How to Avoid Mandatory Arbitration With Chase & Why You May Want To

Note: This is not legal advice. Please consult your own legal professional for information based on your own personal situation.

This is a guest post by Bethany Walsh. There is some good info in here and I can’t thank her enough for putting this together. Make sure you follow her on Twitter.

Update: There are reports on Facebook that people have been told that Chase would close their accounts if they object to this. If I find any reports of this I will add them here.

- Reddit comment that says Chase will shut down your accounts

- Reddit comments that are a mixed bag

- Comments in a DoC post go both ways

Chase has since come out and said they will not close people’s accounts for opting out.

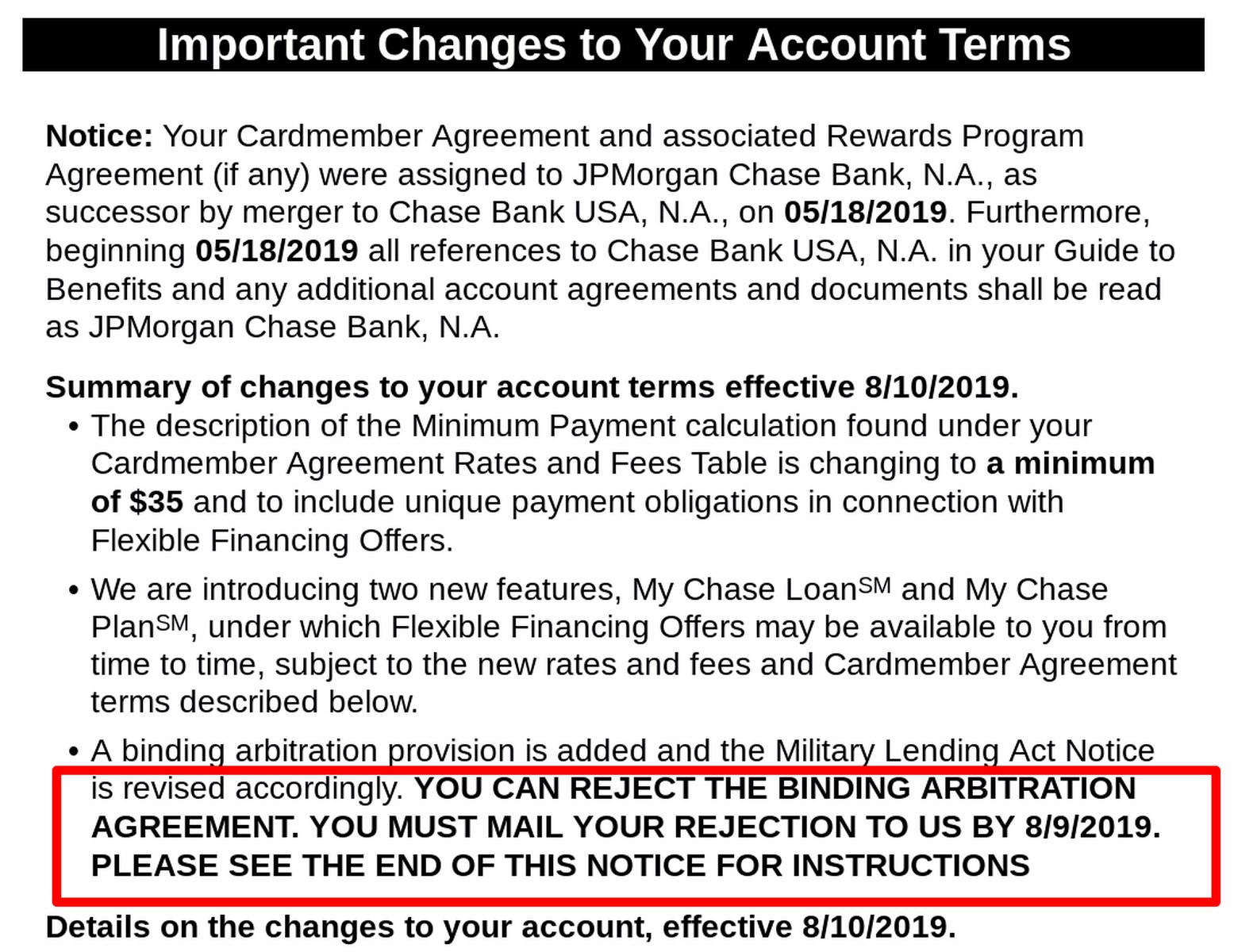

Chase sent emails for at least three of my credit card accounts today about a few changes to the account terms. The changes will modify your existing cardmember agreement with Chase in a few ways that didn’t concern me until I saw that Chase was adding a mandatory arbitration clause.

