Citi Auto-Shifting Credit Lines

Last week I did a mini round of applications. While I will write a summary post soon with all of the results, this application round was a bit off the wall. I applied for the Banana Republic credit card for a very specific reason along with the NBA credit card for potential 5X. There was also a third credit card on the list.

Citi has a ton of great offers right now, but the truth is I have most of their products. I currently hold a Prestige and Premier, I have several American Airlines credit cards and really don’t have a need for two free Hilton nights anywhere with the Reserve. What I do have a need for is Hilton HHonors points.

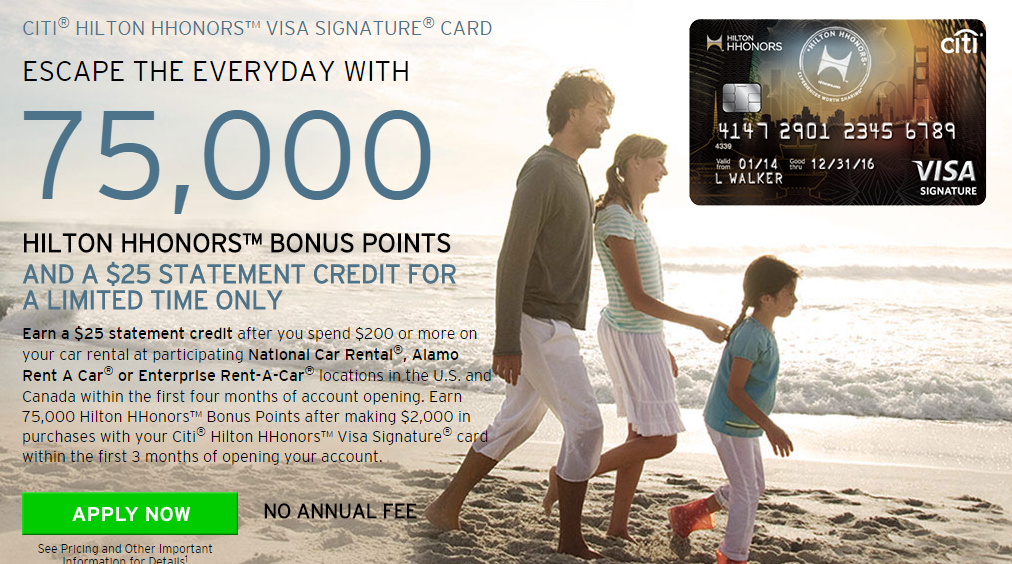

For that reason I applied for the HHonors Visa Signature with a 75K bonus (Direct non-affiliate link). There are a few reasons I chose this card:

- A 75K bonus on a no annual fee card is very very good.

- I already have two of this same product from years ago and would like to product change one. That will probably start the “18 month clock” ticking and I won’t be eligible for the bonus on this card for awhile after that.

- The Amex Surpass has an 80K bonus, but I have opened quite a few new Amex cards this year and don’t need the status since I now have HHonors Diamond. It is on my list, but now is not the right time.

The Application & Approval

After applying for the Citi HHonors Visa Signature card, I was not approved instantly, but was told the application needs further processing. This is the same message I have received on every Citi application for the past couple of years. Normally it takes a few days, they call me and the card is approved. This time something very different happened. I received an email the day after the application. This is what it said:

Congratulations, you’ve been approved!

We’re delighted to let you know you’ve been approved for the Citi® Hilton Hhonors(TM) Visa Signature® card, with a credit limit of $11,000. Your account is considered open as of today, 12/10/15.

This was good news and I was sort of shocked that Citi gave me that high of a limit. I have a lot of cards with them and am pretty close to my maximum available credit. Either way I was happy and went about my business until the next day. I received another email. Here is what it said:

Your new account, ending in —-, has been assigned a total credit line of $11,000.00. In order to extend to you this total credit line, we moved $8,000.00 from the existing credit line on your Citi account with card(s) ending in —- which had a credit line of $10,000.00. You still have an open credit line on this account for purchases.

To be honest, I don’t really care that they shifted credit from the specific card that they did, but what if they had moved credit from a card I need a larger line on? This also seems to be a new practice, because PDX Deals Guy ran into the same thing on an application this week. He received the same “Approved” email and then the same “Credit Shift” email.

What to Do?

I don’t think there is anything really wrong with what Citi is doing, but I think it is important to be aware of this new practice. If you are someone who doesn’t like to call right away, you may end up having credit shifted from an account that you need a high limit on. I would probably suggest that people call Citi so the processing can be done with you on the phone and you can decide with the agent which card has credit shifted from it.

Conclusion

In the end I’m glad that Citi continues to approve applications even if I am close to the total credit they are willing to extend to me. Now that I know they are doing auto-shifts, I’ll make sure to be proactive and call on my applications so I don’t end up with any big surprises. Has this happened to you?

[…] actually picked up one of these cards last year. Being able to earn 75,000 points on a no annual fee card is very nice and keeping this […]

[…] is also the Citi HHonors Visa Signature and its 75K bonus that I will use to supplement my account balance so I can take advantage of my HHonors Diamond […]

[…] Citi Is Auto-Shifting Credit Lines on New Applications: What Is Happening & What You Need to Kno… by Miles to Memories. This is very annoying, especially when you consider that reallocating your credit limits with Citi typically involves a hard credit pull. […]

I thought Citi’s rule was 18 months after a card has been closed…is this not correct? I was hoping to apply for this, but I have the card. Even though it has been greater than 18 months since I received the bonus, could I apply for and receive the bonus again? It still is open

Very annoying consider doing a reallocation with Citi is a hard pull.

This happened to me a year or so ago with Citi. They put a CL of about 15K on a new card and reduced another to 1K.

Since you were not automatically approved this sounds more like a case of an underwriter shifting your limits in order to approve your account. Normally you need to call them (did you submission page include a phone number and application ID?) or Citi will call you to discuss shifting lines to open a new account. If they are unable to reach you then they go ahead and shift the limits without your input.

It is possible they have started to forego the attempt to contact the applicant to cut down on processing time. I’ve had every bank there is shift lines without my input at one time or another (common when you have as many cards as we do).

The one auto-shift I can confirm though is Bank of America. Just had a card this week instantly approved and then noticed that the limit on one of my existing cards was drastically lower that it was before I applied for the new card — so it was definitely the computer that made the shift.

I have actually had this happen with BofA too, but never with Citi. You are right they are just foregoing the call to talk about shifting lines. I have no issue with it, but it is good to know what they are doing, so we can call in to make sure everything happens the way we want.

This has happened to me with amex, really annoying. Basically moved a huge amount of credit from my primary card onto the new app. I guess they figured I’d want to use a new card I applied for more than the one I’ve been consistently putting my everyday spend on.

A quick call to customer service got it all resolved. They even gave me a bit more credit line to make things more even between the old and new card.

Additional hard pull for moving credit around? I was under the impression that Citi did that for moving credit around.

Is Citi willing to product change from an AA card to the Dividend card? Or a TY card to the Dividend card? What’s the best way to ask a CSR to do this?

They generally are, although lately I have heard they have stopped some product changes. The best way to find out is to speak to a retention representative and ask the options. I normally tell them the card that I would like to switch to and have always had success.