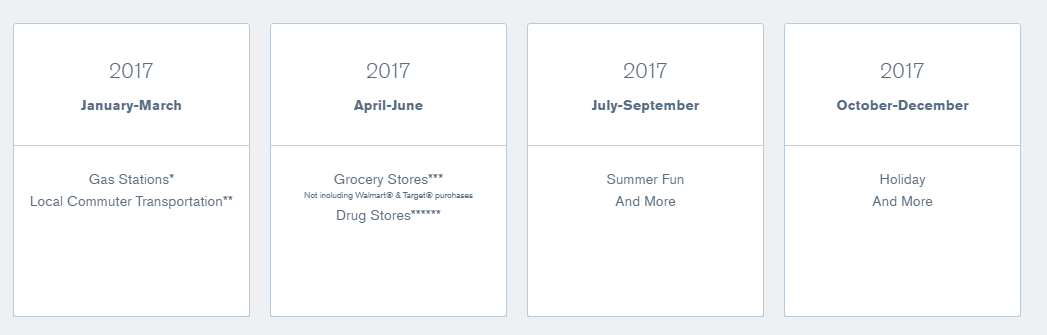

Chase Freedom 2017 Calendar

One of the better no annual fee cards in my opinion is the Chase Freedom. I highly value Ultimate Rewards points and the Freedom comes with no annual fee and allows me to earn 5X points in rotating categories each quarter on up to $1,500 in spend. For example, in this quarter (Oct – Dec) I am earning 5X points at Department Stores, Drug Stores and Wholesale Clubs.

Now, Chase has officially revealed which categories will earn 5X in the first two quarters of 2017. If you login to your Freedom account and click through to view your cashback, you will see the following:

While they aren’t quite ready to reveal the second half of the year, the first half is now locked in.

January – March, 2017: Gas Stations, Local Commuter Transportation

- Fine print for gas stations: Does not include merchants that do not specialize in selling automotive gasoline; for example, truck stops, boat marinas, oil and propane distributors, and home heating companies. For more information, please visit chase.com/freedom and click on the “View Chase Freedom FAQs” link at the bottom of the page.

- Fine print for Local Commuter Transportation: Includes taxis, subways, local commuter buses and trains: does not include parking, tolls, and Amtrak® purchases.

April – June, 2017: Grocery Stores & Drug Stores

- Fine print for Grocery Stores: Does not include purchases made at Walmart® and Target®. You still earn unlimited 1% cash back on these purchases.

- Fine print for Drug Stores: Does not include merchants that sell a wide variety of goods including prescription drugs and over-the-counter medicines, supplements and various health-related items, and which may contain an onsite pharmacy, for example, warehouse clubs, discount stores, or grocery stores.

Analysis

It is nice to see the grocery store category come back this year, although having it stacked with drug stores is a bit of a disappointment given the ease of buying gift cards both places. Quarter 1 will also be nice for people who spend a lot of money at gas stations, although for most it will have limited potential of maxing out more than one or two cards. Either way, things are looking pretty good.

Related: Discover’s 1st Quarter 2017 5% Bonus Categories Announced: Familiar with 1 Awesome Addition!

Can anyone suggest a place to buy gift card that is counted in the commute? I know I can buy shell gas gift card and use later, but shell is pricy and I pump at costco most of the time. And I also have discover, their 5% in Q1 includes costco, so.

This cards rewards are getting worse by the quarter. I buy gas at BJ’s and groceries at WalMart or Target……I’m about to drop my account.

Lol. I can make the freedom work at the fuel kiosk at my local Kroger! Buy Kroger gift cards and use in store!

I’m very excited about these categories… I live in Giant Eagle/Get Go land. Q1 I can buy Giant Eagle gc’s at Get Go (the gas station end of Giant Eagle) . The Giant Eagle gc’s are good for groceries, gas at Get Go and loads of gift cards which generate Fuel Perks – usually $.20/gal/ $50 in gift cards.

Q2 I’ll spread it around and include Aldi’s, Trader Joe’s, Whole Foods and CVS.

That’s it for Q1? No retail or dining locations? Just Gas Stations and Local Commuter BlaBlaBla?

Are they trying to convince CF holders to upgrade to something else?

Guessing Uber/lfyt will count in Q1 like it did last time for the same category.

Any prediction on whether warehouse clubs will pop up for Q3 or Q4 in 2017? Also, what do you make of Amazon not appearing at all in 2016 after having a brief 10x opportunity in 2015?

Freedom goes in drawer for Q1. I fuel up at Costco, have plenty of CashCard credit.

Can’t use it on my FasTrak (tolls account? Can’t use it for Amtrak or parking?

Wasted quarter for me, boo!

Don’t forget -4 for Q1.

I wonder if it’s a trap.