20,000 Amex Membership Rewards Points with One Authorized User

American Express is offering generous bonuses for adding Authorized Users to credit card accounts. These offers are sent by mail, email or show up online when you log into your accounts. You can earn up to 20,000 Membership Rewards points just for adding one authorized user and spending $1,000. Let’s see the details.

Update 9/21/21: Business Platinum cards being targeted too.

Amex Business Platinum

The Miles Man is reporting that he was offered 20,000 Membership Rewards points for adding an authorized user when he called in about something else. The new user would need to spend $4,000 within 6 months to earn the points. He was able to add the Green Business card as the AU card to avoid the increased fee of a Platinum card. This trick also works on the Personal Platinum card when you add a Gold card as the authorized user card.

The interesting thing is that the rep said it is good for up to 99 cards. I am pretty sure the rep was wrong, since most of these offers are capped at 20,000 points. But if that is true it would be amazing. I put the likeliness of that being the case at 0.0001% though. Either way it may be worth asking if there are any authorized user bonuses on your account if you are calling for something else anyway.

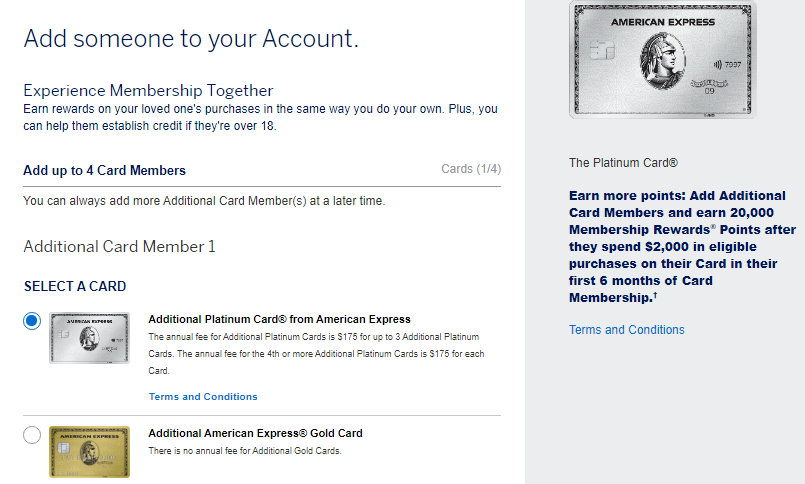

Platinum Card

Add at least one additional user to your account and you will earn 20,000 Membership Rewards points when they spend $2,000 on their new card within the first 6 months.

The annual fee for up to 3 Additional Platinum Cards is $175. Each Additional Platinum Card after the first 3 Cards is $175. You also have the option to add Additional Gold Cards to your account for free if you don’t need the extra benefits.

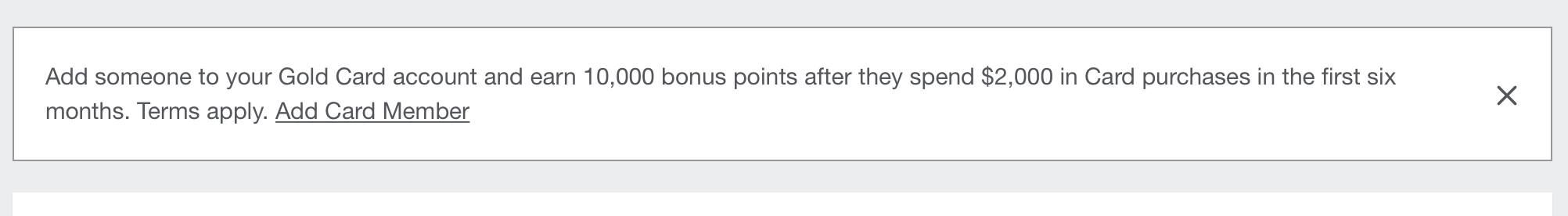

Gold Card

Add at least one additional user to your account and you will earn 10,000 Membership Rewards points when they spend $2,000 on their new card within the first 6 months.

There is no annual fee for up to 5 Additional Cards. The annual fee for 6 or more Additional Cards is $35 for each Card.

Amex Everyday Card

Add an additional user to your account and you will earn 10,000 Membership Rewards points when they spend $500 on their new card within the first 6 months.

There is no fee to add an additional card on this account.

Key Terms

- Points will be posted to the Basic Card Member’s account within 8–12 weeks after an Additional Card Member makes required purchases.

- The Additional Card Member’s Social Security Number and Date of Birth are not required to submit this request. However, this information must be provided by you or the Additional Card Member within 60 days after the Card is issued, or the Additional Card will be canceled.

- Maximum of one 10K/20K bonus per account.

Conclusion

These are great offers for adding just one authorized user to your account. It works out to 10X Membership Rewards on the Platinum Card offer or 5X for the Gold and Everyday cards.

Remember that adding an Authorized User will count against their Chase 5/24 count as long as the card is open.

I would suggest completing spending requirement with organic spend. American Express has been getting much tougher on bonuses and rewards earned with cash equivalent purchases.

Please let us know if you are targeted for any of these offers, or any similar offers on other Amex cards.

My wife got the 20k bonus offer with 2k spend inn6 months

To clarify in the Platinum card: does the bonus apply even if you add an AU with a free gold card? Or do you have to get the AU a platinum? Thanks

How exactly is the AU’s credit profile reflected? My understanding was that adding an AU would show the original applicant’s open date as the open date for the newly added AU. If the original applicant opened it more than 24 months before, I would think that the AU’s Chase 5/24 tally (and similar metrics for other issuers) would not be harmed. Anyone know for sure on that?