Get $1,250 When You Upgrade to Chase Private Client

Chase has a huge bonus offer of $1,250 that was sent by mail to some current customers. The offer is to upgrade your account to Chase Private Client. This account needs a balance of $250,000 or more, so this is not a deal for everyone. let’s look at the details and whether it makes sense.

The Offer

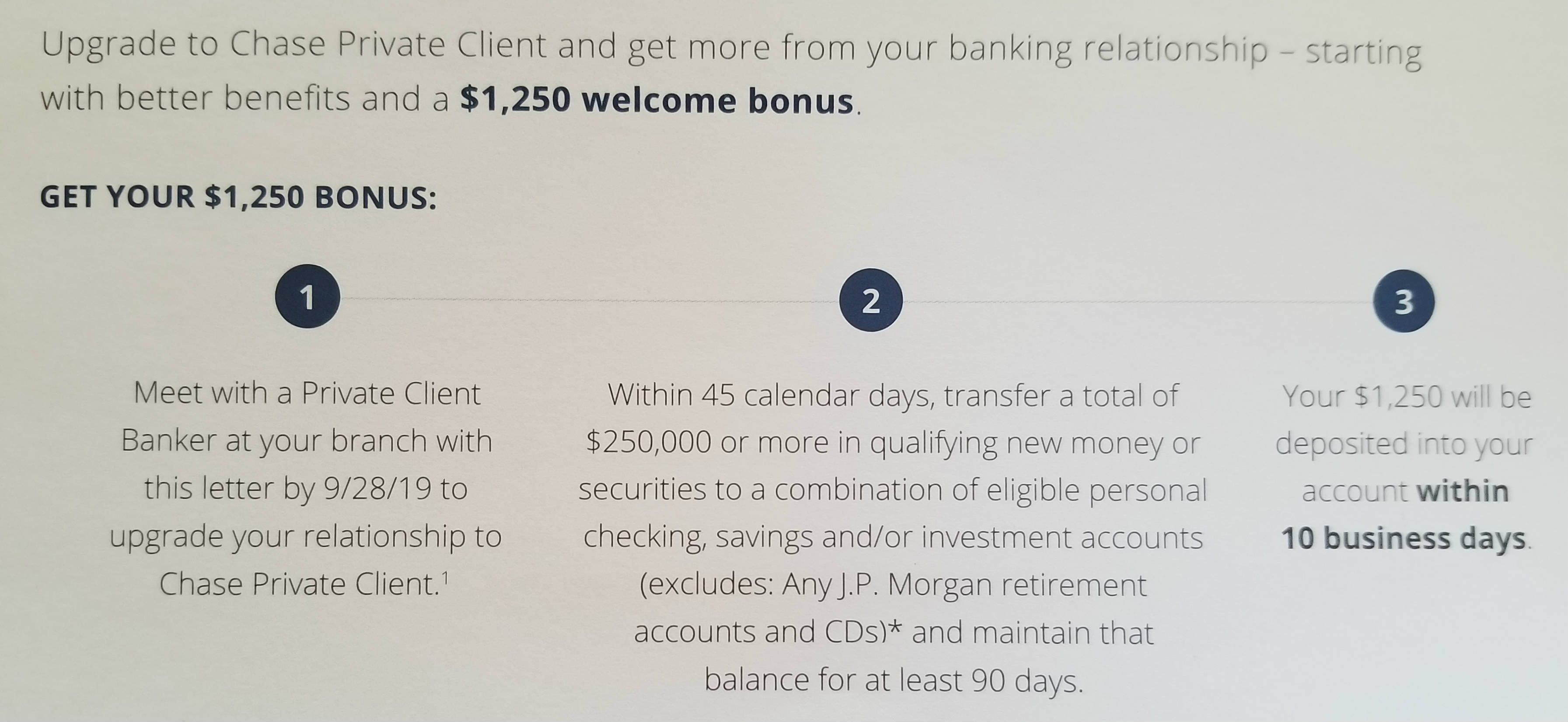

Save time and money with better banking benefits and special services, plus a $1,250 Welcome Bonus. Hereʼs how to get started:

- Meet with a Private Client Banker by September 28, 2019 to upgrade your account to Chase Private Client.

- Within 45 calendar days, transfer a total of $250,000 or more in new money to a combination of eligible checking, savings and/or investment accounts, and maintain the balance for at least 90 days.

- Receive $1250 within 10 business days.

The account has no fees, but you need to maintain the $250,000 balance. Otherwise, you will be downgraded to another Chase account.

Key Terms

- Offer not available to existing Chase Private Client customers.

- Ineligible accounts: any You Invest accounts, Certificates of Deposit, insurance products; fixed and variable annuities; 529 College Savings Plans; any retirement accounts such as Traditional and Roth IRAs, Keogh, Simple IRAs, and 401(k) Plans.

- After you have completed all the above requirements, we will deposit the bonus in your existing Chase Private Client Checking account within 10 business days.

- You can only participate in one Chase Private Client Checking, Sapphire Checking or You Invest new money bonus in a 12 month period.

- Coupon is good for one time use.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

- Account must be kept open for 6 months, otherwise bonus could be taken back.

- This bonus will be considered as interest, so you have to pay taxes.

Conclusion

Not a great deal. You Invest accounts would have been a good option to meet the balance requirement, but are excluded in the terms. If you keep the $250K in the account for exactly 90 days, you get a 2% return. Not very exciting, as you can usually do a bit better with other high yield accounts that do not have such a large balance requirement. But could be worth it for someone who wants the Chase Private Client relationship.

[…] Update 8/15/19: Deal has been extended until September 28th, 2019. Hat tip to MtM […]

Earlier this year Chase sent me a deal to upgrade to Sapphire Checking. I had to put in $75,000 for 90 days and they deposited $600. I did it. But what prevented me from keeping the Sapphire checking account was no option for a high yield money market interest bearing account.

Several of my banks have the option to simply move the funds into a Money Market checking account where you can use the funds whenever you want and earn up to 2.1%. But Chase doesn’t have that option. They said I could move it to a UInvest account an invest it myself but I just wanted to move it into a money market account earning 2% like other banks and they couldn’t do it so I closed the account.

And given that 2% on $250k is just over $400 a month, keeping the money outside of Chase and in a money market account would also yield $1,250.

9-mth CDs generated 2% & incl in the $75k req