Note: Miles to Memories has an affiliate relationship with Cash Freely. The following links are our affiliate links. The words and thoughts in this post are ours alone.

Cash Freely Review: My Initial Thoughts

A few weeks ago, Mark brought up that Zac from Travel Freely has built a new tool focused on cash back, aptly named Cash Freely. I’ve described plenty about why cash back is my favorite rewards currency. Naturally, I wanted to take the new tool for a spin. Here’s my Cash Freely review. I’ll focus on the tool from a cash back beginner’s perspective to more fully capture the tool’s utility.

What Is Cash Freely?

Cash Freely is a site that enables credit card organization and tracks the best credit card welcome offers available, focusing on cards that enable cash back / cash outs. With the program you can record your welcome offer progress and cash back success. Also, Cash Freely’s My Best Offers function uses an algorithm to recommend card products based on your current card portfolio, bank rules, and the latest welcome offers.

What Cash Freely Isn’t

Cash Freely is not a tool which updates your rewards balances. That capability is present in many other useful tools already. The service is also not expensive; it’s actually free. I was pleasantly surprised that the site is not a time-suck, either. Cash Freely is not intrusive – it does not require you to enter any credit card numbers or track your purchase history.

Getting Started

Signing up is simple and very similar to Travel Freely. To get started you only need to do the following:

- Provide your name and email address

- Verify your email

- Create a password

- Select beginner or advanced level

That is it and you are up and running.

Speaking of email, beginners can expect a few e-mails weekly from Zac Hood, Cash Freely’s founder, containing useful info, tips, and links. You can also decide to track cards for a second user, such as your spouse or domestic partner. Probably the most time-intensive task in starting out is entering your existing card information. For beginners, though, you most likely won’t have too many cards to enter! The site asks for the following info:

-

- Card Name

- Account Type (User 1, User 2, or Business)

- Date Opened

- Optional Categories:

- Authorized Users

- Bonus Achieved

- Notes

- Status (Active/Closed)

I enjoy how the Card Name field auto-populates based on my entry. Again, I find the site requiring minimal info a refreshing aspect. Of course, adding more info makes the tool more useful. The automatically attached card art is an aesthetically pleasing touch.

