ABOC Platinum Rewards Mastercard Card Details

There is a new rotating 5X cashback card on the market. It is the ABOC Platinum Rewards Mastercard. I know how much our readers love their 5X cards from the Chase Freedom, to the Discover It, and the Citi Dividend so we thought this would be of interest. I will give you a quick rundown of the card and share my thoughts on it as well.

Details Of The ABOC Platinum Rewards Mastercard

Amalgamated Bank of Chicago is a smaller issuer, but this no annual fee, cash back card with rotating categories is very competitive and was launched in 2017. The Platinum Rewards card has gone under some retooling this year and they added the rotating 5X categories.

Here are the card’s offer details:

- Earn a $150 statement credit after making $1,200 in purchases within the first 90 days of account opening.

- No annual fee

- 1 ABOC Rewards point per $1 spent otherwise

- Rotating 5X earning categories, up to $1,500 in spend per quarter

- 0% APR for the first 12 months

- Points can be redeemed for travel, gift cards, merchandise, and statement credits.

- Travel – 1 cent per point through their portal

- Gift Cards – .77-.93 cents per point depending on the denomination

- Statement credit – .75 cents per point

- It is a Mastercard accepted at over 30 million merchants worldwide.

- 3% Foreign Transaction Fee

Click Here to apply

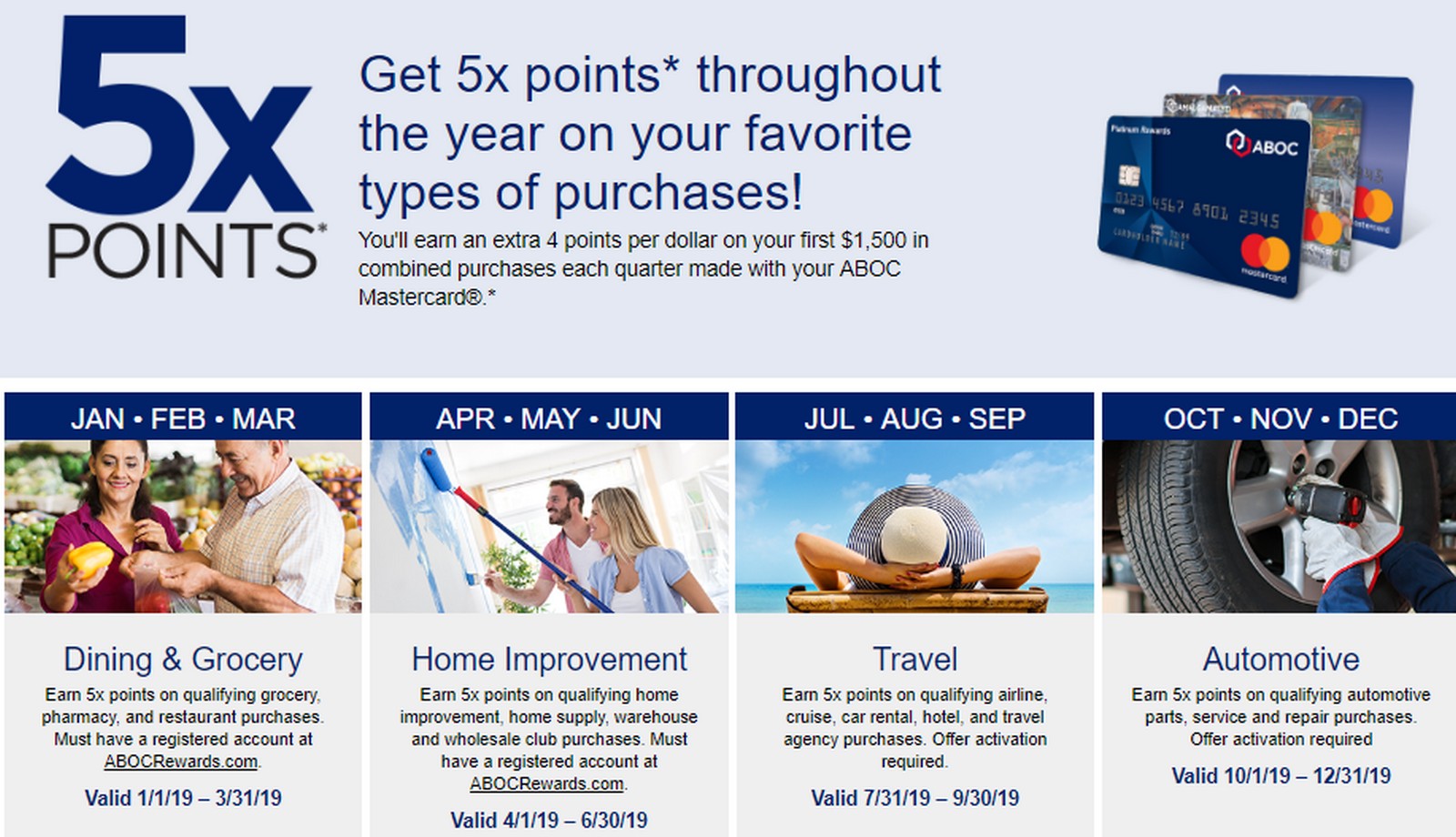

5X Bonus Categories

The 5X bonus categories have been announced beginning in 2019. They are as follows:

- January – March: Dining, Grocery, and Pharmacy

- April – June: Home Improvement & Wholesale/Warehouse Clubs

- July – September: Travel (airline, cruise, car rental, hotel, and travel agency purchases)

- October – December: Automotive parts, service, and repair purchases

These are pretty good categories, especially the first two. At first I didn’t really like the 4th quarter, but I can’t think of another bank including auto repair in their rotating calendar. It could be great if you need new tires for the winter etc.

