New Chase $600 Bonus for Checking and Savings Account

Chase is one of the most generous banks out there when it comes to checking and savings account bonuses. Now they have brought back their best ever bonus of $600, and it’s available online. Do this bonus quickly, as the last working link disappeared within a few days.

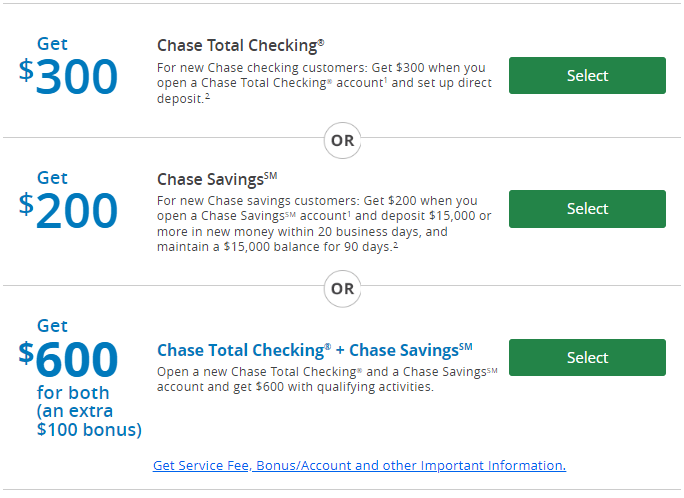

The Offer

- GET $300 for new Chase checking customers who open a CHASE TOTAL CHECKING® account and set up Direct Deposit.

- GET $200 for opening a new CHASE SAVINGS account, depositing a total of $15,000 or more in new money within 10 business days, and maintaining a $15,000 balance for 90 days. (not the best offer)

- OR get $600 for both (an extra $100)

Key Terms

- Expires 3/5/2019

- Checking offer is not available to existing Chase checking customers. Savings offer is not available to existing Chase savings customers. Both offers are not available to those with fiduciary accounts, or those whose accounts have been closed within 90 days or closed with a negative balance.

- For checking bonus, make a direct deposit within 60 days of account opening. Your direct deposit needs to be an electronic deposit of your paycheck, pension or government benefits (such as Social Security) from your employer or the government.

- For savings bonus, deposit a total of $15,000 or more in new money into the new savings account within 10 business days of account opening and maintain at least a $15,000 balance for 90 days from the date of deposit. The new money cannot be funds held by Chase or its affiliates.

- If either the checking or savings account is closed by the customer or Chase within six months after opening, we will deduct the bonus amount for that account at closing.

Avoiding Fees

Chase Savings has a $5 fee per month. You can avoid the fee in the following ways:

- $300 or more minimum daily balance

- or at least one repeating automatic transfer of $25 or more from your personal Chase checking account (available only through Chase Online Banking)

- or when linked to a Chase Premier Plus Checking, Chase Premier Platinum Checking or Chase Private Client Checking account

Chase Total Checking has a $12 fee per month. You can avoid the fee in the following ways:

- Direct deposit totaling $500 or more made to this account.

- or a $1,500 or more minimum daily balance in this account

- or an average daily balance of $5,000 or more in any combination of qualifying linked deposits.

Analysis

Usually you need to have a branch nearby to complete the account opening process, but now it’s much easier since it can be done online as well and you get $600, the highest bonus ever. Most likely you will need to have a Chase branch in your state to be eligible though.

This bonus can be done only once every two years now and you have to wait at least 90 days since the last personal accounts bonus from Chase. Keep in mind that you WILL receive a 1099-INT for these bank bonuses and thus you will be taxed.

Conclusion

If you aren’t a current Chase checking/savings customer then this Chase bonus is about as good as it gets when it comes to bank bonuses. While the savings deposit amount is a bit high, I think it’s still worth it if you have $15,000 to leave in the savings account for three months. The total of $600 is the highest we have seen from Chase.

You can do this bonus once every two years, and you must not have had a Chase account in last 90 days. It’s even easier now that it’s online.

HT: Doctor of Credit

I signed up for the old deal for $350 and immediately got offered the $600 when I logged into my credit card account. I cancelled the first deal and then wasn’t allowed to get the $600. I kept trying for a few months and kept getting an error message that I already got the deal. Now, the deal is worse than the original one I cancelled. I’m about to roll my 401(k) into a new IRA and I’m going to take the TD Ameritrade $600 with higher trade fees, instead of the Chase version with much lower fees and a $625 bonus. I’m going to take advantage of Chase credit cards with better cash-back than others (and I don’t pay interest), but I’m not going to give them MY money.

Looks like link is expired?

Can you tell me if it is only one direct deposit I have read and reread but it is not clear/

Yes, one deposit any amount.