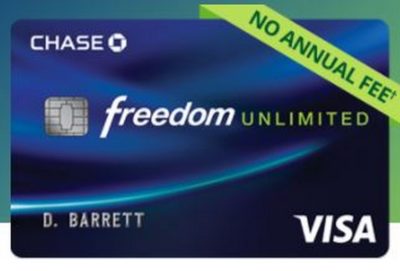

Chase Freedom Unlimited 3% Offer Ends Abruptly

Chase released an amazing offer a few weeks ago for the Freedom Unlimited card. They were giving new cardmembers 3% back (3 Ultimate Reward points) on every dollar spent in lieu of a sign up bonus. For people like us this was a gold mine.

RELATED: Why You Should Get the Ink Cash Before May 20th

Why Did it Get Pulled so Soon?

People have speculated that this offer played a large part in the rumors of Chase ending pooling points. When you transfer the 3 points per dollar from the Freedom Unlimited card to a premium card that makes the CFU a 4.5% back on everything card. That made it the most powerful card on the market.

What follows is 100% speculation but it is fun 🙂

I think Chase felt like they could use this offer to compete with Discover but then realized how much value people could get from it. So they hatched up a plan to eliminate pooling to counteract their poor decision making. Once it was leaked that pooling could be ending there was a large amount of negative blow back so they decided to just pull the offer. Now they have to decide what to do next.

Hopefully they just swallow the loss on the new people and keep the pooling intact.

Either that or the offer was meant to be targeted and it went too public too quickly and they yanked it.

Conclusion

This was an amazing offer if you were able to jump on it. I am lol/24 so was not able to get this 5/24 card. But if you did get it be cautious with your spending on it for a little while. I have a feeling they will be watching these cards closely.

Why do you think the offer was pulled so quickly? Let me know in the comments section.

Hat Tip Doctor of Credit

I was running through two other sign up spends, and literally finished this weekend…just in time for this to expire. But honestly, I think this dying was for the best overall; I do believe that it would herald the end of pooling. Only wish I could have gotten the 3x myself. 4.5 UR on everyday spend would probably be the best overall card in the game.

I am hoping this was the decision instead of killing off pooling…fingers crossed!

THIS!

I was 5/24 so couldn’t get one. But with my business spend I could’ve easily cycled about $700k on there without any manufactured spending. But if I wanted to manufacture spending, the only barrier would be paying off the entire credit line every 2 days.

If some of the people that signed up are anything like me, Chase would’ve lost a bunch on those cards.

The offer was only for the first year. You had to spend at least $10,000 on the card in the first year to make it a better offer. It was a good option for someone expecting lots of spend in their first year, but it wasn’t a long term game changer as you present it.

It was a one year game changer…better than Discover Alliant or anything else that people get for the first year. 10K is nothing for most people around these parts. So much potential…and it was hands down the single best card for that first year on everyday spend (if pooling stays in tact). It was a pretty amazing offer.

What I especially appreciate is its terms revert to the normal 1.5 (2.25) after Year 1, which those in the points & miles world already agree is a solid deal from Day 1. Chase could have, for instance, decreased the points to .01 starting Year 2, yet they did not because they seek stability.

I also appreciate the AU bonus. No-AU bonuses would’ve been consistent with their otherwise no-upfront bonus tactic on this offer. Chase was obviously trying to make this offer attractive to long-term household spend, however, which is also my particular vernacular. The naysayers to this offer include the hard-core earn & burners who are more interested in multiple 50k W(hatever)R(ewards) over the next year.

I think I disagree with you on Chase’s motives, Mark. After the losses they have taken, & continue to sustain, on their CSR product (with a $450 fee no less), they are now fully cognizant of the URs attraction. I don’t see them dangling UR-related products out there (esp NF) without fully anticipating their direction & bottom-line impact. I repeat myself, but I do think this offer will return after August when folks are looking for an AMEX non-bonus spend replacement. In 2 weeks, Chase figured out this is a ripe market but there is now an economic question if it should also be a UR tie-in.

Interesting times – the upcoming SPG AMEX devaluation promises more significant reverbs in the P&M marketplace.

My husband was approved first day. I tried to give a referral, but since the bonus was new I spoke with an agent (no referral bonus btw).

The agent said Chase was trying 3x out in addtn to their 2 other available offers that day: the $150 standard bonus & a statement credit.

I think Chase decided to test the non-bonus spend waters after the horrible SPG AMEX devaluation announced earlier that week. The response was likely favorable, so it may be a choice they eventually bring back after the SPG AMEX finally devalues 8.1.

We couldn’t jump on this offer quick enough & are now earning 4.5 on doctor’s appts, car repairs, shoe repair, alterations, dry cleaning, etc etc etc that usually don’t like (as small businesses)/won’t take an AMEX. It’s also SO much easier for my husband to keep up with just 1 card for spend so we now never leave bonus points on the table!

We will easily overshoot the $20k breakeven point (on a $300 bonus) to make this card/offer a true game changer for our family this year. Even if Chase ends point pooling, we will focus on 3x cash back we would normally only earn 2x, so it’s a win either way for our strategy.

It was probably the best offer in a long time and even if it goes to cash back it is still solid. But if pooling stays intact it may be the best 1 year card ever imo.