Two Reasons to Consider the Southwest Performance Business Card

We recently did a review of the Southwest Performance Business card. The card comes with one of the best welcome offers out there, $1000+ in value, and has some pretty good perks as well. We covered all of that in the review but there were two reasons to consider the Southwest Performance Business card that I thought were worth going into more detail on. One I had not even really considered until reader Becky asked the question on the card’s review.

Some of these offers may have ended or changed.

Reason 1 – The Companion Pass

The first reason to consider this card is the Companion Pass. I realize that the best time to earn the Companion Pass is at the beginning of the year so that you essentially get it for two years. That means signing up for the Southwest Performance Business card right now may not be the best timing. But there are a few instances where it makes perfect sense.

If you were one of the people who grabbed the Companion Pass (CP) plus 30,000 Rapid Rewards points earlier this year then you fall in this bucket. The CP that you earned expires 12/31/19. Since you are already sitting on 30K+ Rapid Rewards points getting the Southwest Performance Business card would give you the 80,000 points needed to unlock the CP for all of 2020. Waiting until the end of the year would not make sense in this instance since the personal cards are under the Southwest family rule.

If you have a lot of Southwest flights upcoming before the end of the year and have 25,000+ Rapid Rewards points then it may make sense to get the card now as well. If you don’t have a lot of upcoming Southwest travel then it makes sense to wait until November or December.

Reason 2 – The In Flight WiFi Credits (Works on Multiple People)

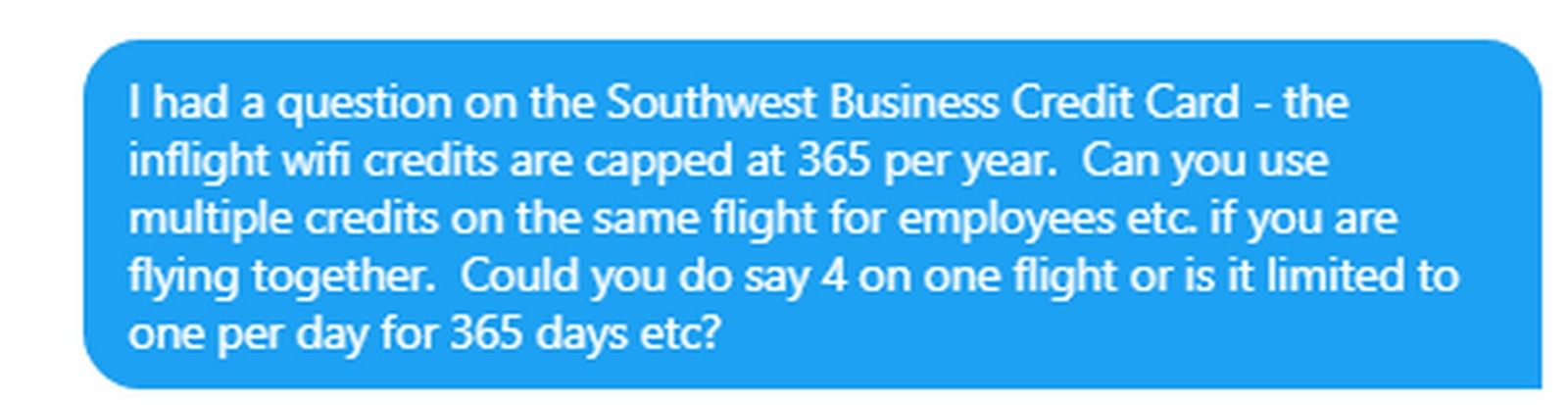

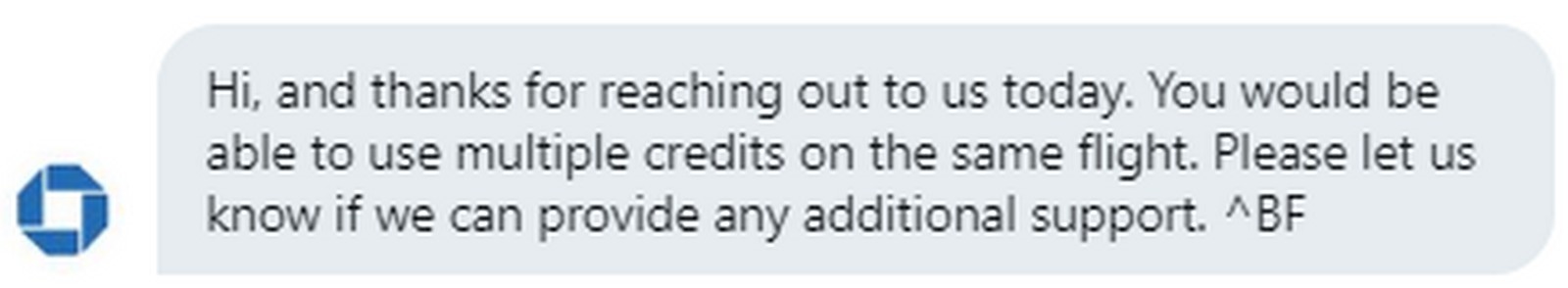

This is the idea that came from reader Becky. She wondered if you could use the WiFi credits on other people as well. You do get 365 of them per year but I wasn’t sure if it was one per day or one per flight etc. So I reached out to the Chase Twitter team for some clarification:

So you can use more than one per flight. That would make sense in case you were flying with employees etc. I know many people have family members as employees in their small businesses too. This could be a huge cost savings if you fly with Southwest regularly.

Final Thoughts

The Southwest Performance Business card comes with some interesting perks I have not seen before. The welcome offer is one of the more rewarding ones on the market. It could give you that push you needed to unlock your Companion Pass for another year. It could also save you good chunk of change on Southwest WiFi for you and your team. The savings would depend on how often you would use it though. Those are two things to consider when checking out this card.