Chase 5/24 Official Language

Oh Chase Sapphire Reserve. You have given us so many ups and down over the past few weeks. Now you are a trendsetter in a new way and I suppose you should be given that you are Chase’s flagship card.

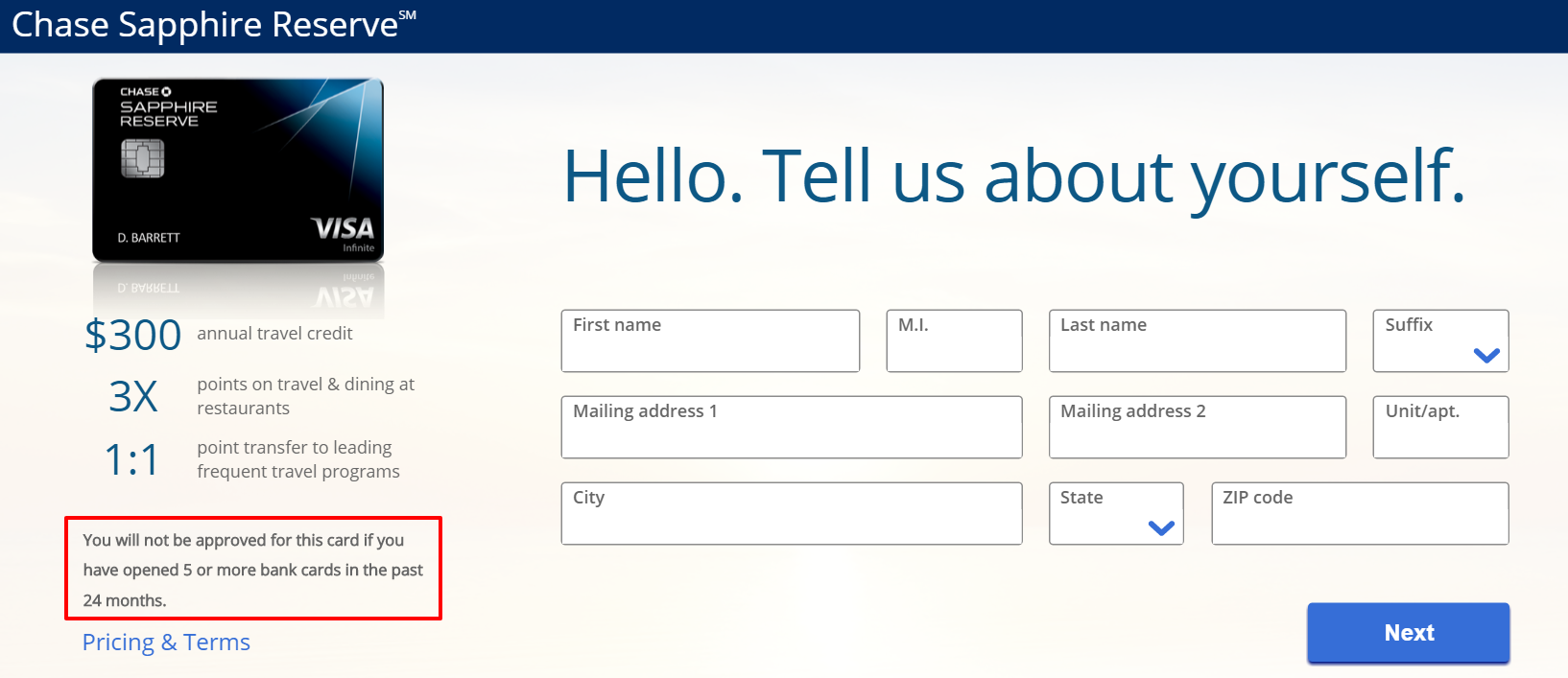

The 5/24 RULE

Update: Since this was published Chase has removed the 5/24 language from their app, although the rule is seemingly still being enforced.

For anyone new to credit cards, Chase has had an unofficial policy or rule for over a year called 5/24. Basically they will deny your application if you have opened 5 or new revolving credit accounts in the past 24 months. Up until now it wasn’t in writing anywhere, but that changed recently on the Chase Sapphire Reserve application.

There it is in writing. 5/24 in all of its glorious sadness. What is quite interesting is they use the term “bank cards” when they have been applying this rule to any sort of revolving account. I am not sure if the enforcement will change or if this is simply just the way they chose to put it in writing.

Why This Is Good

You may think I am crazy, but this is actually a very good move from Chase. I am sure there have been quite a few people over 5/24 who have been denied unknowingly for this card and others. At least this way Chase is giving you fair warning up front that they will deny you. I think it is fair and while I don’t like the rule, at least Chase is being a bit more honest and hopefully this will prevent a few unnecessary hard inquiries.

Avoiding 5/24

As far as I can tell, the two known ways for avoiding 5/24 (in-branch preapprovals and Chase Private Client) are still working, although time will tell on that. Of course the in-branch application may not have this language so that isn’t a huge surprise. For more on avoiding 5/24 with the Sapphire Reserve and other cards, see: Chase Preapproved & Prequalified Offers: The Difference, Avoiding 5/24 & Becoming a 2 Sapphire Reserve Household!

Other Cards Without Language

Despite the fact that Chase has been known to apply 5/24 to all other cards in the Ultimate Rewards family (Sapphire Preferred, Freedom, Freedom Unlimited, Ink Cash, Ink Plus), as of now this new language can only be found on the Sapphire Reserve application. This is why I use “Sort Of” in the title. It isn’t official everywhere. If Chase is going to continue to apply 5/24 to these cards, I would expect them to make it official on their apps as well.

Conclusion

Well, we knew that 5/24 was a reality already given the numerous data points and Chase has now officially confirmed it. Things of course change over time, so what is a rule now may not be later. In the mean time, this new language doesn’t change much of what we know and I for one am happy that at least it is in writing.

Your thoughts?

HT: Doctor of Credit

[…] that way, doesn’t show on your credit since it is a business account which can help with Chase 5/24 and it earns 5% back at office supply […]

[…] or been added as an authorized user on 5 or more revolving credit accounts in the past 24 months. Click here for a much more in depth look at […]

[…] opened more than 5 bank cards in the last 24 months. Some believe it doesn’t exist, but Chase made it semi-official a while […]

[…] the world of 5/24 and other bank tightening, being an authorized user or AU on someone’s account isn’t […]

[…] If you apply for more than five credit cards every two years, you should read this: New “5/24” rule stymies credit card points hobbyists […]

A while back when I applied for a new chase card I was denied and was told that I had more than 5 in the last 24 months. I argued that I had excellent credit. The csr indicated that they may be reconsidering the 5/24 rule but she didn’t elaborate. I sure would love to know if anyone else has heard anything like this.

[…] Chase has no doubt issued, one has to wonder if they are rethinking this product. We have seen them add 5/24 language to the application for the first time and they have even seemingly run out of the fancy packaging they send to new […]

If I look at report from Trans-Union report which Chase uses and see only 4/24 that means I can apply?

Yes they only go by reports that show on your report, but keep in mind that Chase can pull other bureaus. For example they pull Experian for me and most others.

Which companies use Experian?

It varies by state. Here is an article I wrote with more info.

https://milestomemories.boardingarea.com/credit-pulls-database/

They pulled Equifax for me.

Glad to see it listed there as well. This helps draw the line for people who hope they can still somehow get approved online if they are over 5/24. I hope they put this language into all impacted card terms soon.

Agreed.