Roundup of 5% Bonus Category Calendars for Chase Freedom, Citi Dividend & Discover it

The three major 5% cashback credit cards have released their 2018 quarterly bonus categories for the most part. Let’s look at the 2018 calendars for Chase Freedom, Citi Dividend and Discover it and see if we can spot some opportunities!

Chase Freedom 2018 Bonus Categories Calendar

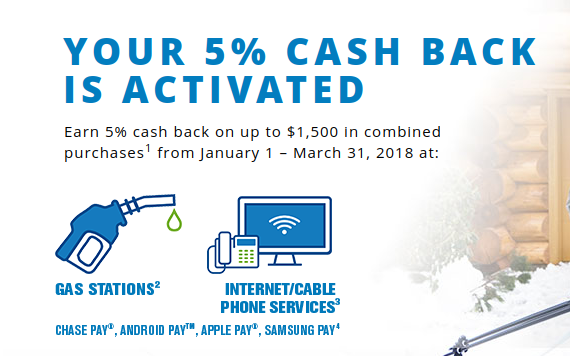

The 2018 calendar has not been released yet, we’ll keep you posted when Chase announces the categories. This should be an easy quarter to maximize will all major mobile wallets included because you can basically choose your own category. Any purchase that you will make through these wallets with your Chase Freedom card will earn 5% Cash Back. Just keep in mind that it will be 5% total, so if you use your mobile wallet at a gas station for example, you will not earn 10%. As for the cable/internet and phone category, that’s great for everyone who doesn’t have an Ink card.

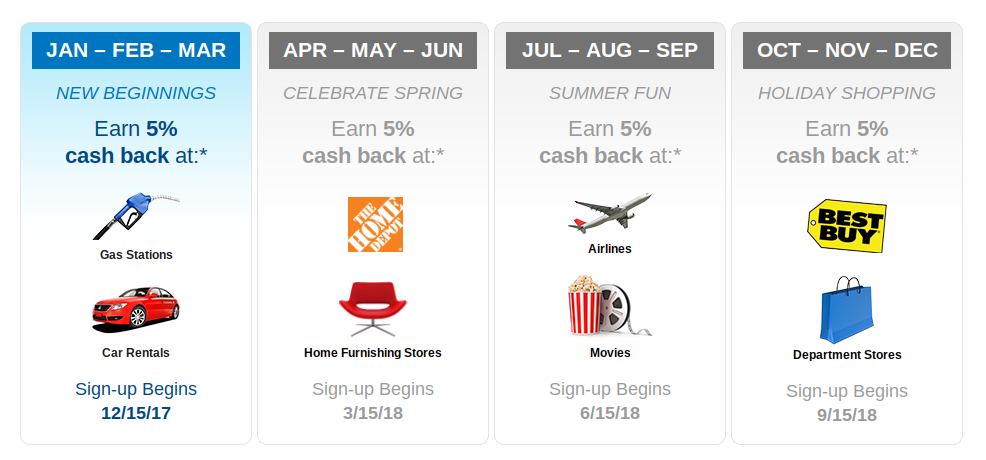

Citi Dividend 2018 Bonus Categories Calendar

Citi Dividend is unique to either the Discover it or Chase Freedom cards since you can earn all of your cashback ($300) total any time during the year. That means you aren’t stuck to any one quarter’s categories. Between home improvement and department stores, airlines and Best Buy this couldn’t be easier to max out.

The Dividend card isn’t available to the public anymore, but you may be able to product change over another card to it. You can find the calendar here.

Discover it 2018 Bonus Categories

Look another gas station bonus. The Q1 categories are similar to past years with one exception, they’ve removed the ground transportation category and that’s always been a good one. On a positive note, wholesale clubs are incredibly popular and between that and gas, it should be fairly easy for most people to spend the full $1500 over three months for the max cashback bonus of $75.

Aside from the gas stations, I think Discover really crushed it this year and gave us the best possible categories.

Conclusion

You’re covered on gas in the first quarter, that’s for sure. If you’re lucky enough to have a dividend, I would definitely not use it for gas since you can use the others instead. None of these categories are life changing, but there are a bunch of things that I am happy about. The Citi Dividend should be very easy to maximize this year and Discover has both groceries and restaurants this year. It’s also great to see the addition of the mobile payment apps, hopefully the other cards will follow suit.

How to maximise on restaurants for q3 Discover?

What would be the best place to buy a $500 visa gift card using the mobile wallets to maximize returns?