Chase Freedom Unlimited Application

The brand new Chase Freedom Unlimited card has been available for conversions from another product and in-branch for a few weeks, however there hasn’t been an online app. Chase promised to make the card available online in April and they have delivered a bit early. Let’s recap a little about the card and the sign-up offer.

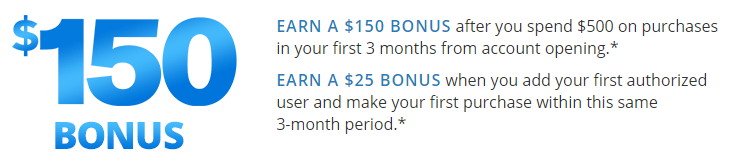

The Offer

Earn a $150 bonus after you spend $500 on purchases in your first 3 months from account opening and a $25 bonus when you add your first authorized user and make your first purchase within this same 3-month period.

Chase Freedom Unlimited Application

Card Features

- 1.5X everywhere.

- Points can be redeemed at $.01 each or transferred to travel partners if you also have a Sapphire Preferred or Ink Plus.

- No annual fee.

5/24?

Chase has been strict with approvals on Ultimate Rewards earning cards. Specifically many people who have opened five or more new accounts within the past 24 months have been denied for the Sapphire Preferred, Freedom and other similar cards. Luckily it seems from reports that the 5/24 rule isn’t be applied to this new card. I have heard from several people who have been approved in-branch with more than five new accounts.

Update: Chase may be getting stricter about approvals. HT: Doctor of Credit

Analysis

I won’t be applying for this card since I just got a new Chase Ink Plus, but I plan to convert one of my three regular Freedom cards over to it. My plan is to max out the 5% grocery store category bonus in early April on my Freedom and then convert it to a Freedom Unlimited. I think the ability to earn 1.5X Ultimate Rewards is powerful, especially in categories where it isn’t easy to get a bonus. I can see myself using this card often and I’ll still have two other Freedoms to earn 5X as well.

Conclusion

If you had been holding off on applying for the Freedom Unlimited because you hate going into a branch and actually dealing with people, then you are now in luck. It is great news that Chase has seemingly loosened on approvals for this card, so hopefully everyone who wants one can get it.

Have you opened or converted an existing card to Freedom Unlimited? What has been your experience? Let me know in the comments!

Miles to Memories has partnered with CardRatings for our coverage of credit card products. Miles to Memories and CardRatings may receive a commission from card issuers.

I converted my CSP today. I was a little sad to let the CSP go, but I have an Ink Bold for converting UR points from the free cards, so it seemed silly to keep paying that $95 AF on both of them. I was excited to get the CSP last year, but it didn’t turn out to be that useful for me. Maybe if I did more overseas travel I would use it, but for domestic travel and everyday spend I have better cards for almost everything. So… bye-bye CSP.

I now have what seems like the new Chase Power Trifecta: Freedom+FreedomUnlimited+Ink. This might just change my whole credit card strategy, leading me to focus more on UR points and less on cash back.

But now I’m faced with the problem of how to destroy the old CSP cards. Would a blowtorch do the job? Maybe leave them balanced on the train tracks?

[…] The Chase Freedom Unlimited card is now available online for applications (HT: Miles to Memories) […]

My husband was denied for Chase Freedom just today. He only has Chase Sapphire, so won’t be converting to this. I can’t apply. I’m waaaay over 5/24. We’ll pass on the Freedom Unlimited. Maybe in a year or two everyone with a Freedom will be converted to a Freedom Unlimited… who knows. None of the current rules are ever set in stone…

Will we still get the $150 bonus if we convert one of our chase cards?

No so that is a decision you have to make. Personally I want the card now and have other Chase apps I would rather go for so the conversion makes sense.

[…] Miles to Memories, Chase has activated the online application for the Chase Freedom Unlimited ahead of schedule. […]

Applied in a branch last Sat. Have way more than 5/24. Was approved + the nice banker offered free expedited shipping. So I got the card the following Tue! I was prepared to shift credit lines from other Chase cards, but they gave me large enough new credit line.

Had to talk to Chase analyst, but only to hear him congratulating me on getting the card. No special requests from the branch banker were necessary.

I applied for the freedom unlimited by phone about 3 weeks ago and was denied because of 5/24

Thanks !! Applied , Approved !!!

Were you post-5/24?

no

No, i left myself a open spot for this card, i did apply for my wife a few weeks back post 5/24 and was denied