The good news is that you have the right to reject this provision and you should (I’ll explain later). As per the notice, if you choose to reject the arbitration clause, you must notify Chase no later than 8/9/2019.

How to Reject the Arbitration Clause

You must do so in writing (no later than August 9, 2019) by stating that you reject this agreement to arbitrate and include:

- your name

- account number

- address

- personal signature.

Your notice must be mailed to Chase at P.O. Box 15298, Wilmington, DE 19850-5298.

NOTE: Rejection notices sent to any other address, or sent by electronic mail or communicated orally, will not be accepted or effective.

Here are the instructions from the terms Chase sent out:

Can I (the customer) reject this agreement to arbitrate?

Yes. You have the right to reject this agreement to arbitrate if you notify us no later than 8/7/2019. You must do so in writing by stating that you reject this agreement to arbitrate and include your name, account number, address and personal signature. Your notice must be mailed to us at P.O. Box 15298, Wilmington, DE 19850-5298. Rejection notices sent to any other address, or sent by electronic mail or communicated orally, will not be accepted or effective.

What is Arbitration?

Basically, mandatory arbitration means that members with a legal claim against the bank may not sue the bank in court, instead they may only pursue a legal action through arbitration. For anyone who doesn’t know, arbitration is an out of court, binding legal proceeding where a a person or group makes a binding decision that resolves the legal dispute.

Why is Arbitration Bad for Cardmembers?

Simply put, arbitration blocks a customer’s access to court and resolving a matter through a trial with a judge or jury. The major issue for me is that mandatory arbitration precludes you from taking part in a class action lawsuit and as we’ve seen in the past, class actions against large companies can be lucrative for customers.

Banks like arbitration for several reasons. First, the proceedings are private, so if they’ve done something wrong, there’s less publicity. Second, it’s much cheaper because each individual consumer would have to bring legal action against the bank and they’re generally not going to go to the trouble for a few bucks. However, if there’s a class action it’s not just a few bucks for one consumer, it’s a few bucks for each member of the class and that could be millions of people.

Warning

There are people that have commented that Chase will shut down your accounts for this. We did not see anything in the terms about this when posting the article. Some have said that they saw reports of people calling Chase to ask and they said they would close your accounts if you refuse. Chase has since refuted this on Twitter. Others have come out and said they have sent out these letters to other banks and had no issues.

I believe it is more speculation based on results in similar instances but some have also said that was explained in the terms in those instances. You may want to reach out to Chase yourself and see what they say. You will need to weigh the pros and cons and overall risk and make the final decision yourself.

Conclusion

While I realize that the mandatory arbitration clause is probably not going to affect you it’s probably worth taking the 10 minutes to send a rejection notice.

I havent received any letter for any of my accounts- chase freedom, chase sapphire, checking/debit card.

After reading this online, I called chase to check if there was anything sent for any of my cards or accounts. They said no, no service agreements changes has been made to any of my accounts..

Thank you for your reply Shawn.

Blessings

Mary Alice

Does this arbitration letter apply only to Chase Credit cards or does it also apply to chase bank accounts?

I didn’t receive this notice for my bank accounts as far as I know, but you may want to check with Chase directly to see which accounts you have with them which might be affected.

[…] has been following the story of Chase sending emails to cardholders alerting them about needing to opt out of mandatory arbitration for disputes. The outstanding question was if Chase would cancel your account if you didn’t […]

They are saying they will not close accounts if you reject the provision:

https://twitter.com/ChaseSupport/status/1135961244760977409

Thank you Michael – I wrote a follow up post thanks to this comment 😉

https://milestomemories.boardingarea.com/chase-says-they-will-not-close-your-accounts-upon-refusal

This sounds like a petty way to get dumped and blackballed from any future business with Chase. I am not jeopardizing my current and future offers over the one-in-a-million chance I have to go to arbitration.

I really think people are overthinking this. Any new card they apply for will have these T&C anyway and in this hobby isn’t it always about new cards anyway?

[…] the email Chase sent to many of their cardmembers this week. If you didn’t bother to read it, unless you WRITE THEM A LETTER, you will no longer be able to sue them and will have to go through a…. This will also forbid you from taking part in any class action lawsuit. The question still lingers […]

I don’t know, I’m not terribly concerned about opting out. As far as class action lawsuits, the payout to covered individuals is always chump change at best…maybe a discount coupon or some token.

