Get $525 Bonus with Chase Checking and Savings Accounts

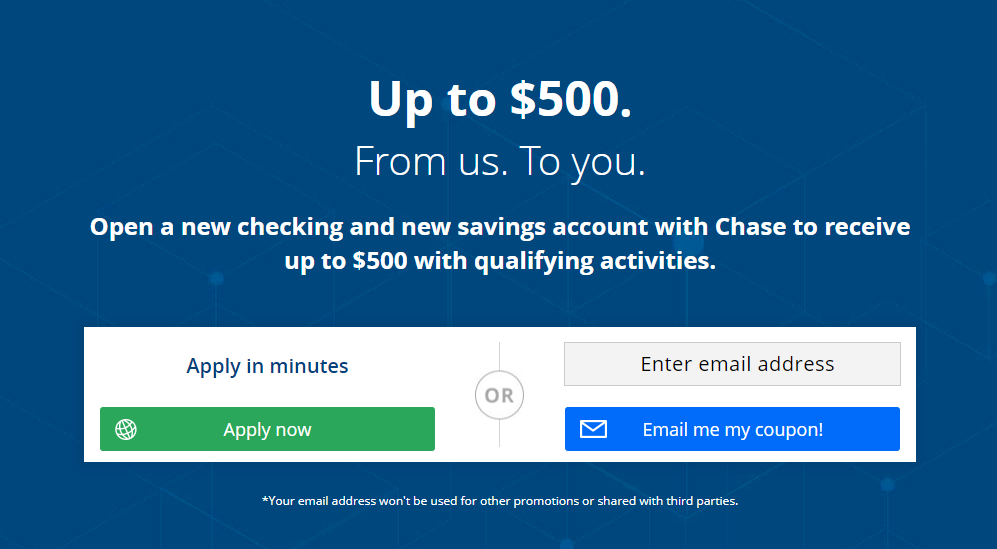

Over the past few years Chase has been the most generous of the big banks with bonuses for opening checking/savings accounts. They continuously have a very popular $500 personal offer that can be done annually. Now it is even better, as you can get an extra $25 for a total of $525.

RELATED: Don’t miss out on these offers on our Bank Bonus Roundup!

The Offers

- GET $300 for new Chase checking customers who open a CHASE TOTAL CHECKING® account and set up Direct Deposit.

- GET $200 for opening a new CHASE SAVINGS account, depositing a total of $15,000 or more in new money within 10 business days, and maintaining a $15,000 balance for 90 days. (not the best offer)

- Expiration Date: 10/13/2018

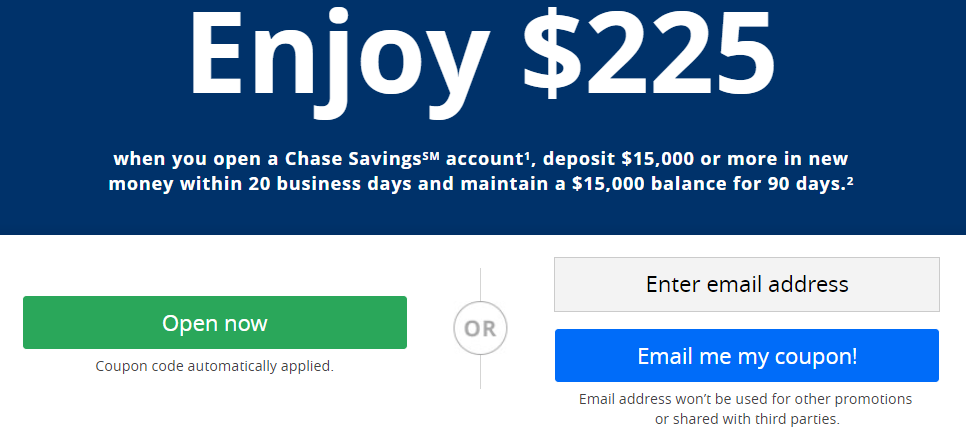

For the savings offer, there’s actually a separate and better deal that can get you a bonus of $225 instead of $200. So you can do the checking offer above and then the following offer for the savings account.

Apply online now or enter your email address to get your coupon and bring it to any Chase branch.

- Open a new Chase Savings account by September 27, 2018

- Deposit $15,000 or more in new money within 20 business days

- Maintain a $15,000 balance for 90 days.

Key Terms

- Checking offer is not available to existing Chase checking customers. Savings offer is not available to existing Chase savings customers. Both offers are not available to those with fiduciary accounts, or those whose accounts have been closed within 90 days or closed with a negative balance.

- For checking bonus, make a direct deposit within 60 days of account opening. Your direct deposit needs to be an electronic deposit of your paycheck, pension or government benefits (such as Social Security) from your employer or the government.

- For savings bonus, deposit a total of $15,000 or more in new money into the new savings account within 10 business days of account opening and maintain at least a $15,000 balance for 90 days from the date of deposit. The new money cannot be funds held by Chase or its affiliates.

- If either the checking or savings account is closed by the customer or Chase within six months after opening, we will deduct the bonus amount for that account at closing.

The full terms can be found on the offer page after generating your unique code. (See below.)

Avoiding Fees

Chase Savings has a $5 fee per month. You can avoid the fee in the following ways:

- $300 or more minimum daily balance

- or at least one repeating automatic transfer of $25 or more from your personal Chase checking account (available only through Chase Online Banking)

- or when linked to a Chase Premier Plus Checking, Chase Premier Platinum Checking or Chase Private Client Checking account

Chase Total Checking has a $12 fee per month. You can avoid the fee in the following ways:

- Direct deposit totaling $500 or more made to this account.

- or a $1,500 or more minimum daily balance in this account

- or an average daily balance of $5,000 or more in any combination of qualifying linked deposits.

Analysis

I have received this bonus in the past. Usually you need to have a branch nearby to complete the account opening process, but now it’s much easier since it can be done online. It’s a good opportunity for those who don’t have branches nearby or have to take long drives to open the accounts. There’s some reports that the offer is working even for those who don’t have branches in their state. It might be worth visiting a branch though, to check for increased targeted offers on Chase credit cards.

This bonus can be done once a year and you have to wait at least 90 days since the last personal accounts bonus from Chase. Keep in mind that you WILL receive a 1099-INT for these bank bonuses and thus you will be taxed.

Conclusion

If you aren’t a current Chase checking/savings customer then this Chase bonus is about as good as it gets when it comes to bank bonuses. While the savings deposit amount is a bit high, I think it’s still worth it if you have $15,000 to leave in the savings account for three months. The total of $525 is the highest we have seen from Chase.

You can do this bonus once a year, and you must not have had a Chase account in last 90 days. It’s even easier now that it’s online.

I would suggest opening the account right away if you’re eligible, because it has never lasted till the expiration date the last few times we’ve seen it.

HT: Doctor of Credit

Would a frozen Experian credit file prevent one from opening an account? They denied mine based on my Experian credit file, which I know is immaculate, albeit frozen.