Doing Too Many Deals Can Lead to Personal Breakage

I had a recent issue come up that was the byproduct of doing too many deals at one time. I think of myself as an organized person but I almost let this one slip through the cracks. The sad thing is I would have never known that I had turned a profitable deal into a loss. Personal breakage can kill your margins pretty quickly.

Juggling Too Many Deals

I have talked a lot about simplifying life lately and some of that comes with not chasing every deal. The credit card purge has already begun for me and the wife but limiting my deal chasing has not.

I took advantage of one of the recent Meijer deals where you get $5 in store credit for every $50 in 3rd party gift card purchases. These deals can even be stacked with discounted Meijer gift cards from eBay deals. I usually purchase a $500 Home Depot or Best Buy gift card to resell or to source items.

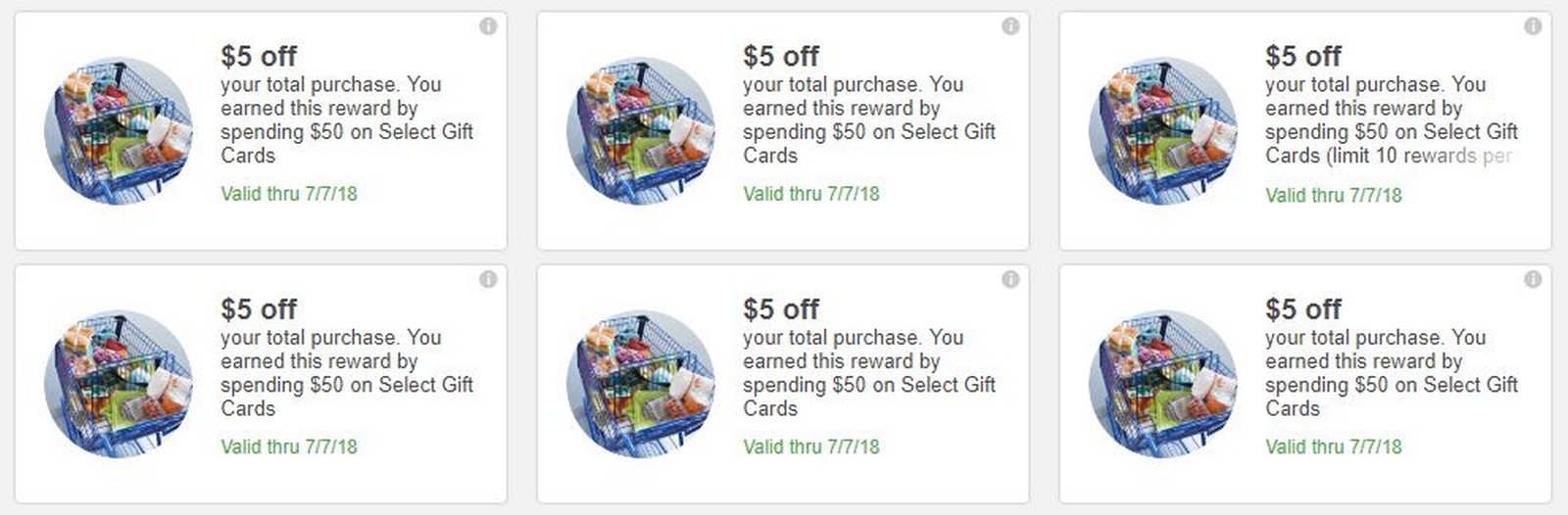

The problem is two of these deals came pretty close together so I thought I had already used my earned credits. When I went to the store last week to pick up a few things I ended up with a zero balance. I instantly knew what happened and when I went home and checked my account I saw this.

Luckily I still had a few days to use the remaining credits on my account. Had I not happened to go to Meijer I would have missed out on $50 in credit. The worst part is I would have never known it.

Creating Personal Breakage

Companies tend to do delayed deals like this hoping for breakage. They are hoping that we forget to go back to use the offer or mail in the rebate etc. That is why American Express breaks up the Platinum card‘s Uber credit into 12 months instead of one lump credit.

Sometimes we end up creating personal breakage by letting things fall through the cracks. Maybe there is a balance left on a Visa gift card we forget about or a returned item goes back onto the store’s gift card and we never use it. That is why I try to fully complete a deal before moving onto the next deal.

I often drain a Visa gift card the same day I purchase them to ensure this. And when I return an item purchased with a gift card I always ask for store credit so I don’t have to track down the old gift card. Even with systems in place things fall through the cracks sometimes, and we may not even know it.

That may be why some of the lessor deals, or ones that take multiple trips, may be worth skipping if I am busy with other things at the time.

Conclusion

I like these Meijer deals because I can stack them with Meijer gift cards to make a small profit and knock out a nice chunk of minimum spend. But when I lose focus a profitable deal can turn into a loss pretty quickly.

The key is to be organized, have a system, and avoid the small deals that are not worth your time. Because they may end up costing you breakage on one of the bigger deals when you are distracted.

[…] When Doing Too Many Deals Ends Up Costing You […]

At Meijer, I usually purchase the gift card, then do my grocery shopping. The mperks are available when I’m ready to checkout the second time. Then, I don’t have to worry about not using them.

I have tried that in the past and they did not load in time when I went to check out. But I only gave it 25-30 minutes. A great way to ensure not to miss out if they load in time though.

I’ve managed to get a check once or twice when I was making a return and informed the cashier I paid with a Visa gift card which I discarded (true).

Interesting – good tip!