Citi Credit Limit Increase How to Request

Banks love to be conservative, so it isn’t uncommon for them to start customers off with a rather modest credit limit. If you have established yourself with a bank or find that you need to make a big purchase, it is often possible to get them to increase your limit. Thankfully Citi makes this quite easy.

Related: How to Easily Request a Discover Credit Limit Increase

Citi Credit Line Increase Request How To

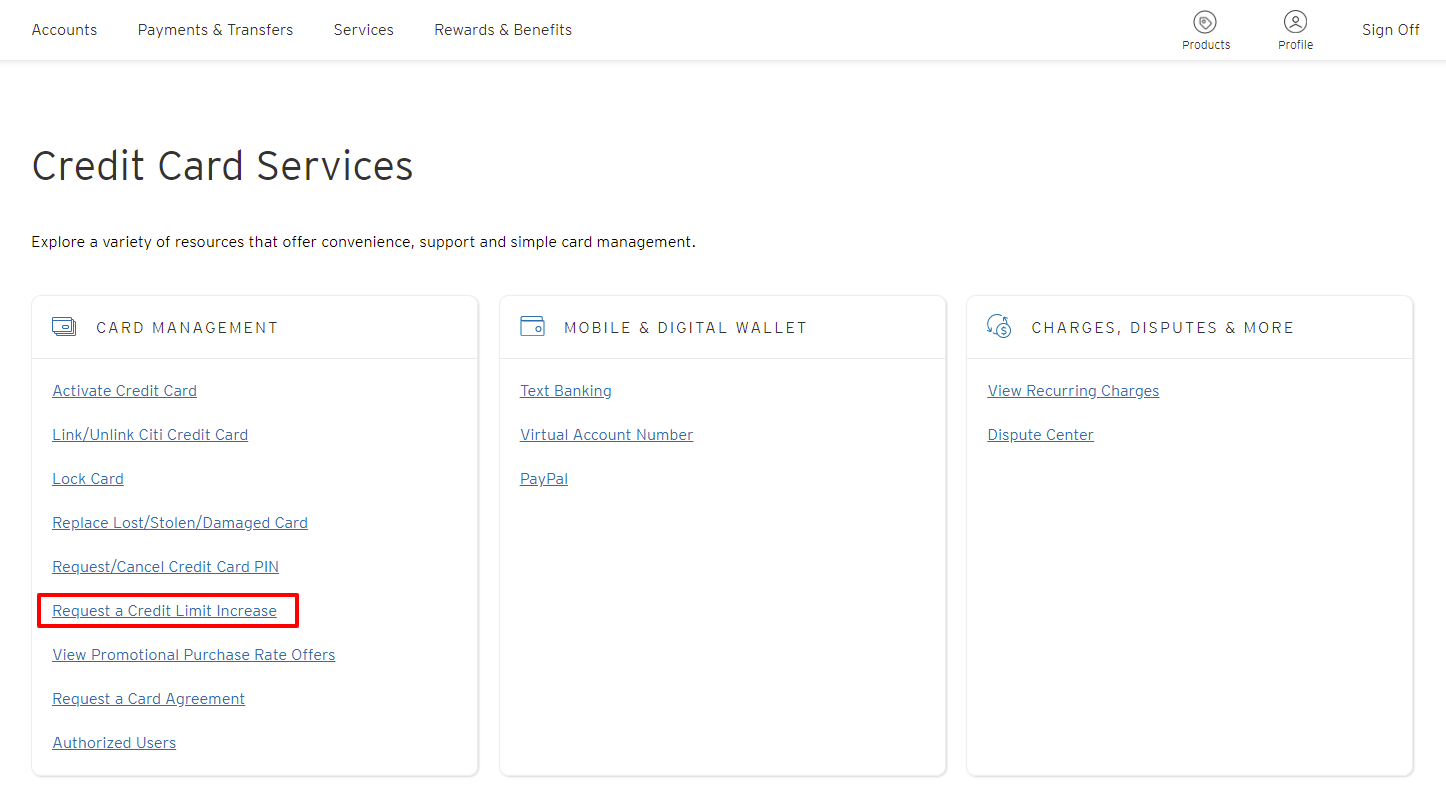

To ask for a Citi credit line increase first you must login to your account and navigate over to “Credit Card Services” which is located under the “Services” menu on the top. Once there click “Request a Credit Limit Increase”.

