| Miles to Memories does not have a direct relationship with the card issuing bank(s) and this post does not include any affiliate links. If you wish to support the site by applying for credit cards or using other referral links, you can do so here. Before applying I highly suggest reading the following posts: Slow & Steady Doesn't Make You A Loser and A Mandatory Waiting Period to Apply for Credit Cards?. You can find all of our credit card reviews here. |

|---|

Citi AT&T Access More Card

Citi has really been on a roll lately. They have been aggressively offering sign-up bonuses, targeted offers on cards, generous retention earnings and have revamped much of their product line.

Today they announced a new co-branded card called the Citi AT&T Access More Card. While the press release was a little light on facts, thankfully I was able to dig into the terms on their website to learn more.

Sign-Up Bonus

The sign-up bonus on this card is not quite typical. Here is how it works:

- Sign up for the card and spend $2,000 with the first 3 months.

- Use your card at any time to purchase a new smartphone from AT&T with no contract. (New phone purchases do count towards the $2k spending threshold.)

- Activate and maintain service with AT&T for at least 15 days.

- Citi will give you a statement credit for the phone up to $650. (Credit does not include tax, shipping or fees.)

If you are in the market for a new phone this is probably a fantastic sign-up bonus. You can get the phone off contract and take it to any carrier you want after paying for only 15 days of service.

Earning

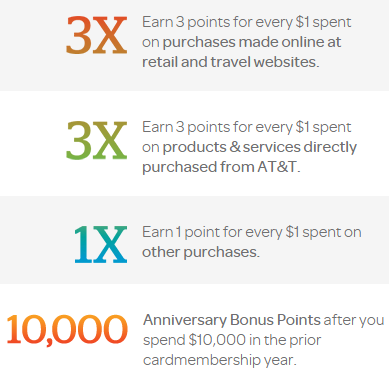

This card also has a very interesting earning structure. The first great thing about it is that the card earns ThankYou points. That is huge! Here is the earning structure:

- Earn 3X ThankYou® Points for every $1 you spend on purchases made online at retail and travel websites.

- Earn 3X points for every $1 you spend on products & services directly purchased from AT&T.

- Earn 1X points for every $1 you spend on other purchases.

- 10,000 Anniversary bonus points after you spend $10,000 in the prior cardmembership year.

- $95 Annual Fee is not waived the first year.

3x For Online Purchases?

3x earnings made online at retail & travel websites seems very interesting. While at first it may read like 3x on all online purchases, I have a feeling that isn’t true. With that said, here is how they describe the two:

“Retail websites are websites that sell goods directly to the consumer through an online website and include department store websites, specialty store websites, warehouse store websites and boutique websites.

Travel websites are websites that allow you to book travel and include online travel agencies, hotel websites and airline websites.”

They go on to say:

“We do not determine how merchants or establishments are classified; however, they are generally classified based upon the merchant?s primary line of business. We reserve the right to determine which purchases qualify for this offer. Purchases not eligible to receive the additional ThankYou Points include but are not limited to payment for or to medical services, insurance, taxes and government services, education, charities and utilities.”

Analysis & Ideas

This seems like a really solid card. If it ends up earning 3x at certain online retailers like say GiftCardMall, this could be a real game changer. We will of course have to wait and see what happens there.

As for the bonus, you are paying a $95 fee upfront and receiving a $650 bonus (if you maximize it.) A $555 bonus is very good and definitely worth a sign-up in a lot of situations. (Of course you do have to pay for 15 days of service and tax as well.) The combination of earnings potential and bonus is very appealing. Also don’t forget that you get 10,000 bonus points after $10k in spend each year which offsets the annual fee.

Finally, consider this interesting idea. Yesterday I wrote about Google’s new revolutionary cell phone service. That service requires the Nexus 6 phone. AT&T sells the Nexus 6 for $699, so this could be a cheap option for getting it if you are interested. (You do have to purchase through a special link, so there is no way to know if they will have all of their phones available to purchase or not.)

Conclusion

There is no doubt that Citi is really being aggressive in the marketplace with the revamp of old cards and the addition of new ones. The fact that this card earns ThankYou points is huge and the 3x on online purchases has the potential to be a gamechanger!

