One Finance, New Startup Gives You Up to 3% APY and More

“One” is a new San Francisco-based banking startup launched by former PayPal, Capital One and Azlo executives. The online bank aims to unify customers’ finances by allowing them to save, spend, borrow and share money through one account. One of the most attractive features is the interest rate of up to 3.00% APY that you can earn. There’s is also a signup bonus up to $75. One has partnered with Coastal Community Bank to issue the One Card and to provide banking services, such as the One account.

One was just announced and signups are not available yet. You can be among the first to experience better banking when you sign up to get early access.

$300+ in Bonuses

You can earn $50 when you sign up for a new account. To earn the bonus you need to fund your One account with a single deposit of $20 or more.

You can earn up to $250 when you invite friends to open and fund an account with One. You will receive $50 for each of the first five friends who sign up using your referral link and fund their One account with a single deposit of $20 or more.

I also see these two bonuses mentioned in the terms:

- $5 reward for downloading the One iOS mobile application. To be eligible and able to download the One app, you will need to have an iOS mobile device and a One account.

- $20 reward for a single transfer of $20 or more into your One account. To be eligible, you will need to have a One account and initiate the transfer in the One app.

High-Yield Account

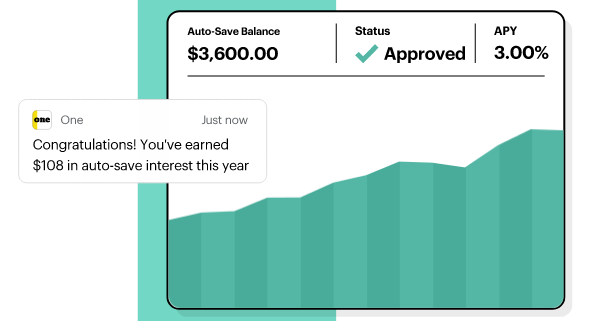

Reach your goals faster with One.

- Earn 3.00% APY on your Auto-Save pocket. Once enabled, One will automatically move 3% of your paycheck, up to $100, into your Auto-Save pocket, where those funds will earn 3.00% APY.

- Earn 1.00% APY on all other Save pocket balances

- Save toward goals together with shared savings pockets

Annual Percentage Yield effective as of 3/17/2020 and subject to change

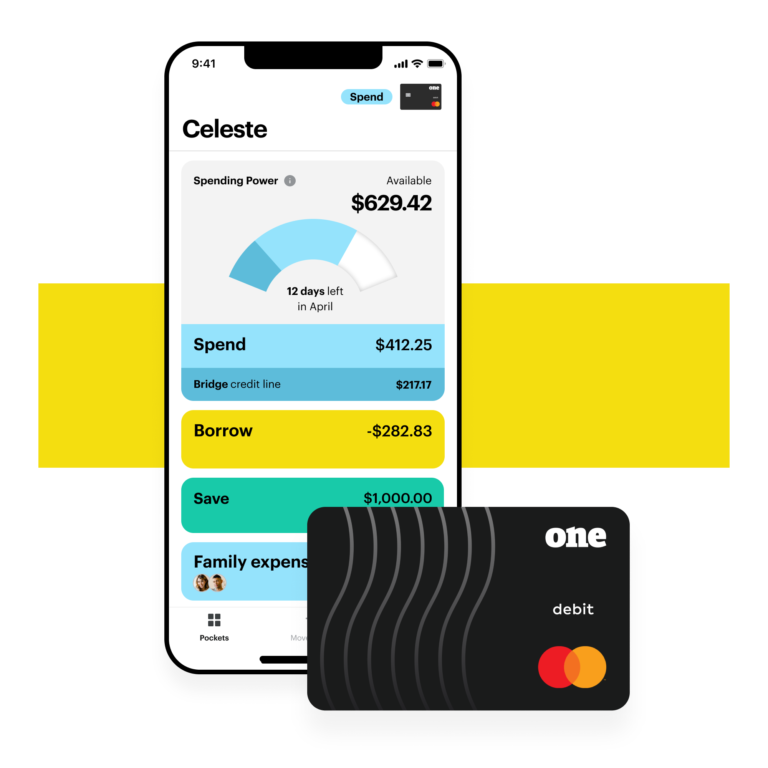

Credit

Your One account includes credit to help you bridge those financial gaps that pop up from time to time.

- Get instant approval and immediate access to funds

- Increase your credit limit by setting up direct deposit

- No interest on funds repaid within the month you borrow

One Card

With pockets and your One card, you decide how to organize and spend your money.

- Create pockets that support your financial goals and your individual needs

- Use your pockets to designate funds for specific purposes or simply for easier management

- Assign your One card to Spend or Borrow pockets, whether individual or shared

Omg, this is another bank like Simple where the bank thinks its clients are stupid for the reasons above and how the system is organized with pockets. Can’t banks use regular banking terms anymore?

“One of the most attractive features is the interest rate of up to 3.00% APY that you can earn.”

“It adds up over time”

No, it doesn’t. Run some numbers off of the fine print. This offer is for poor people that can’t do math. The “3% APY” interest is actually capped at a few cents for each paycheck you auto deposit into the account. For the typical poor person who would use this account who nets $30k a year after taxes and gets paid every two weeks, their big “3% APY bonus” = ($30,000/26) * 3% (maximum contribution) * (3% APY / 26) = 4 cents per paycheck every 2 weeks that they deposit and permanently leave in the account.

They could have just paid out 1.05% APY, but that’s not as sexy as a “3% APY bonus” to scam the mathematically-challenged.