Chase Sapphire Reserve Travel Credit Track

Paying $450 up front for a premium travel card represents a significant investment. It is thus very important to make sure you are maximizing the benefits of that card in order to fully get the value from your annual fee. With the Chase Sapphire Reserve card two of the biggest “value centers” of the card are its $300 annual travel credit and 3X earnings on dining and travel.

While the American Express Platinum card has a very restrictive $200 airline fee credit each year, the Chase Sapphire Reserve comes with a $300 credit that is good for anything in the travel category. Still, what good is a credit if you can’t easily track how much you have used? Thankfully Chase is generous in that department and has made tracking both your credit and your earnings very easy.

Chase Sapphire Reserve Top to Bottom

The Chase Sapphire Reserve is probably the best overall travel rewards card on the market. We have covered it in depth. Here are some of the posts you might want to explore after this one:

- Chase Sapphire Reserve & 5/24: Mixed Results from In-Branch Applications

- How to Activate Chase Sapphire Reserve Priority Pass Lounge & Car Rental Elite Benefits

- Chase Sapphire Reserve Full Benefits Guide Released: All Card Benefits Top to Bottom

- Chase Sapphire Preferred vs. Sapphire Reserve: Which Card to Get & Which to Keep

- How I Got Approved for the Sapphire Reserve but Almost Completely Screwed It Up! (And Other Tidbits)

- Chase Sapphire Reserve & The 5/24 Rule: It Doesn’t Look Good, But There May Be a Way for Some

- And We’re Off: The Chase Sapphire Reserve Application Link Is Live! How to Apply

Checking Your Chase Sapphire Reserve Travel Credit

To view your progress towards using your Chase Sapphire Reserve travel credit, simply login to your Ultimate Rewards account. This can be done by going to Chase.com and clicking on your Ultimate Rewards balance or by going to UltimateRewards.com and logging into your account. Make sure to select your Sapphire Reserve card if you have multiple Ultimate Rewards earning cards.

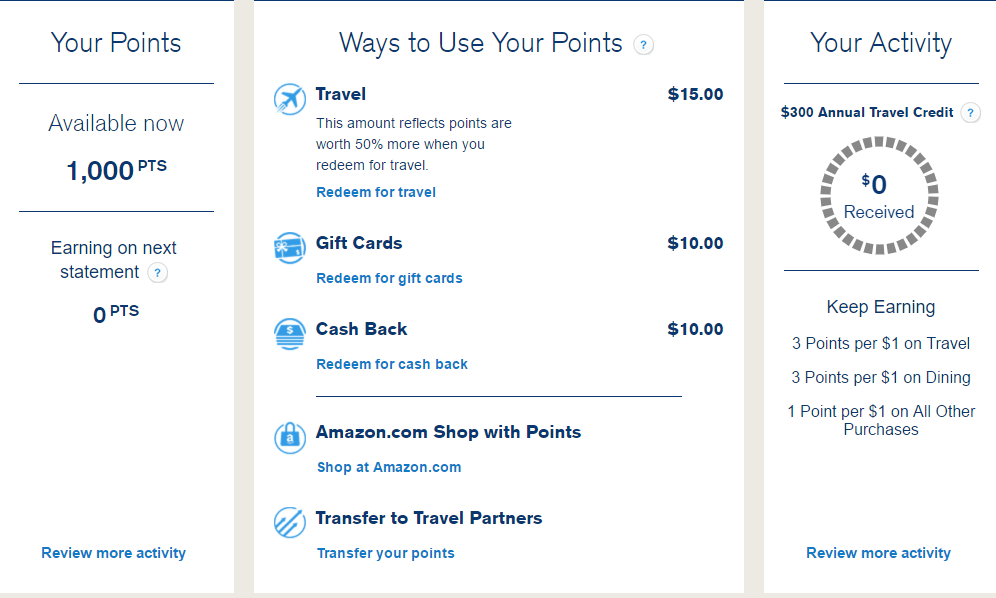

Once logged in you will see a dashboard with a variety of helpful information including how you can redeem your points and most importantly your status towards using your Chase Sapphire Reserve travel credit.

