Discover Bank $100 Bonus – Takes Less Than 5 Minutes

I know a lot of you jumped on the recent Citigold AAdvantage and ThankYou bank bonuses. There is no doubt that the value of those bonuses justifies the effort you have to put into earning them. Still, you do have to get a $30 per month account, perform some tasks and then wait a few months.

There are of course a ton of bank bonuses that come around and some people like to jump on all of them. I tend to be more selective and look for bonuses that are easy to fulfill and justify the effort I put in. One such targeted bonus came in the mail recently and you can get in on it too if you would like.

The Offer

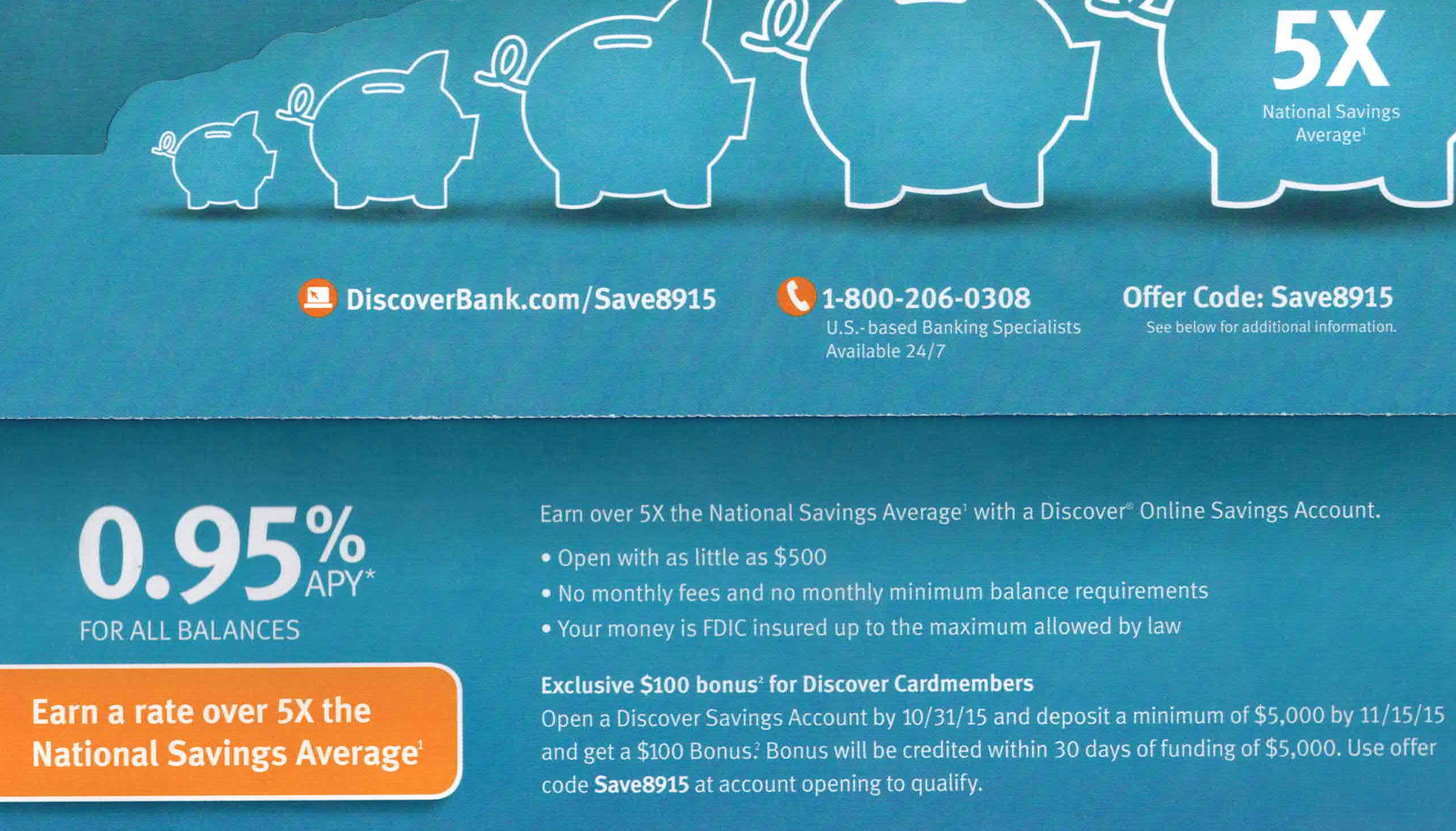

Open a FREE Discover Online Savings Account and earn a $100 bonus with a $5,000 minimum deposit. Use offer code SAVE8915 when opening the account. (Code is not unique.)