My Thoughts

Any 5X card is worth looking at in my opinion. These types of cards usually offer good categories and offer ways to rack up points or cashback. The welcome offer on the ABOC Platinum Rewards Mastercard is on par with others in the category at $150. The spending requirement is on the higher end at $1200 vs the normal $500 of other cards.

The categories look solid and the redemption options are decent. I am not sure how travel redemptions price out in their portal versus booking directly but they offer the best value. That is unless they offer discounted gift card redemptions from time to time like Discover does when cashing out.

I don’t know anything about Amalgamated Bank of Chicago, if they are inquiry sensitive, or how their online system is. Since they are so new to the space I don’t think many others will either so we are going in a little blind. I do think the opportunity is worth the risk, if over Chase 5/24, since you can’t have too many 5X earning cards.

Conclusion

While I think the Chase Freedom is the overall better product because it offers the possibility of transfers to travel partners (when partnered with a premium Chase card), it isn’t available to many people because of the Chase 5/24 rule. This is an option on par with a Discover it or Citi Dividend card in my opinion.

As for the bonus, it’s okay but the spend requirement is slightly on the high side. In conclusion, the long term gains are the key here. Having another option for 5X earning is a great way to offset some of your travel expenses once you get to your destination.

Share your thoughts below, do you think this card is worth applying for? Did you apply? Share your experiences in the comments.

Mark- Check to see if this ABOChicago credit card still has a Foreign Transaction Fee. They recently went to no Foreign Transaction Fee on their Union Strong credit card.

( And, why do the Oldest Comments appear before Recent Comments ? Normally Recent Comments are at the top of the Comments Section. I find listing Recent Comments first more helpful.)

I will take a look W R and I’ll look into the comments section thing as well.

Thanks!

Was expecting there to be more activity since this was posted. I have a note set to apply for this card in about a month, just before the Q2 warehouse (Costco) offer begins. I’m hoping that buying a Costco cash card online will trigger the warehouse coding, just as Discover does.

As long as it codes as a Costco purchase and not a 3rd part gift card provider (like Best Buy does) I think it should work.

It’s just not a great card. Travel portals generally are more expensive than the cheapest non-portal alternative so it’s not really a 5X card. You can redeem the points for statement credits but only at 0.75 cents per point. So that makes it a 3.75% rotating cash back card.

Check the quarters:

1. Dining, Grocery, and Pharmacy — 4%+ dining available via Uber, CSR, Amex Gold, etc.; 4%+ grocery available via other rotating cards or amex cards; pharmacy is interesting but again OBC and rotating cards still trump it.

2. Home Improvement — generally Q2 is when you see that category pop up on Discover or Citi Dividend so that’s a true 5%.

3. Travel — there are so many alternatives that earn more than 3.75% on travel all year round.

4. Automotive — this is the only category that’s unique. The only alternative here would be using Samsung Pay or Apple Pay with an Altitude card. This would be much more valuable if your repair shop would sell you a gift card that lets you burn that $1500 throughout the year (oil changes, tire replacements, etc.)

In sum, this is why the card isn’t more popular.

Thanks for letting us know on the portal aspect. That was one of the main things we were not sure on.

Thanks for this feedback. Do you know what gift cards are available towards the .93 redemption?

[…] Hat tip to MtM […]

[…] Hat tip to MtM […]

[…] Hat tip to MtM […]

[…] Hat tip to MtM […]

[…] Amalgamated Bank of Chicago is a smaller issuer, but this no annual fee, cash back card with rotating categories is very competitive and was launched in 2017. The Platinum Rewards card has gone under some retooling this year and they added the rotating 5X categories. Read more here. […]

It would be nice to know if there is a foreign transaction fee, and if these categories only apply to US purchases. Not everyone is based in the USA.

3% foreign transaction fees. I updated the post – thanks

Maybe if I was way over 5/24 but at this point there’s a lot of SUB’s to be had before this one is of any interest. I do like the 5X rotating cards though.

Best for people over 5/24 for sure. I wouldn’t get this until 5/24 is far in the rear view.

Since it was launched in 2017, I am curious their quarterly bonus in 2018.

The 5X earning was just added to the card this year so nothing to look at unfortunately.

Im going to hold off until I hear from others. It would be a nice card to have for the 5x points.

Can’t blame you – a lot of unknowns at this point.