to waive a $30 monthly fee.

The second offer gives you less, just $300, but requires a deposit of $15,000 within the first 30 days and you need to keep the money in the account for at least 60 days. You then need to have only a balance of 10,000 in your account to waive a $25 monthly fee. That’s why this is probably the best offer.

Also, Citi is often difficult with giving out bonuses, so you might have your money tied up longer than expected, which will make the first offer worse with each passing month.

You’ll also need to make direct deposits for these bonuses, something that wasn’t required in the past with similar bonuses.

Conclusion

Citi is not the best for bank bonuses as there’s been plenty of issues with bonuses in the past. But $300 is a big bonus, so should be worth it if you complete all the requirements in time and stay on top of them to receive the bonus as fast as possible. The faster you close the account the better, and there’s no closing fees.

HT: Doctor of Credit

[…] also has two checking bonuses for $300 and $500 if you don’t want to deal with points and we also wrote about a 50K ThankYou points offer for […]

I took one of these Citibank bonus offers for a checking account, and it was a nightmare. This bank is just unbelievably unprofessional and inept. They did not follow through on a single thing that they promised. Example: it took 10 days to verify the bank account I was transferring money from instead of the “2-3 days” they promised. I never got my welcome packet, which means I never got the all-important “debit card and PIN,” without which I could not access my online account. Getting both the ATM card and the PIN took multiple calls and several weeks. Finally I was able to access my online account – which immediately BROKE my pre-existing Citibank credit card account. That required almost an hour on the phone with tech support to get it unsnarled. Unsurprisingly, my bonus did not appear. After more online chat sessions and phone calls I finally found someone who took care of it. 6 months has now gone by. The bonus is in my account at last, and I can hardly wait to try cancelling the account. I hope it doesn’t take another 6 months to extricate myself from this mess. Assuming closing the account goes smoothly, I’ll have had $16K tied up for 6 months to earn a measly $400. It wasn’t worth it.

[…] New Citibank Bonus, Get $300 or $500 With New Checking Account […]

Great post, my first time here and been reading 3 great posts so far, loving it!!