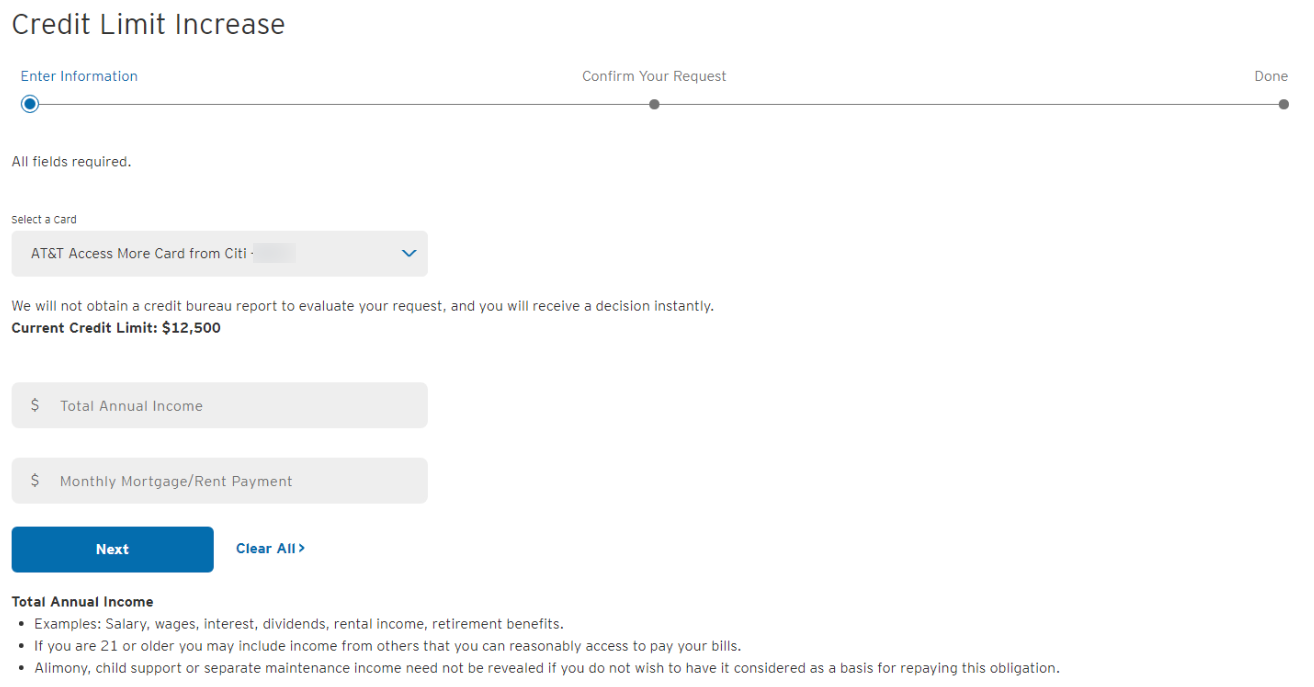

Once on the Citi credit limit increase screen you will find a drop down menu containing all of your Citi card accounts. Select the card you wish to request an increase for and the screen should look something like this.

No Hard Credit Inquiry

Notice the language above stating that Citi won’t obtain a credit report for the increase. You definitely want to look for this language, since I did notice that not all of my accounts have it. In other words, if that language doesn’t show up then Citi most likely will check your credit when you request an increase. While this isn’t the end of the world, its always best to keep your number of inquiries as low as possible.

