U.S. Bank Altitude Reserve Changes Coming in December

The U.S. Bank Altitude Reserve card is one of the best cards out there for everyday spend. It earns 3X on mobile wallet spend (Apple Pay, Google Wallet, Samsung Pay) and you can redeem points for travel at a value of 1.5 cents per point. That can be a 4.5% return on all spend.

But there’s bad news. 3X earning will be capped soon, and redemption value will drop. Another negative change is that the annual travel credit will not be as easy to use as it currently is.

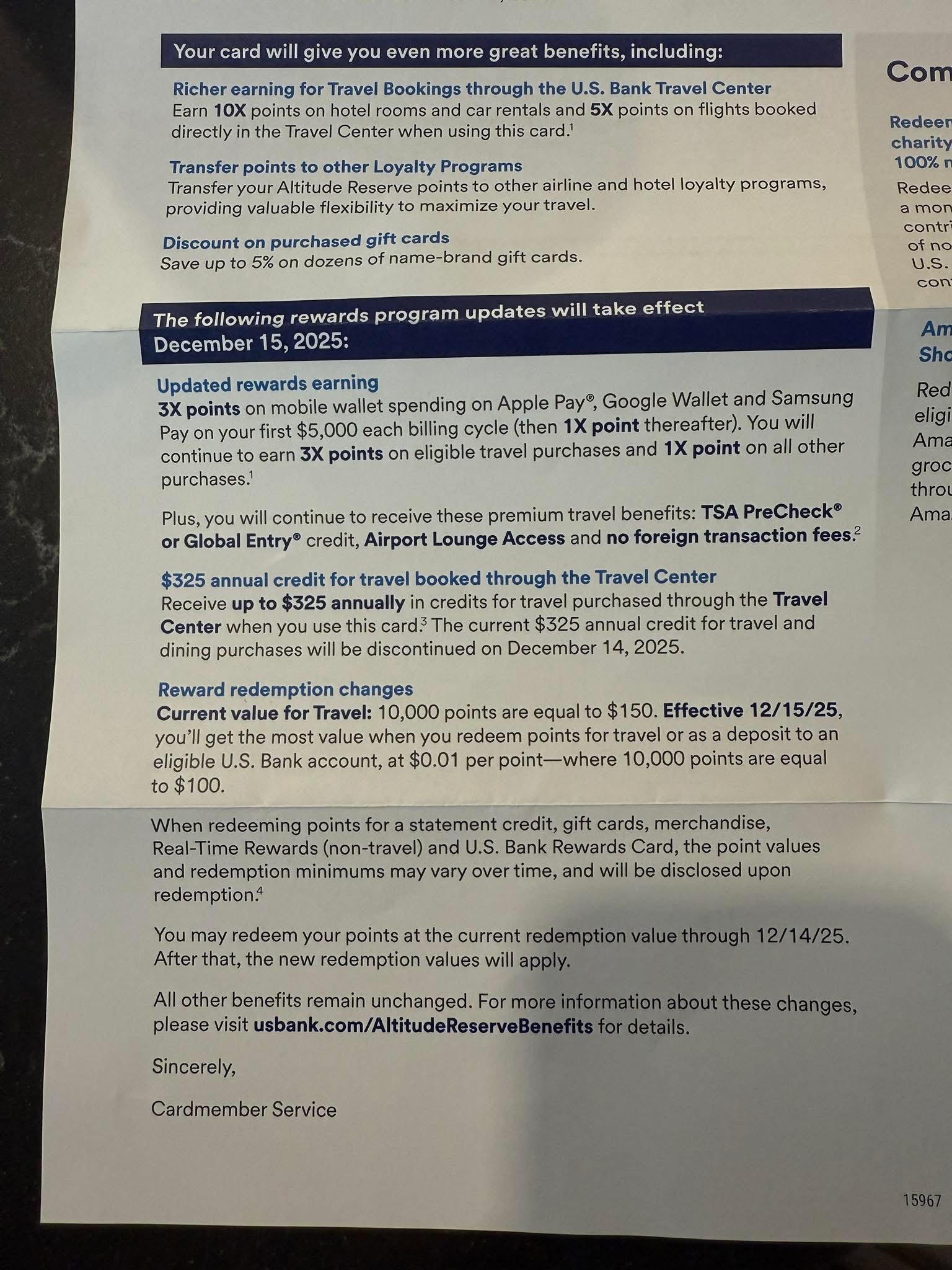

The changes were shared in a letter by U.S. Bank that was posted at r/creditcards. The changes that will go into effect on December 15, 2025 include:

- 3x points on mobile wallet spend will be capped at $5,000 each billing cycle. That’s still plenty of spend, but you can’t beat uncapped spend at 3X.

- $325 travel credit will only apply to Citi Travel Center bookings. It currently works for travel booked direct and dining.

- No more 1.5 cents per point redemption for travel. You will only get 1cpp starting 12/15.

As you can see in the letter, there’s also a bit of good news. Starting December 15, 2025, you can transfer your Altitude Reserve points to other airline and hotel loyalty programs. We still don’t know what travel partners will be included.

Do you have the U.S. Bank Altitude Reserve card? Let us know what you think!