Credit Demand Slumped During Pandemic, Mortgage Refinancing on the Rise

Demand for consumer credit fell dramatically during the Covid-19 crisis in the United States. Credit card applications have fallen to multiyear lows according to a Federal Reserve survey released this week.

The October 2020 survey shows most credit application and acceptance rates falling sharply with the onset of the coronavirus pandemic. Application and acceptance rates for credit cards and credit limit increases showed the largest declines since February 2020, followed by auto loans. On the other hand we saw more mortgage application as refinancing continued to climb through 2020, driven by demand from borrowers with high credit scores. Respondents also reported a lower average probability of being able to come up with $2,000 in an emergency; that figure now stands at 65.6 percent, a new series low.

Credit Cards

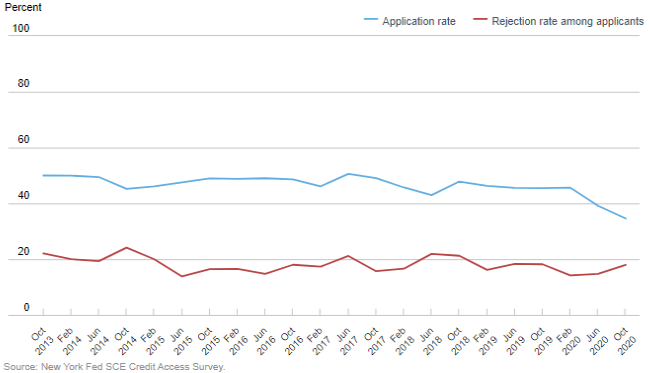

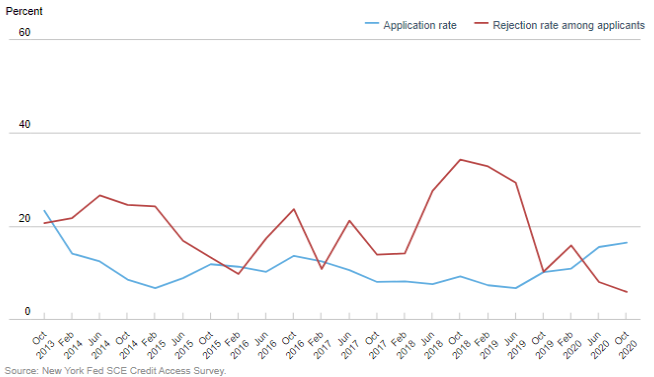

The proportion of households applying for any form of credit over the past 12 months fell by 11%, to 35%, between February and October. But the drop in demand was sharper for new credit cards, where the application rate fell 10% to just under 16%, the lowest level since the Fed began collecting application data in 2013.

The decline was broad-based across credit score and age groups, but largest for those with credit scores below 760 and those aged 60 or older. Overall, the average 2020 application rate of 39.8% was well below the 2019 average of 45.8%.

At demand for credit has fallen, financial institutions have also become more selective about extending it. Rejection rates for all types of consumer credit application rose by almost 4 percentage points, to 18 per cent, between February and October.

Credit card balances held by US banks have also fallen by about $100 billion, to $750 billion since the pandemic began. Credit card networks recorded lower spending for much of the year as consumers were focusing on essential purchases only for several months. However, Visa and Mastercard said there had been an almost full recovery in US payment volumes by October.

Mortgages

Over 15% of the surveyed households applied for a mortgage refinancing in the 12 months ending in October, according to the Fed survey. That is up from 11% in February, reflecting sharply lower interest rates. The increase was driven by those with high credit scores (above 760).

In contrast to application rates for mortgage refinancing, mortgage loan application rates declined from 6.7% in February to 5.5% in October.

You can read more information and see the results of the survey here.

“Credit card balances held by US banks have also fallen by about $100 billion.” I hear most of the drop was due to AMEX and their RAT going after the MS folk.