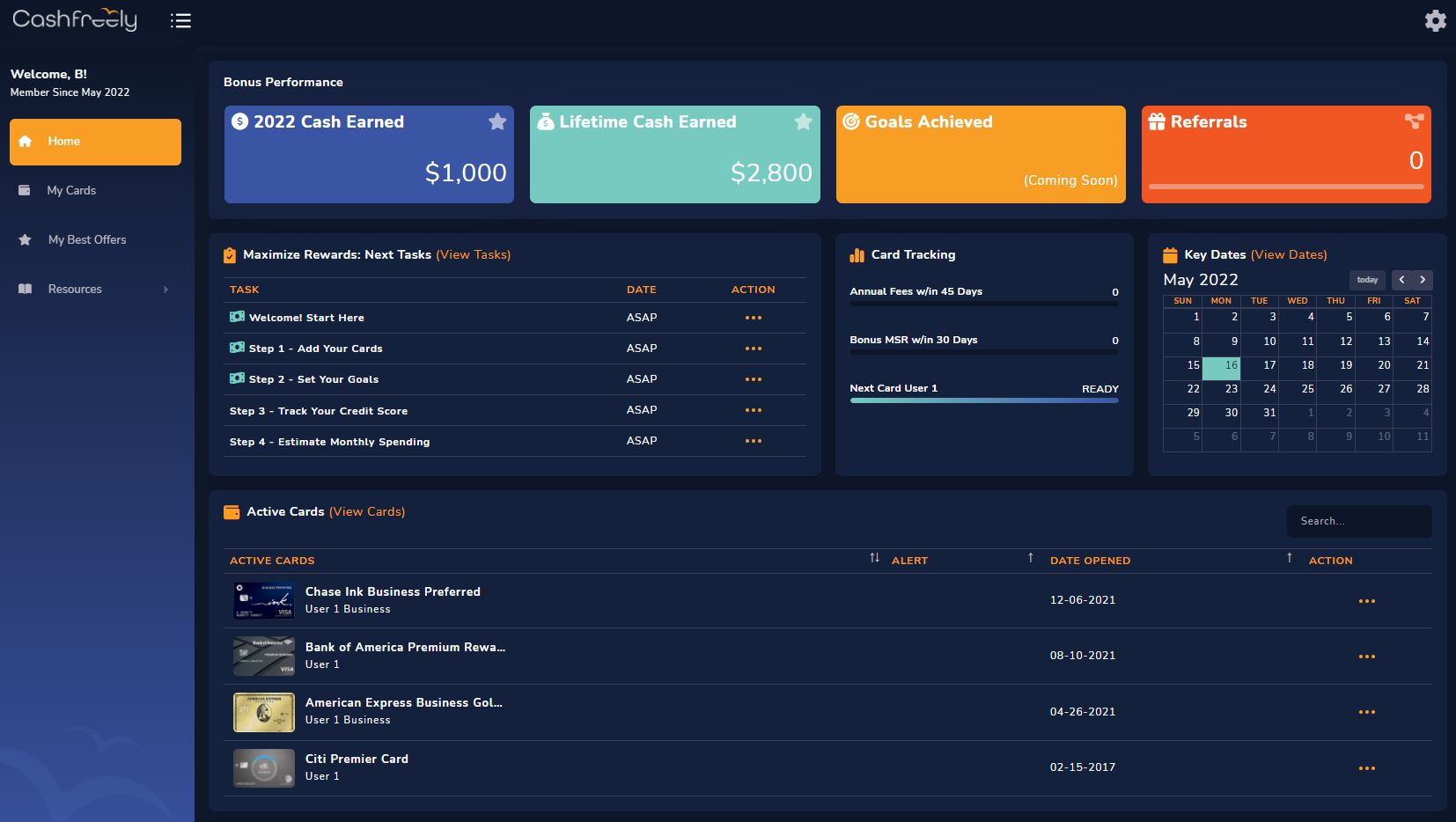

Cash Freely – Dashboard

My Dashboard page (labeled as Home on the site’s left column), is pictured above. My active cards are prominently displayed, along with a task list for maximizing rewards and cash back info and totals. I found the card tracking window particularly helpful for beginners – it includes:

- Annual fees posting within 45 days

- Bonus deadlines within 30 days

- A rough timeline for when user(s) should consider applying for another card

Related dates are displayed to the right. The Goals window is populated based on your entries in Task Step 2. You can easily refer friends to Cash Freely using the window quite prominently displayed in the top right area.