Submit Your Request Information

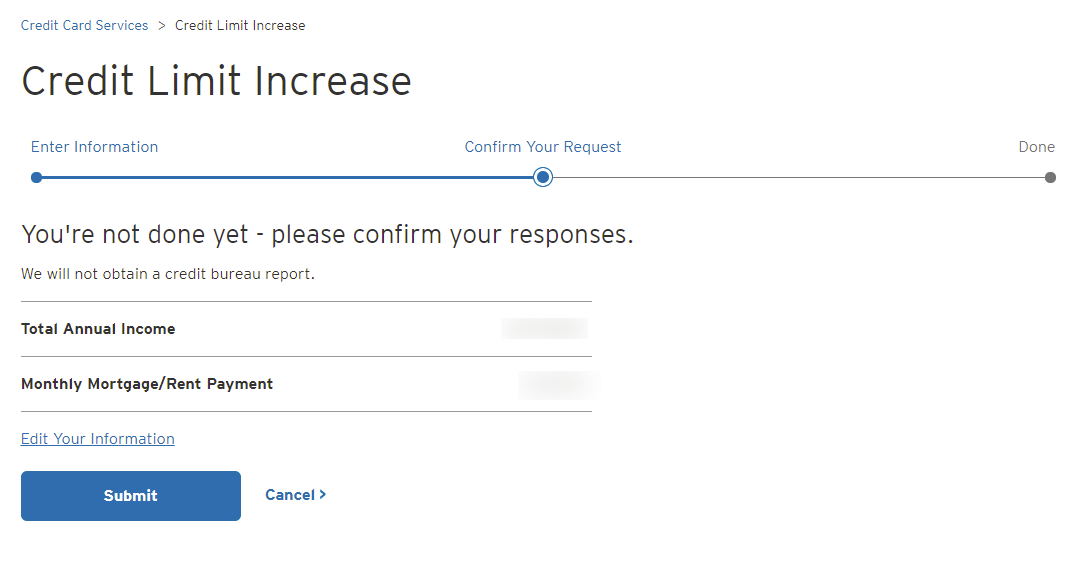

Once you have complete the questions, click “Next” and you’ll find yourself at a confirmation screen. This screen will just show the figures you entered on the previous screen and it will once again confirm that no credit report will be run.

Citi Credit Limit Increase Results

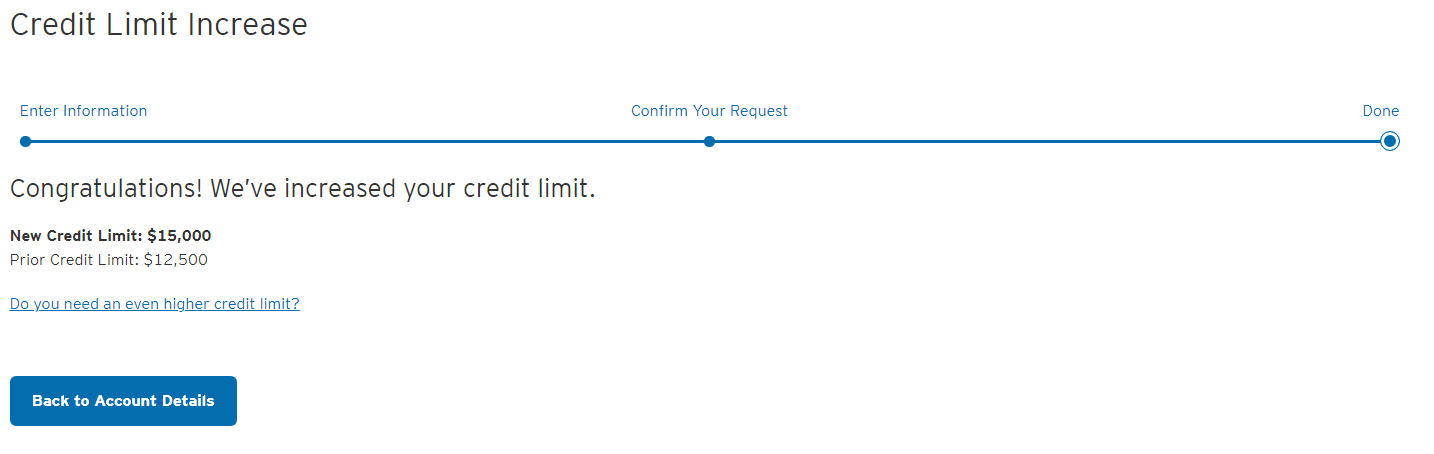

After submitting your Citi credit limit increase request you should receive an answer immediately! In this case we received a small credit limit increase without any credit check or human interaction. Simple, easy and effective. These aren’t always words used to describe experiences with Citi, so I’m happy the Citi credit limit increase process is so easy.

Bottom Line

Overall I am impressed with the Citi credit limit increase process. It seems to be transparent, it is automated and most importantly it is simple. If you need a few more dollars on your limit without wanting to call in then this is the way to go. Just make sure you see the “no credit check” language and you should seemingly be on your way to a higher limit. Happy spending! 🙂