Capital One Savor Card, Now with $500 Welcome Offer & 4X on Dining

Offers in this post may have changed.

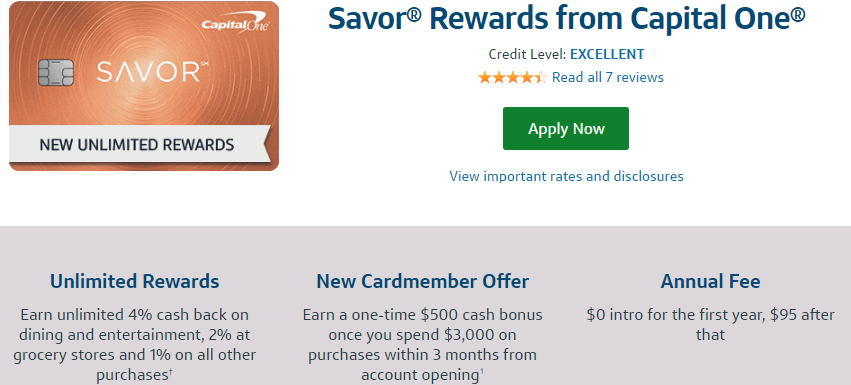

Capital One released the new Savor card in October of last year. As Mark pointed out in that post, it was not a card worthy of an application for most people. The bonus was only $150 and the best perk was 3X on dining. But now the Capital One Savor card has been enhanced with a better welcome bonus and earning rate. An annual fee was added to go along with the improvements, but it is waived the first year.

Capital One Savor Card Welcome Bonus

The card comes with a $500 cash welcome bonus once you spend $3,000 on purchases within 3 months from account opening.

The card now has a $95 annual fee that is waived the first year.

Capital One Savor Card Earning Structure

The card earns cashback as follows:

- 4% Dining & Entertainment

- 2% Groceries

- 1% on everything else

Capital One Savor Card Perks

The Savor card comes with a 0% APR for the first 9 months. It also has a 0% balance transfer offer for the first 9 months, with a 3% balance transfer fee.

Capital One Saver Card Welcome Bonus Value ($500)

The card has an annual fee of $95 that is waived the first year so you get to keep the entire $500 sign up bonus.

Analysis

The increased $500 bonus makes it worthwhile for those who prefer cash welcome bonuses.

4% on dining is the best cashback rate out there, only matched by the Uber card. The Chase Sapphire Reserve is still probably the best option for dining but it comes with a large annual fee.

Earning 2% cash back on groceries and 1% everywhere else is not a very compelling offer. You would be better off getting the Citi Double Cash and earn 2% on everything unless you spend a large amount on dining out.

Conclusion

When the card was first released it was not very enticing. But now with a $500 welcome bonus and 4% on dining is worth a look and possibly a decent option for those that prefer cash instead of miles and points.

Why would the CSR dining be better? CSR 3x points on dining vs COS 4%. 3x points is same as 3%, With CSR its only good if you use it through there travel site which would equate to 4.5 but Chase travel is not always the best deal so I think COS beats CSR with dining

You can transfer the points to travel partners as well. If you are not getting at least 1.5 cents per point out of UR points then you are not doing it right imo. Southwest, United, British Airways, Hyatt will all get you over that.

[…] Airlines Sued Over Flights Canceled Last Winter Capital One Savor Card, Now with $500 Bonus and 4X on Dining Gyft, Buy $50 Nike Gift Card with $10 Bonus plus […]

Lousy card. Not worth spending $9500 for an extra 1% cash back on dining.

Why would you? Just close the card before the annual fee hits, or downgrade it.

As far as flat-out cash bonuses go, $500 for $3K minimum spend is much better than the the $4.5 spend required by their Spark Cash cards for the same bonus. Any clues on what to downgrade this card to, before the annual fee hits?

You should be able to downgrade to their Savor One no-AF card: https://www.capitalone.com/credit-cards/savorone-dining-rewards/

Yep. That idea hit me while getting ready for work today. Thanks, still.