Chase Starbucks Credit Card Review, Should You Get It?

There has been promises of a Chase co-branded Starbucks card for a while now and the application just went live today.

I do have a feeling this will be a popular card since Starbucks has a cult like following. The more savvy of us know better though!

Starbucks also has a current Chase Pay offer – check it out here!

Details on the Bonus

The Starbucks Rewards Visa card comes with a sign up bonus of 2,500 Stars (Starbucks rewards points) after you spend $500 within the first 3 months of card membership. That is enough Stars for 20 free drinks/food items (125 Stars per free item).

Remember that Star reward points expire after 6 months so you must use the 2,500 points within 6 months.

The cards $49 annual is not waived the first year.

Earning Structure

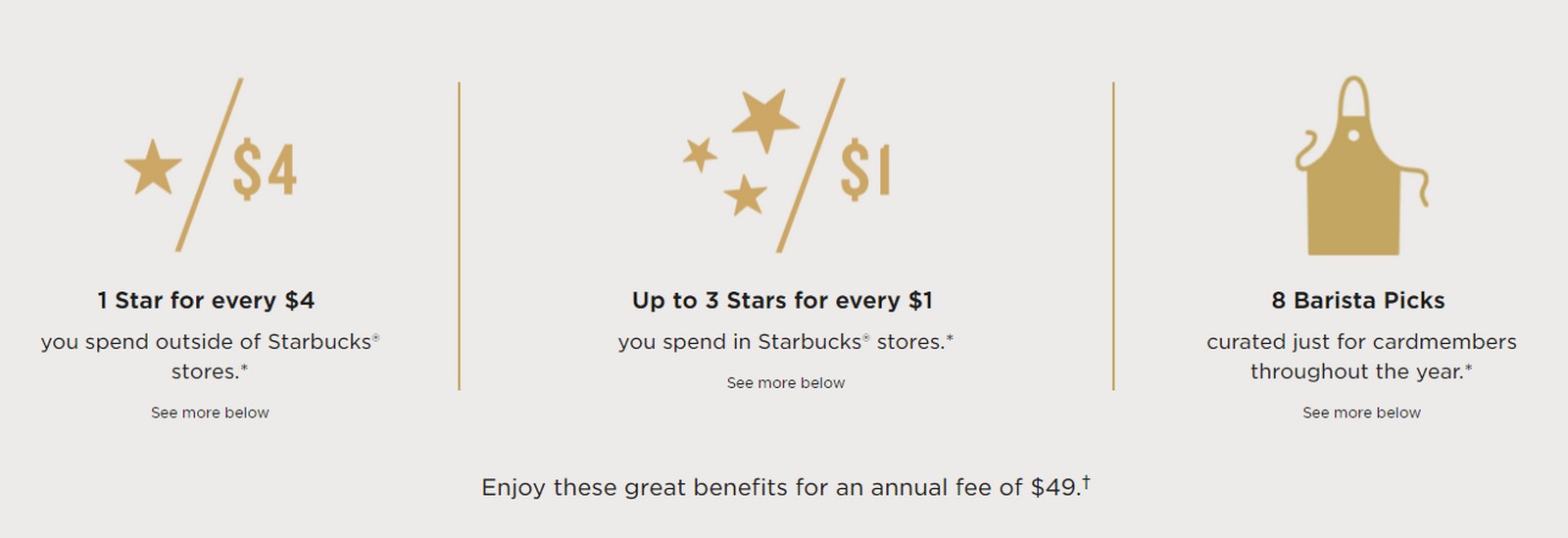

The card earns at the following rates:

- Earn 1 Star per $4 spent outside of Starbucks

- Even purchases inside Starbucks earn 1 Star per $4 if you pay directly with the card

- Earn 1 Star per $1 for Starbucks digital loads (loading your Starbucks account)

Fees

The card has the following fees:

- $49 annual fee which is NOT waived the first year

- Foreign transaction fees

Cardmember Perks

For the $49 annual fee you get the following perks:

- Upgraded to Starbucks Gold status (earns 2 Star per dollar for Starbucks purchases)

- Earn 250 Stars with your first load to your digital account with the card

- 8 barista picks per year – free food or drink item

- Coupons you will receive via to your email or app 8 times per year.

Sign Up Bonus Value – $100? ($51 net)

The sign up bonus (2500 Stars) is enough points for 20 free drinks/food items. Based on an estimated average savings of $5 per drink/food item the bonus is worth $100. Subtract out the $49 annual fee, which is not waived the first year, and you get a bonus worth a whopping $51!!!

Summary

The hoops you need to jump through to earn a measly 1 Star per dollar seems ludicrous. So if I use my Starbucks card in store to pay for my coffee I don’t get a bonus – say what?

Putting that aside, the value of a Star is 4 cents per point assuming a $5 per drink cost (average cost of a drink). That sounds like a pretty decent discount until you realize Sam’s Club sells Starbucks gift cards for 5% off all day everyday. So that is a 1% better discount and it is guaranteed – you can get whatever drink you want, even a $2 coffee without losing value. Plus you can earn an additional 2% on top of that by using a card like the Citi Double Cash which has no annual fee.

But gift cards are a hassle you say, you need to load them to your account you say. You would have a point if this card didn’t make you reload your app to get the increased rewards anyway.

Spending outside of Starbucks, or just paying at Starbucks with your card directly, it is even worse. You come away with a paltry 1% earning rate since you are only earning 1 Star per every $4 spent.

The Barista picks may help offset the annual fee, with a possible value of $40. But that only works if you like what they choose to offer you.

Conclusion

As you can see this card is a hard pass in my book. The sign up bonus is not compelling, the annual fee is overkill, and the earning rates are as pedestrian as it gets. They should have at least had the card extend your Star rewards life past the 6 month expiration. That is a perk that would have added value for little or no direct cost to them.

If the card came with no annual fee then maybe they would have a little something to work with. I don’t appreciate the deceptive marketing either saying earn up to 3 points when 2 of the points are earned from the rewards program and have nothing to do with the card.

Add in the hoops you have to jump through to earn that 1 Star per dollar, reloading your digital account, and this card falls short in every single way.

Let me know if you agree in the comments section!

The $49 annual should be waived for the first year.

I don’t see that in the terms on the application page Richard. Are you saying there is an error on the offer page and it supposed to be free the first year?

I can’t blame Charbuck’s for wanting to extract a few extra shekels, but since I always thought their coffee products were fairly acerbic, I’ll just have to pass and concentrate on planning my around the world trip in F on the ME3. Their coffee is probably just as good, heck, Austrian Air’s coffee is something for Charbuck’s to get jelly over. They could take a lesson from Austrian.

Nice 🙂

Instead of using this card, if we buy Discount Starbucks gift cards we can save more money 🙂

yup!

One word: lol 😉

Pretty much

I couldn’t agree more. What a waste.

As a side-note, Starbucks’ reward program really needs an option to scan your “membership” but pay with a credit card. There is no imaginable scenario where I would use my Corporate Card to load a Gift Card, and when traveling on business Starbucks loses a lot of my business due to the total loss of any form of reward or loyalty credit from my purchase.

Wow Jeff I didn’t know that was how it worked. I am not a Starbucks member so I wasn’t aware of that – I wonder if they save money on swipe fees by making you pay with the app and that is why they set it up that way.

For Chase it may have 5/24 rules what a waste but I believe someone will apply it.

True – unknown whether or not it is under the 5/24 rule. I am sure quite a few people will apply for it – unfortunately 🙁