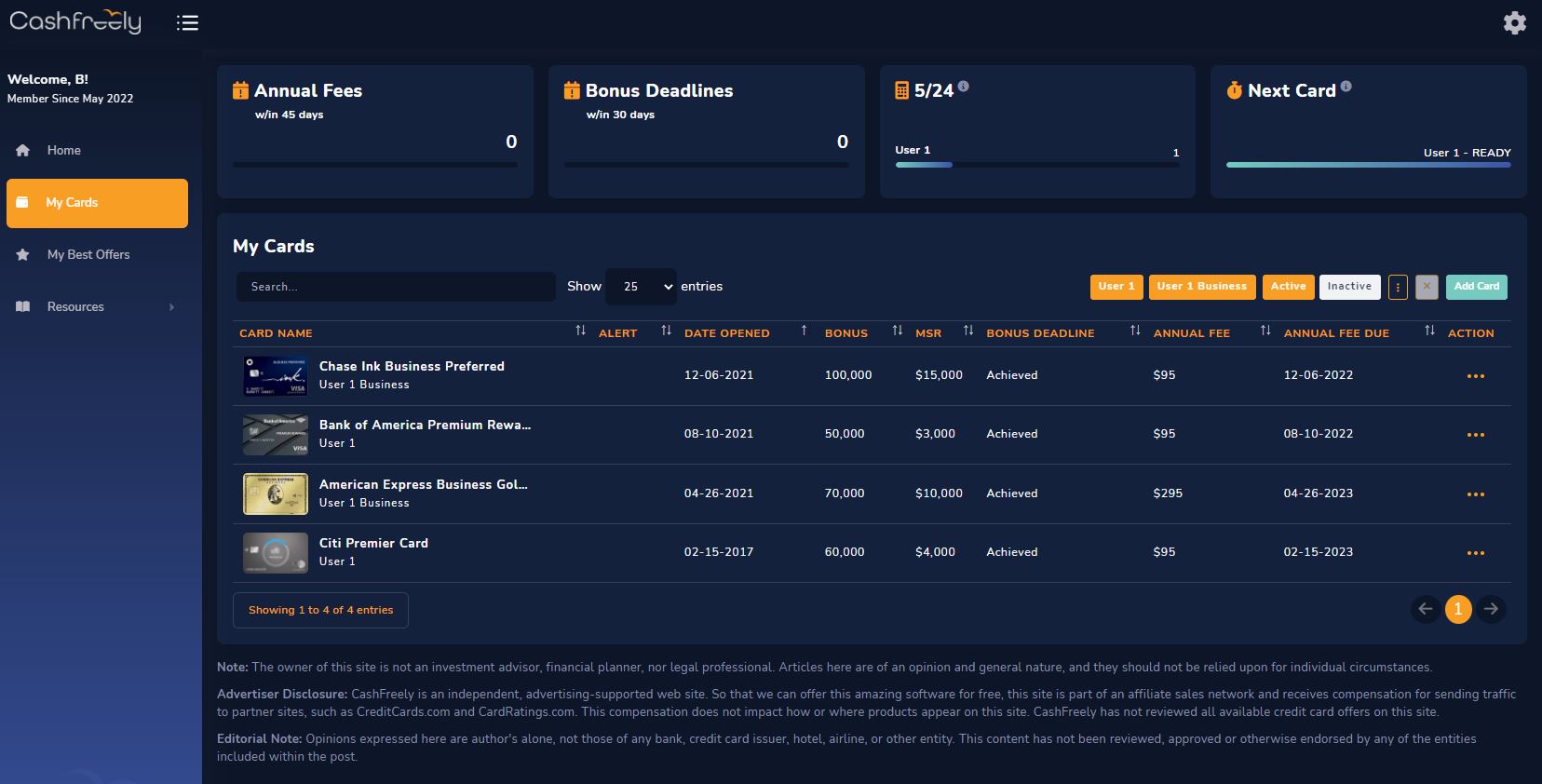

Cash Freely – My Cards

You can drill down into your card specifics in the My Cards page. I like this page providing more useful info and the ability to easily edit your current entries. Like Travel Freely, key time periods in Cash Freely are color-coded. For instance, if a card entry is prominently marked orange, that means the annual fee is due within 45 days. Card entries are labeled differently if the welcome offer deadline is within 30 days. Simply float over the alert column messages to display this specific time-sensitive info.

The other columns encapsulate info you entered when you added cards and certain card characteristics which were auto-populated, such as annual fee amounts and future due dates. I can filter cards based on the user and business by simply clicking on the buttons above my cards. Also, I’m able to easily customize which columns show up.

A few windows across the top include similar info and also my Chase 5/24 status. While displaying status of additional bank rules would also be useful, beginners are understandably more focused on the 5/24 rule.