Key Terms

- $100 bonus valid through 10/31/15

- New savings customers only

- 1 per customer per account

- Bonus will be issued within 30 days of funding of $5,000 as credit to the account.

- Bonus is considered interest and will be reported on IRS form 1099-INT

One section of the flyer does say this bonus is for existing Discover cardholders, however the official terms don’t seem to mention this. I cannot guarantee if this will work for people who don’t have a Discover card, although it seems like it will.

Deal Analysis

While $100 doesn’t seem like much, you are opening a free account and they only require the funds stay in the account for 30 days. For that reason this is a no-brainer in my opinion. While you can get as complicated as you want regarding the value of the money, I try to keep it simple. My $5,000 isn’t earning that type of interest over 30 days anywhere else.

Walkthrough of Opening the Discover Account

I recently took advantage of this offer and opened a Discover Savings account. The entire process from start to finish took a total of 5 minutes. The best part is that the bonus is confirmed for you on the screen, so you don’t have to wonder if it stuck. Here is how to open the account.

Step by Step

Go to: DiscoverBank.com/Save8915 and click “Open Account”. You will be asked what type of account you want to open. Select “Online Savings” and then login to your Discover cardmember account if you have one. You will now be on the “Get Started” screen.

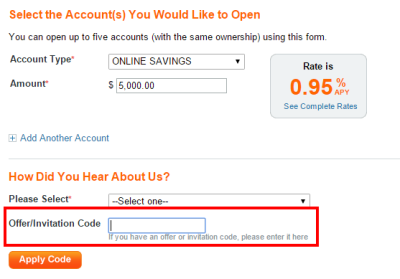

There is some information for you to fill out here. If you have a Discover card then your name and address should be pre-filled. You will also have to provide your social security number and date of birth. Many people have reported that Discover only does a soft inquiry. The key part to look at here is the “Offer/Invitation Code” box.

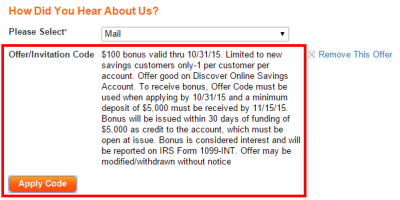

Make sure to input the code SAVE8915 here and click “Apply Code”. Once the code is applied, you should see the terms of the bonus appear on the application.

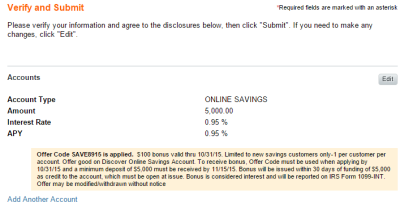

From here verify all of the other information is complete and continue to the next screen. You will now be asked to verify all of the information is correct. The bonus information is once again displayed on this screen as well.

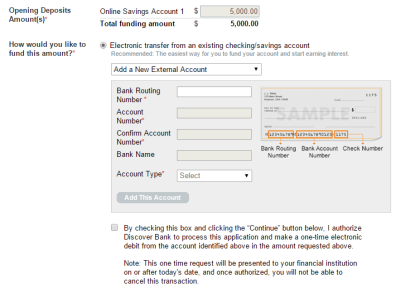

Along the way you’ll be asked to read disclosures and agree to them. Finally, you will arrive at the funding screen. Unfortunately Discover doesn’t allow you to fund with a credit card, however they do allow you to do an ACH transfer from your bank. You can also elect to do a wire transfer or send a check, but ACH is by far the easiest.

Once you have input your routing and account numbers, check the box to agree and click “Continue”. You will now see the final account confirmation. Congratulations, you have just setup an account and should get $100 within 30 days!

Conclusion

As I mentioned, I was finished opening the account in about 5 minutes. Yes $100 isn’t the biggest bonus in the world, but it allows me to take some liquid funds and help them generate much higher interest than they are receiving now. Since I already have a relationship with Discover, this type of deal is one that I would jump on every day.

[…] that Discover has had a similar bonus in the past with only a $5K deposit requirement. In fact, I opened an account last year with such an offer. With that said, considering you only need to park the $15K in the account for […]

I loved as much as you’ll receive carried out right here.