What do you think?

HT: Doctor of Credit

Now down to 2X points on purchases made online at eligible retail and travel websites 🙁

[…] While it may seem based on the subject that Citi is adding the travel category, it has been there since the beginning! For example, here is a screenshot of the offer from my post about the card in April, 2015. […]

[…] part what you see is what you get. Of course that is if you can actually get one. The card just hit its first birthday and seems to have […]

[…] Related: Citi Launches AT&T Access More Card […]

[…] For more information about the AT&T Access More card, see: Citi Launches AT&T Access More Card – With 3X for Online Purchases & Up to $650 Sign-U… […]

Does this card earn 3x at giftcard mall or giftcards?

I read no on giftcards. Not sure about giftcard mall.

I know this thread has been dead for a while, but I used this promo and I’m now almost at 60 days of service with AT&T and I’m looking to unlock my phone and switch to cheaper provider. Have you Shawn or anyone else gone through this process already, or know the right steps and timing to get this (iPhone) unlocked? Thanks!

[…] Miles to Memories […]

You need to have the phone activated and on service for at least 60 days for the phone to be unlocked, per AT&T’s unlock page.

https://www.att.com/deviceunlock/#/

Which essentially brings down the credit even more after the $95 annual fee, activation charges, and 2 months of prepaid service.

Couple of thoughts after reading your comment.

By canceling service after 15 days and paying a 3rd party to unlock the phone we’d save money. That is of course if this is even possible per At&t t&c.

The MS opportunity of this card may very well be worthwhile even if it comes without any sign up bonus.

I’m hoping more data points roll in with this offer over time.

As Anthony mentioned you can generally pay a couple of dollars to have a phone unlocked. With that said, I would wait until we have more info about which phones are available and how much they cost. When that information is public we can then judge what our actual cost will be including unlocking the phone.

Are you adding this to your next batch of cc applications? Curious to see the final cost on the phone and the time frame involved etc.

I am definitely considering it. I would like to find out some more about the card and which phones are available. If it as good as it sounds right now then I probably will.

Great info and analysis. Thanks.

@Shawn — I see on Citi’s offer page that you can “buy a new phone from AT&T, at full price and with no annual contract.” Your post then mentions that “You can get the phone off contract and take it to any carrier you want after paying for only 15 days of service.” I interpret your statement as saying the phone is unlocked and can be used on, for instance, T-Mobile, is that correct? I wouldn’t have necessarily assumed that a phone “with no annual contract” (as AT&T describes it) is the same thing as an unlocked phone. Perhaps I’m mistaken, or perhaps you have more information about that — would you be able to clarify?

Since you are paying full price for the phone and have no contract, AT&T has to unlock it. They have certain guidelines, but most people should fall into them. Here is more info: http://www.att.com/esupport/article.jsp?sid=KB414532&cv=820

Wow, I didn’t think of the GiftCardMall angle! I guess we’ll have to wait and see how this develops.

Yes could be big. I like that it accrues TY points.

Wow. This really could be a game changer. Setting aside the very generous $650, the spend categories are very complementary with other cards. Effectively 3-4x (after $10k spend) on all (most?) online retailers, and with a flexible currency at that, would be amazing. To some extent it depends how broad their “Retail Website” definition is. If it encompasses Amazon, it would be a no-brainer for me.

Worth mentioning that a combo with the currently very popular Citi Prestige card would turn those 4x into 6.4% cash on American Airlines.

Sallie Mae does 5% at Amazon up to $750/mo

does this Thank You points combine with the Prestige TK points ?

Yes you can combine these with Prestige points. The only issue with combining Citi TY points is that points expire 60 days after you cancel the card they were earned with. Even if you transfer these to Prestige, they would still expire 60 days after canceling this account.

IME (years worth) multiple TYP cards for one person earn in the same “account” so there’s no transfer (as for Amex MR) so no 60 day expiration.

I’ve had the Att universal card which gives 5x for Att purchases. This one only gives 3 . For new applications I wish they would bring that back .