Final Update on Citi App – Did the Bonus Post as Promised?

Back in June I conducted a test of Citi’s new application rules. As a quick refresher, here is the language on their application regarding getting a bonus again on the same product:

Bonus offer is not available if you have had a (insert Citi product name here) account that was opened or closed in the past 18 months.

My wife had a Citi HHonors Reserve card that was open almost two years. She was getting ready to close/convert it, which meant that she might not be eligible for the bonus on the card for another 18 months. Based on the language, I theorized that she could apply for another Reserve card before closing/converting her current one.

Overall Success

As I reported in June, she did apply for the Reserve card and was approved. A day later she converted her old Reserve card to a Citi Dividend card. I was also able to confirm the bonus amount via secure message. Everything looked to have worked.

Follow Up

In the comments of the results post, Al asked the following:

“I kindly ask if you don’t mind providing a 3rd update on this topic. I would like to know if Citi actually ends up issuing the 2 free weekend nights as they had confirmed in writing. Without any follow up on your end that is… will it be automatic or will it be a nightmare of back and forths between you, Citi and Hilton.”

Good News

Thankfully I can now provide an answer to Al’s question and it is good news. After meeting the minimum spend immediately on the card, I waited for the statement to print. The first statement printed on July 9, 2015 and I received the certificates via email on July 11, 2015.

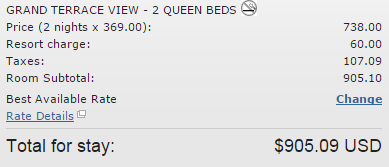

In fact, my wife just called Hilton yesterday to book a room for two nights at the Grand Wailea in Maui this October. That is the exact same hotel we redeemed the two free nights at when she got the card the first time. For the dates of our stay, the room goes for $905.09 including tax, so we are definitely getting a good value!

Conclusion

It really does seem that Citi is enforcing their application rules as written. In this case my wife received the bonus as promised without any issues or hoops to jump through. I’ll certainly be thanking Citi and Hilton when I am enjoying the amazing pool at the Grand Wailea later this year!

[…] your first card, you can potentially convert to another Citi credit card with no annual fee or cancel after receiving the bonus on card […]

Shawn, I followed your wife’s footsteps. Applied for my 2nd Citi Hilton Reserve card with the 1st one active and approx 1 month away from the AF hitting. I got approved. I do not wish to convert my current Citi Hilton Reserve to a non-fee citi card, but would rather just simply cancel the card. Do you think cancelling it now is risky and you think I should wait till i get the 2 free night certs from the new Citi Hilton Reserve first before cancelling card #1?

Shawn,

Near the beginning you wrote “Chase” instead of “Citi”. You might want to change that to avoid any confusion.

Thanks Eric. It has been fixed.

Can I still get the bonus if I already converted (not closed) the card before applying for it again? The question boils down to does Citi look at conversion as closing?

I am guessing that converting = closing, but no one has tested that. I am hoping to do it, but don’t have any cards currently in the right position. Hopefully someone will be able to provide a data point eventually.

Thanks so much for the update! I’ve been waiting to apply for a second 75k AA Executive card, and now I know it’ll work.

ill just add that i got the aa citi gold after aa citi exec during the 100k. certainly not 18 months apart. e.g. the conclusion is that they are different products.

Thanks for the data point!

Reward Boss just did a post specific to citi aa churning, referencing this post. @tri n – you may want to check it out to see if there are other citi aa cards that you can sign up for: http://therewardboss.com/2015/07/28/qualify-citi-american-airlines-credit-cards-signup-bonuses-50000-75000-aa-miles/

regarding your redemption, how much would it have cost you in hilton pts? my pt being if it costs less than 95k per night, you might be better off forking out hilton pts for the Wailea stay and saving the certs for nights where the hilton property costs 95k per

It would be 70,000 points. I am happy with the value since I primarily stay at Hyatts and have a ton of points and free nights with Hyatt to use as well. I really like the Grand Wailea, so it is more about having a property we want to stay at and getting a decent overall value.

You definitely make a good point and if I was in a situation where I had plans to stay at another high-end Hilton property before next July, then your strategy would definitely be ideal!

that’s awesome news. i will do the same with my hilton reserve when the AF comes due. in the meantime, there’s tons of other citi cards for me to churn… i mean, apply for, haha.

[…] A: We now have at least 1 data point from MilestoMemories that confirms no need to cancel account first before re-applying! […]