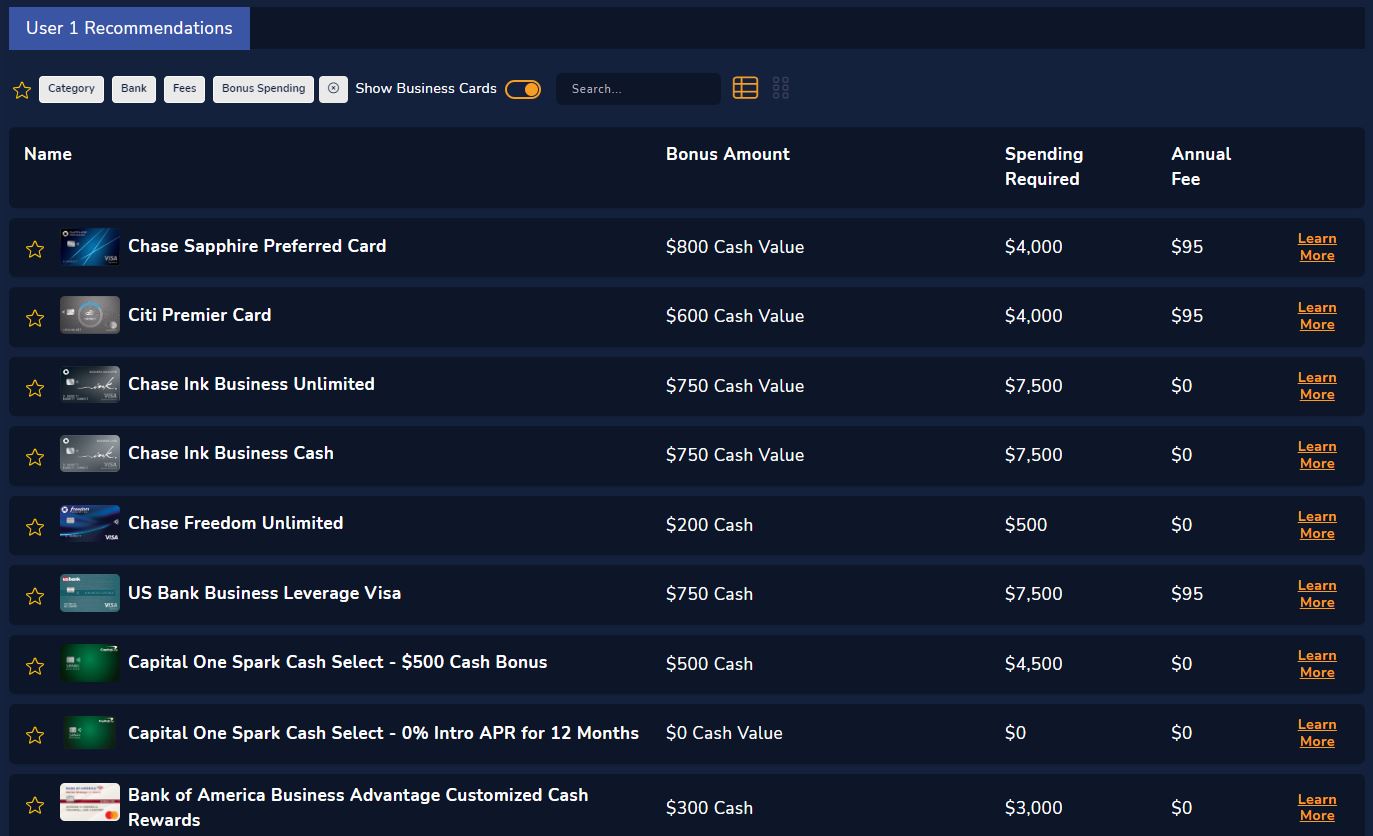

My Best Offers

My Best Offers, similar to the CardGenie page on Travel Freely, contains card welcome offers based on Cash Freely’s algorithm. In my opinion, this page particularly shines with its clean, streamlined format. I like how uniform the page is, and Cash Freely strikes a great balance of useful info without too much on one screen. Simply click Learn More on the far right to get a great background on each card, including Zac’s customized take. Similar to the My Cards screen, you can easily customize and filter the display. In terms of appearance, I think Cash Freely has the most attractive referral page of any site I’ve seen.

Getting back to Cash Freely’s algorithm, I couldn’t easily tell at first glance what offers distinguish the tool from any other site advertising cards without such an algorithm. But with a closer look, it’s what is not in the My Best Offers recommendations that makes it unique. Specifically, My Best Offers excludes any cards a user is ineligible for based on each bank’s application and eligibility rules. In the future, I’d appreciate the ability to quickly view what My Best Offers weeded out and why. I feel like users would obtain an even fuller picture that way. Admittedly, this probably isn’t an issue for beginners, though.

