4 Ways Frequent Travelers Can Avoid Wasted Points

I recently posted a about an Alaska Mileage Plan promo that allowed elite members to transfer miles to other members for free. When Shawn asked us to do a post about the promo, my initial reaction was “who cares?” I definitely didn’t see much value in being able to transfer miles for free when you can always just book a ticket for someone using miles. Further, there are several programs out there that allow free transfers and pooling.

Related: How to Rescue Abandoned Points by Way of Transfers

Nevertheless, my colleagues convinced me that there was definitely some value to this promotion. They gave me a bunch of examples where the promo could be a good benefit. One of the biggest reasons that free transfers are a good thing is being able to avoid “orphaned points” (meaning having accounts with too few points or miles to book an award.) These lone points are even worse in loyalty programs that have short expiration periods. It also stinks to have rewards in programs that you don’t frequently utilize because your points can expire or you may not have the opportunity to earn enough points to use the ones you have.

I started thinking about all of the accounts I have with loyalty points that I’ll probably never use and I decided there must be a better way. Here are some options I came up with to help you avoid the sad reality of orphaned points. 4 Ways Frequent Travelers Can Avoid Wasted Points.

Credit to Another Airline

One way to avoid having too many airline loyalty accounts with orphaned points is to credit your trip to another airline’s loyalty program. This allows you to fly one airline but earn miles on your selected airline. An amazing resource that will help you decide which airline to credit your miles to is Wheretocredit.com All you have to do is input the airline and fare class of your ticket and the site tells you which airlines you can credit the flight to as well as the miles you’ll earn. You can simply choose an airline that you fly regularly and won’t have to worry about losing out on points

Choose Airline Miles Instead of Hotel Points

I never thought I would give anyone the advice to take airlines miles instead of hotel points and vice-versa. But one great reason to do so is to avoid earning points you won’t be able to use. If you can’t use them, it doesn’t matter how much more of a value they are than the partner points. For example, let’s say you figure you’ll stay at a Hilton a handful of times in your life- those points are valueless to you. Now if you choose to earn points with one of their partner programs, you’ll definitely get less points, but at least you’ll be able to use them in the future.

Another great thing about airline miles is that they tend to have longer expiration dates than hotel points and some, Delta for example, never expire. Some hotel programs will give you a set number of miles per stay, while others give you points based on the amount you spend. Hyatt for example allows you to select a partner airline and gives you a flat rate of miles with that airline. As you can see from the pic below, the amount of miles varies.

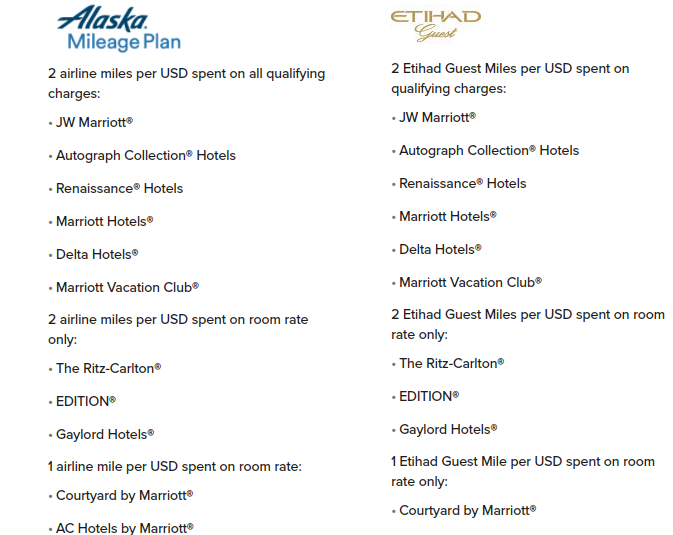

Marriott is an example of a hotel program that gives you miles based on the amount of eligible spend at Marriott. Again, you must select miles as your earning preference and choose an airline.

Choose Programs That Allow Pooling or Free Transfers/Gifts

There are many hotel programs that allow you to pool points or transfer them for free. For example, Hilton allows you to pool points with up to 10 members, Hyatt allows members to transfer to others etc. On the airline side, the only program that offers unrestricted pooling is Jetblue, but there are a few others that allow free transfers if members meet certain requirements. British Airways and Etihad allow household pooling.

Book Through an Online Travel Agency

This is a good option for hotel chains you may not frequent because instead of earning hotel points, you can earn rewards with whatever program you choose to book. For example Expedia has it’s own rewards program and any bookings you make will earn you flexible Expedia rewards.

Another example of this is booking through your credit cards travel platform. If you book a hotel though the Ultimate Rewards site, you will probably not get hotel loyalty points. You may however, get better perks, more value out of your points or discounted rates.

Conclusion

This post is certainly not intended to discourage diversification. I think it’s important to have points in several different programs, but only programs that you will have the opportunity to utilize. Keep in mind that airline programs almost always award miles for flying regardless of the method used to book. This means you should always try to double dip airfare purchases and it would be a good habit to checkout wheretocredit.com before flying.

Please let me know if I missed anything or you have any creative ways to avoid orphaned points.

Also, from a credit card standpoint, the best way to avoid orphaned points is to 1) don’t transfer UR/MR/TYP/SPG until you are ready to book, and 2) only go after hotel/airline credit card sign up bonuses when you have a specific redemption in mind. Points from paid stays and tickets are almost so low now as to be inconsequential compared with what you get from signup bonuses.

2 really great points. I agree 100%

I agree with point #1, but not necessarily #2. For example, earlier this year JetBlue raised their signup bonus to 60,000 double the usual 30,000 – the highest they ever had the signup bonus. I signed up for the card even though I don’t have a specific use for them at this moment. I am sure I will eventually use them.

That’s fair for programs that don’t expire points like Delta and JetBlue.

I agree with your approach for the JB card, I think if you use a program regularly or know that you will be able to use certain points- it’s definitely worth signing up for exceptionally high bonuses.