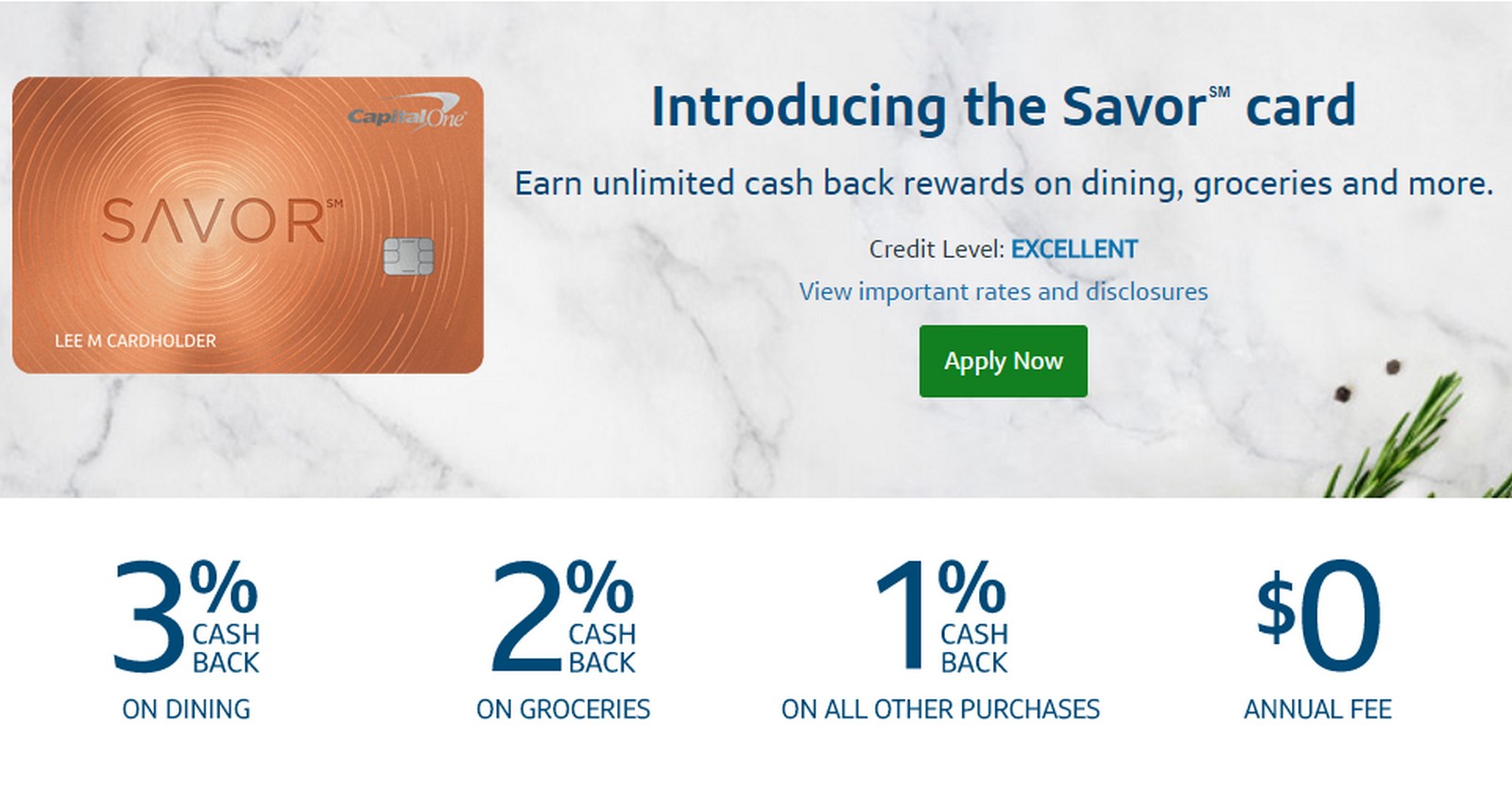

Capital One Savor Card Details and Review

Capital One just released a new credit card product, the Savor card. The Savor card earns cash back and comes with no annual fee. It has a couple of bonus categories and it comes with a small sign up bonus. Is it worth getting? Let’s take a look.

Details on the Bonus

The card comes with a $150 sign up bonus after meeting $500 in minimum spend within 3 months of opening the card.

Want More information? Click here!

Earning Structure

The card earns cashback as follows:

- 3% Dining

- 2% Groceries

- 1% on everything else

Cardmember Perks

The Savor card comes with a 0% APR for the first 9 months. It also has a 0% balance transfer offer for the first 9 months, with a 3% balance transfer fee.

Sign up Bonus Value ($150)

The card has no annual fee so you get to keep the entire $150 sign up bonus.

Analysis

3% dining is on par with the Citi Costco card and the Chase AARP card. Both of which are superior cards to the Savor card in my opinion. While 3% cash back on dining matches the largest cash return for that category you can get a much better return with an annual fee card. Some examples are the Chase Sapphire Reserve, American Express Flexperks, American Express Premiere Rewards Gold card etc.

Earning 2% cash back on groceries and 1% everywhere else is not a very compelling offer. You would be better off getting the Citi Double Cash and earn 2% on everything unless you spend a large amount on dining out.

Where this card could have value is when your annual fee comes due on the Capital One Venture card. In the past the only option to downgrade had been the Quicksilver card. The Savor card is superior to the Quicksilver card so this would be a good option to downgrade to. That is, if you wanted to keep the line of credit open.

Get more info and compare card offers.Conclusion

The card is not all that interesting to me. The earning structure is worse than a standard 2% cash back card. There are better options out there in the no fee arena as well. The $150 sign up bonus is not worth burning a hard inquiry for either.

Where the card comes into play is when/if you decide to downgrade your Capital One Venture card. It is a card you could keep long term, since there is no annual fee, and keep your average age of accounts up.

Hat Tip to OMAAT

Phone rep said change from Quicksilver to Savor was not an option. May try again in the future.

That stinks – maybe down the line. I would imagine Venture to Savor would work.

One advantage that the Savor card has is that there are no foreign transaction fees unlike the AARP or Citi Costco card. It also comes with World Elite MasterCard Benefits which is unusual for a no fee card. Also, the Citi Costco isn’t really a no fee card as a Costco membership is required to have it. The Savor card would be useful for a person that eats out a lot, likes cash back instead of points or miles, and doesn’t want to pay annual fees. I wouldn’t use it anywhere else though, because there are better no fee options for other categories of spending.

Good points – thanks!

Good question. I have the quicksilver card from before the double cash citi card. I rarely use it because citi has a higher cash back now. Since it has a very high line I don’t want to cancel it. This would allow me to use my capital one card again for dining and maybe groceries. Aside from cash back are the two cards just as good otherwise? Would there be any downside if it can be switched?

I can not see any downside Michael. Quicksilver used to get 20% credit on Uber but that ended a long time ago so I think you should be fine making the switch.

Not really attractive offer

Nope not really.

can you switch from a Capital One Quicksilver to a Savor?

Unknown at this but I would guess so. If you give it a try let us know how it goes!