There you have it. As you can see, my card is new and I haven’t used up any of my $300 credit, but that will change soon. The Chase Sapphire Reserve travel credit is issued per calendar year, so you will want to use it up before your December statement closes. You will get an entirely new $300 credit beginning on your January statement. If you don’t use the entire $300 before the end of the year, the unused portion is forfeited.

Checking Chase Sapphire Reserve Bonus Category Spend

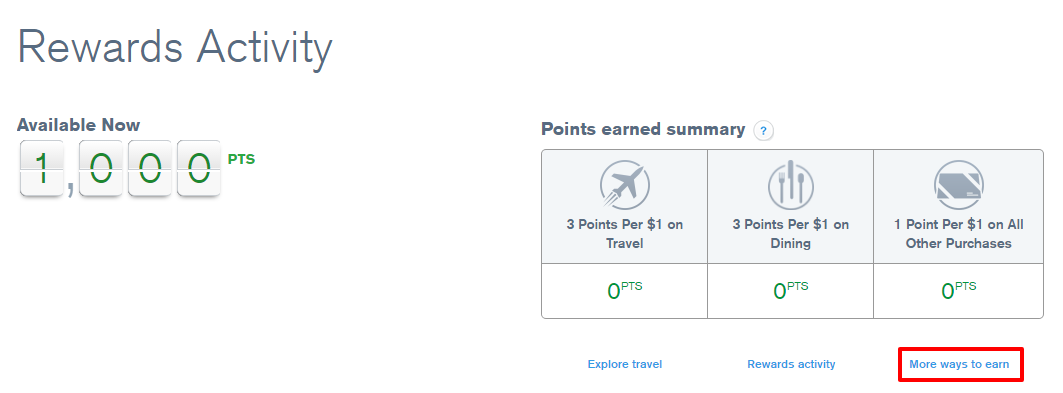

It is also quite easy to see how many points you have earned year to date in the Chase Sapphire Reserve dining and travel 3X bonus categories. To see your earnings, simply click either of the “Review more activity” links at the bottom of the dashboard (shown above) and you will be brought to the “Rewards Activity” screen.

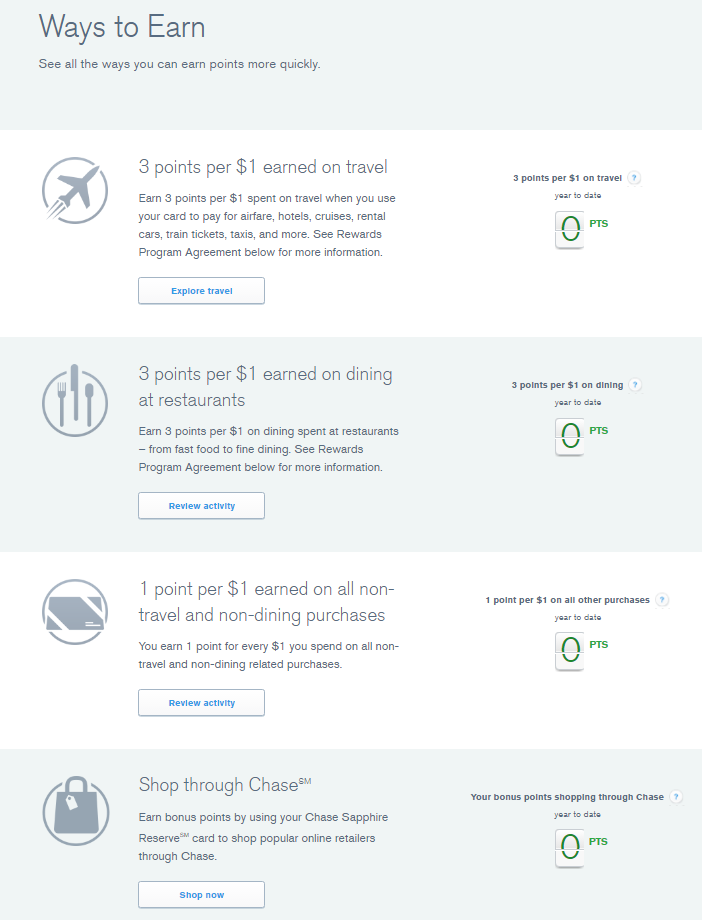

On the “Rewards Activity” screen you will be able to see your earnings for the most recent statement period. That is nice if you want to see why you earned points and how, but if you want to see your overall earnings in order to judge the value you are getting from the Chase Sapphire Reserve, then simply click “More ways to earn”.