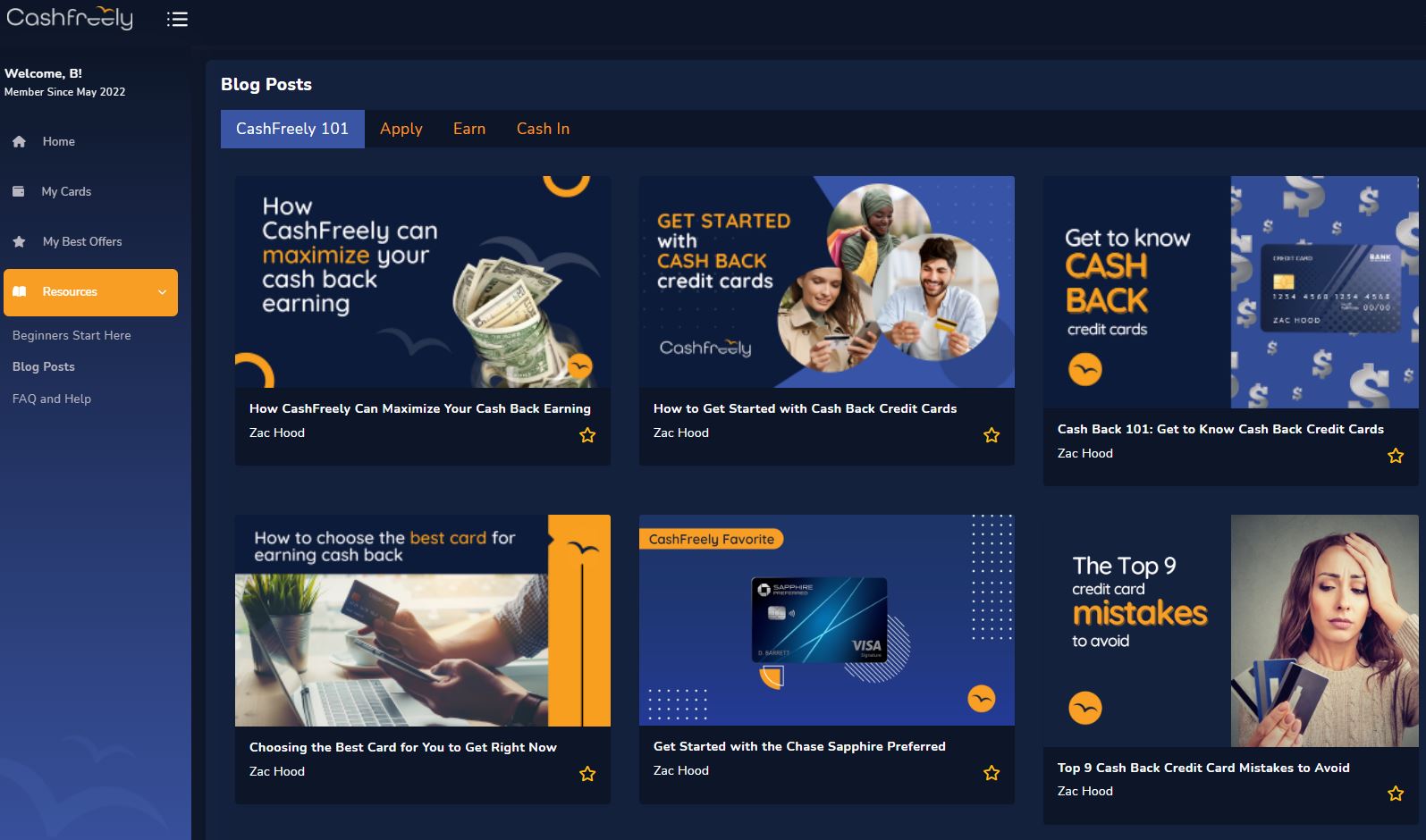

Resources

Finally, the Resources page contains several handy items for beginners. Under the Beginners Start Here section, beginners can go through Cash Freely’s seven steps, helpfully including videos from Zac. The Blog Posts section holds a variety of content, including application, earning, and redemption strategies. Likewise, the FAQ and Help section provide great pointers for anyone starting in the hobby.

Cash Freely Review – Overall Take

Cash Freely provides a great one-stop shop for anyone looking to jump in and better understand the cash back credit card rewards hobby. The tool guides users every step of the way in establishing a solid foundation for cash back rewards. The site has a great overall design and is fun to use. And the additional work and time to benefit from the site is fairly minimal.

Again, it’s free! But how is it free? Cash Freely communicates how the site makes money based on affiliate links / credit card referrals. Kudos to Cash Freely for their clarity on this point – it’s viewable to users throughout the site.

The My Best Offers tool is tremendously handy for displaying a wide variety of welcome offers in a concise format. Cash Freely states that certain cards may not show up because the user isn’t eligible for them. Of course, it’s probably impractical to expect every possible credit card welcome offer to appear in My Best Offers with such a dynamic credit card industry. Zac encourages users to email him directly for any assistance. Like any reliable site, I understand Cash Freely is evolving to incorporate new features and content, and I look forward to seeing what’s next.

Cash Freely Review – Conclusion

I recommend Cash Freely to anyone starting out in the cash back credit card rewards hobby who wants to uniquely organize their cash back endeavors. Some may find Travel Freely sufficient enough to track rewards. Cash Freely may be unnecessary for those individuals. And as with any tool, always ensure to supplement your understanding by taking in content from a variety of sources. The time commitment is minimal, but the tool is as useful as you make it. For a free service and the resources it provides for cash back beginners, Cash Freely is definitely one to consider.

For anyone interested in miles and points then Travel Freely is probably a better fit for you. Cash Freely is a great resource to show your friends and family that are more into cash back versus miles and points though.

Beyond my Cash Freely review, do you use the site? What are your favorite features?

Not ready for primetime. After entering my cards’ info, the very first new card recommendation I was given was for the Sapphire Preferred. Problem is, one of my current cards that I had already entered is the Sapphire Reserve. The site’s algorithm missed that you can’t carry both cards.

Hi Greg, Zac from CashFreely here. Thanks for commenting. This should not be happening as it’s obviously a basic card rule. The algorithm is based on our Travel Freely CardGenie algorithm which has been out for 3 years. Are you sure you looked at your recommendations or user 2? We have separate recommendations for each user. We also let you set a card to be active or cancelled, so the CSP will show up if the CSR has been cancelled and outside the rule time window. Please email me from the app and we’ll investigate more. – Zac