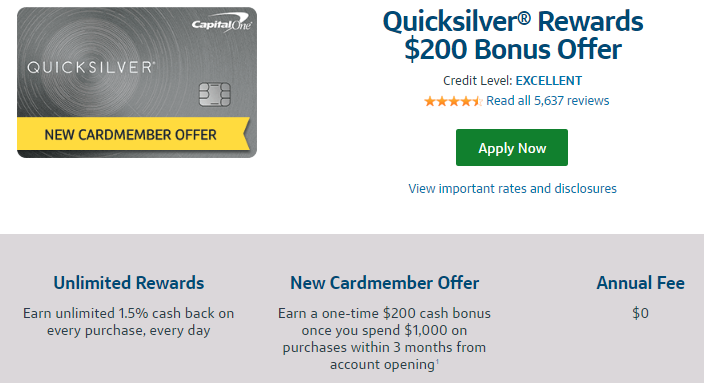

Increased Bonus of $200 for Capital One QuickSilver Credit Card

The Capital One QuickSilver Credit Card has an increased bonus of $200. That’s up from the normal bonus of $100. Let’s check the details.

The Offer

- Earn a $200 bonus if you spend at least $1000 within 3 months of your rewards membership enrollment date. Once you qualify for this bonus, we will apply it to your rewards balance within two billing cycles.

Existing or previous Account holders may not be eligible for this one-time bonus.

Card Benefits

- Earn unlimited 1.5% cash back on every purchase

- 0% intro APR for 9 months on purchases and transfers

- No Foreign Transaction Fees

- No Annual Fee

Conclusion

While this is an increased bonus, still $200 in not that great for a new credit card. On top of that Capital One pulls from all three credit bureaus, which is a big deal for many people. It’s best to look at better bonuses first, before considering the Capital One QuickSilver Credit Card.

HT: Doctor of Credit