This screen will show you your year to date earnings for the 3X travel, 3X dining and 1X everywhere categories and will even display your earnings for the Shop Through Chase portal. It is a good quick way to see how the Chase Sapphire Reserve is benefiting you through earnings and thankfully is quite easy to find.

Conclusion

One of the killer benefits of the Chase Sapphire Reserve is the $300 annual travel credit and thankfully Chase has made it super easy to track your progress towards maximizing it. Combine that with the ability to easily see your earnings on the card and Chase has delivered on their promise of creating the ultimate travel card.

[…] How to Easily Track Your Chase Sapphire Reserve Travel Credit & 3X Earnings […]

Thanks for all your work! I enjoy reading your blog, very informative and more of good to know on some topics just in case for me. However, I am so excited that I got approved for Chase Reserve card. I went to the branch closeby to our home for I want to make sure the banker can get the card expedited. I had a feeling I will get approved automatically, TU and Equifax score = 835, 4/24 have checking & savings with Chase and account of about $40k.. I was told they can only expedite for 3 to 5 business days. But the next day, I called the no. on the back of my Chase Ink plus ( read somewhere this trick could work ), explained I want to use the card to book a hotel overseas for our 40th wedding anniversary ( which is true)….and spending few minutes of chit chat…she came back after checking something and gave me the good news. As her 40th wedding present she is able to expedite my card in 1 to 2 days. I just hope the last beach villa I want to book that requires full payment will still be available.

Good luck to the rest of you. FYI, I also reduced credit limit on 2 of my Chase credit cards via secure message which was reflected within 1to 2 hrs on my account online. I truly prepared to increase my chance for this card, did not apply for any card for 7 mos or so. So happy it paid off.

Thanks Lena and congratulations!

For those of us turned down for the Reserve due to stupid 5/24, seeing the constant blog posts about it are quite depressing. Don’t we all know yet all the details of this card? The horse is dead, the beatings can stop.

I am trying to cover all of the relevant information about this brand new card that people don’t have. I definitely see your point, but I also have covered a huge change to eBay gift cards today and an Ebates promotion among other things so it isn’t just Sapphire Reserve that is being covered.

Ha ha. Maybe u shouldn’t be reading and commenting on the CSR on ALL THE BLOGS.

Those of us that were not turned down appreciate the posts. There is something for everyone, perhaps you should just move along to another blog post, as there are many to choose from.

What’s the easier way to meet min spend req that is not a walmart trip or prepaying mortgage or prepaying something?

any site i can use to send a check with my card for a fee? can i use plastiq to send bill to my wife? That way she can pay back my bill.

Thanks

Do we know yet if regular airfare will be credited back? If so, if I buy a $250 airline ticket and that is refunded, does that $250 count towards my $4k minimum spend towards the 100,000 points?

Also, are there any links to refer a friend for this card yet?

Thanks

Yeah – I’m curious about the airline credit too. The same with Global Entry/TSA Pre. Does that transaction count towards the $4K min spend?

Shawn I am loving your posts SO much. So informative. But I’m dying here, dying I tell you! My hands are tied on this one due to both 5/24 AND a house purchase but it’s killing me! I will be watching and learning as much as I can cuz I think this card is super. Thanks for all your hard work. Appreciate it and will continue to watch and learn!

Thanks Roni and good luck with the house purchase!

I see you have 1,000 points already. Did you transfer those from another UR account? I’m thinking of downgrading my CSP to a Freedom card. Curious if I should transfer the points to the CSR card first. Thanks!

You can transfer your points before or after you downgrade it doesn’t matter. Yes, those 1,000 were transferred in.

Sorry if I wasn’t more clear. The travel credit is automatic, but this allows you to track your progress towards the $300 so you make sure you use it all up.

Thx. I assume parking garages count as travel?

Shawn, was thinking that Chase simply credited the account on the first $300 of “travel” charges each calendar year. This seems to imply we have to actively apply the credit. Either that or I am not smart enough to see it. Likely the latter:)