Earn 3X Ultimate Rewards Everywhere with Chase Freedom Unlimited

The Chase Freedom Unlimited credit card was released back in 2016. It is a no fee card that earns 1.5% on all purchases and usually has a signup bonus of $150 with a $500 spend requirement and $25 for adding an authorized user. You can read our full review here. Now they have a different offer. No signup bonus, but double earning everywhere for a year.

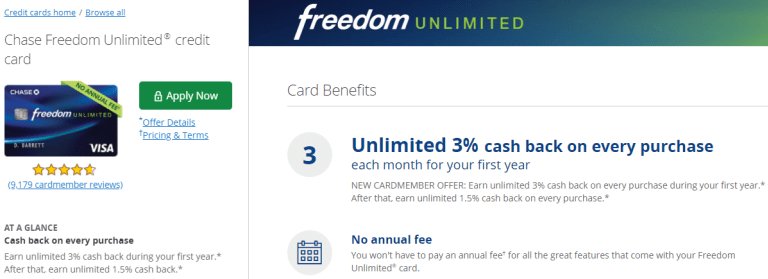

The Offer

- Earn unlimited 3% cash back on every purchase during your first year. After that, earn unlimited 1.5% cash back on every purchase.

- Earn a $25 bonus after you add your first authorized user and make your first purchase within this same 3-month period.

Application Page (direct link)

Bonus Restrictions

The Chase Freedom Unlimited credit card does fall under the dreaded 5/24 rule. You can not sign up for the card if you have had more than 5 new credit accounts within the last 24 months.

The Chase Freedom Unlimited credit card also has the standard 24 month bonus restriction language:

“This product is available to you if you do not have this card and have not received a new cardmember bonus for this card in the past 24 months.”

Analysis

Earning unlimited 3% on all purchases for a year is a pretty sweet offer, even if the signup bonus is removed. But with Chase Freedom Unlimited it gets even better. It becomes 3X Ultimate Rewards points everywhere if you have a Chase premium card that them available to transfer to travel partners. The cards that make this possible are the Ink Preferred, Ink Plus, Sapphire Preferred, and Sapphire Reserve.

Most people value transferable Ultimate Rewards points at around 1.5 cents a piece. That would increase the card’s return to 4.5% for the first year and 2.25% after that. If you can easily put lots of spend during the first year then it can be a very lucrative offer.

Conclusion

Chase Freedom Unlimited usually has a $150 sign up bonus and occasionally targeted $300 offers. But this offer could be even better for some. The main issue is that the card falls under 5/24, so not many people will be able to apply. Then if you are under 5/24 you have to make a decision if it is worth it for you compared to other Chase cards.

Let me know what you think.

Does anyone know when this offer expires?

If I normally spend 30k a year on this card, I would get a 30k signup bonus if/when such an offer was available, and thus earn 30kx1.5=45k, plus 30k bonus=75k

With 15k signup bonus, if available, I would earn 30kx1.5=45k, plus 15k bonus =60k

With no signup bonus, I would earn 30kx3=90k.

For 20k/yr spend, its

60

45

60

So for 20k or more planned spend, 3x for the 1st year is better than any bonus given in the past.

That’s good UR earning, man!

I wonder if you can get this offer if you downgrade from the CSP

Pretty sure it is for new accounts only

Referrals do not get this offer unfortunately.