The sketch is tasteful, your authored material

stylish. nonetheless, you command get got an nervousness over that you wish be delivering the following.

unwell unquestionably come more formerly again as exactly the same nearly a lot

often inside case you shield this increase.

Nice comments , I learned a lot from the specifics – Does anyone know where my business might get access to a fillable IRS 1099-INT example to fill in ?

I keep getting this error, anyone else resolved this?

To complete your application, we will need to confirm some information.

Please call us at 1-888-204-9001 (TDD 1-800-347-7454). Banking Specialists are available 24 hour s a day, 7 days a week to personally assist you.

There is no need to re-submit an application at this time. Multiple applications may result in the processing multiple initial deposits.

Keep in mind they updated the terms for their savings and checking bonuses. Unless you were targeted you won’t get the bonus. So this may have been a blessing in disguise and one less hit to your chexsystems report.

We’re seeing this more and more lately so you have to strike while the iron is hot. PNC bank is another example of changes to bank bonus terms.

Received an offer via snail mail for $200 to open the free checking. I have a Discover cc, so I get these offers often, always at different bonus amounts….

When I tried to “sign in” to my other bank’s checking account as a verification process to do the ACH transfer of $5,000 , it suddenly gave me error message like below and cannot process my application. I did it in incognito window FYI. Anybody has same experience?

We’re Experiencing Technical Difficulties

We are currently experiencing technical difficulties which we are working to resolve as soon as possible. Please try again later. We apologize for any inconvenience caused.

If you have a Discover Credit card account, is it possible to combine usernames? I don’t want another username/password combo!

I couldn’t find a way. Unfortunately I had to create a second login.

Done! Thanks for posting this!

Sorry now I see offer, didn’t put in offer code at first

Thanks!

Just clicked the link, no mention of $100 bonus only 0.95% apy for all balances

Will opening the savings account be a soft pull if you are an existing discover card holder?

That is what others have reported. They didn’t perform a hard pull when I opened my account.

So, if I read this right, you don’t even have to leave the 5K in there for 30 days? Just deposit 5K, move it back a couple days later and you’ll still get the $100?

I just re-read the terms and the only requirement is that the account is still open when the bonus is issued, but I don’t see language saying the $5K still needs to be there. You seem to be correct. With that said, I’ll probably just leave the money there until the bonus posts.

Can a credit card be used to fund the opening balance?

No. They do not allow credit card loads.

Received snail mail with code 6915 for $50 bonus for $5k minimum deposit. I called to ask if there are higher bonuses for higher deposits but csr was adamant (but always very nice as all the Discover csr are imho) that I can only get what I was targeted for. I may send a SM with this code & mention how much I can send their way these days 🙂

If you sign-up online it confirms the bonus through every step of the process. Nowhere on my mailer does it say only targeted people can get the offer for what it is worth.

Agree this is a solid choice. I’m personally waiting for my union plus $5k check that is being held hostage before I go for another savings account. This is definitely on my radar because of the relative ease (underwear MS) and the fact there’s no fees and a decent rate of whatever it is .80 means there isn’t a huge opportunity cost.

They keep rolling offers out and part of me wants to wait because I think we’ll see more offers over the coming months but for only $5k it’s pretty tempting.

As far as getting a 1099 form, what other investment vehicle would you otherwise put this $5k in that doesn’t generate a 1099 and can be pulled within days? In essence, this is the immediately accessible funds that I keep for bills, mortgage etc. So this $5k can sit in this savings or another one like Ally Bank, which BTW will go into a tiered interest rate next month. I also don’t rely on Mango or Netspend funds being immediately accessible as I feel there’s always the risk of complication as they’re not true savings accounts and require a bit more hoop jumping to gain access to.

$5000 will get you a $50 bonus. $10,000 will get you a $100 bonus.

Where does it say that? This particular bonus very clearly states you get $100 with a $5,000 deposit.

Good find. But of course, the $100 bonus will get a 1099. Federal and state taxes on this will reduce the $100 by whatever your marginal tax rate is.

What are the terms and conditions for closing and how easy is it for the money to be redirected back to your bank of choice once you’re received the bonus?

According to their site, “You can withdraw money from your Savings Account in the following ways:

Online transfer to another Discover Bank Account or to an external bank account” This should mean that you can transfer the money out to any account. The one you use to fund should already be linked.

As for closing, there are no fees mentioned in any of the text of disclosures. There also isn’t a minimum balance or monthly fee.

How soon can you close the account out after opening? Also is there a fee if you close early