I see that the arbitration language still permits an individual small claims court action, if there is jurisdiction. Given the low odds that I’d ever need to take action, that’s probably sufficient.

Anyway, any new Chase card I get in the future will have this arbitration language from the beginning, with no ability to opt out, I assume? So, seems like a losing battle.

Those were my thoughts as well plus I don’t feel like mailing stuff haha

It is super common for card companies to let you keep the account but disallow any further use if you reject card changes like this. I’ve been through this in the past.

Thanks for the info Dan – much appreciated

It is, but every time I’ve encountered that, the notice of changes explicitly stated so. Nothing in these notices states anything to that effect.

That is what I found weird Ryan. I would have thought they would have to mention something in the terms about that.

Is Chase sending out emails or letters? They say you can’t reject arbitration by sending them an email, but it is okay for Chase to send me an email saying I need to comply? Hey, what’s good for the goose is good for the gander. Maybe now is a good time to consider trashing all of my cards anyway. Just keep one no-fee VISA in my wallet and forget it. With taxes on points, 1099s, variable point pricing on award dates, dumping priority pass restaurants (AMEX), devaluations and more, I’m sort of getting sick playing this points and miles game. Just take vacations when airlines have a good last minute sale and stay at 5-star, independent hotels, which are generally cheaper than the chains. I’m retired and can go anytime. My carry-on is always packed and ready to go.

They are sending out whichever way you selected to receive their information. So either electronically or via snail mail depending on how your account is set up.

I get frustrated with the constant changes too 🙂

Probably claw back any points you got in your account too? Perhaps transfer them Singapore Airlines.

Doesn’t it also say if you reject the arbitration they’ll close your account(s)?

I didn’t get one with the terms that I can check but I reached out to Bethany to get an answer on this.

Actually I found one in my trash and looked it over. I didn’t see anything in the terms that said that. Can you copy and paste the terms you saw that say that for us to look at?

Added a warning to the post about this.

You are free to reject it, but your card will be closed. Keep that in mind.

Mj can you provide some text that says that? I don’t see anything that says that in the terms they sent out involving the arbitration.

Thanks

Ya, if they want to close the credit card that’s even better. Saves me a call and possibly another written letter 🙂

Go to credit boards and myfico where people in the past have rejected changes to their credit card agreements. Many instances of chase, Barclaycard and Citi closing the account after the date the change becomes in force.

It’s clearing written in all Barclaycard card agreements when you receive your card brochure. “We may change the terms in this agreement at any time. You can reject those terms and the original terms will remain in effect on any remaining balance at that time. We will reserve the right to suspend future account activity.”

Do we simply mail them a letter that says: “Dear Chase, I am writing to reject the Binding Arbitration Agreement for the following cards:

Chase Card #1

Chase Card #2

etc.

Thank you”

That is how I read it:

Can I (the customer) reject this agreement to arbitrate?

Yes. You have the right to reject this agreement to arbitrate if you notify us no later than 8/7/2019. You must do so in writing by stating that you reject this agreement to arbitrate and include your name, account number, address and personal signature. Your notice must be mailed to us at P.O. Box 15298, Wilmington, DE 19850-5298. Rejection notices sent to any other address, or sent by electronic mail or communicated orally, will not be accepted or effective.

I will add this into the post as well

I added in a warning about this John that I wanted to be sure you were aware of.

@Mark, good catch and useful info, thanks.

Can Chase use cardholders’ rejection of the binding arbitration clause as a basis to close their accounts (or deny applications for a new/future card)?

This is my biggest worry – if I send that rejection letter to Chase, would they close my accounts?

Sorry, should have addressed the above to @Bethany (and @Mark)…

Yup totally Bethany’s find! I would say that it shouldn’t affect anything going forward. I doubt they would be that punitive over something like this but I don’t know for sure. Nothing in the terms (as far as I can see) says anything like that.

I have a few Chase cards and haven’t gotten those e-mails yet, but will now be on the lookout for them. Hopefully Chase won’t be punitive to those who opt-out, maybe you all can be the coalmine canaries on this. 🙂

I’ll probably wait until the last week to mail mine. Is it not ironic that Chase wants cardholders to accept electronic delivery of notices and monthly account statements, etc., yet insists customers (who want to opt out) send physical snail mail? I guess they have to raise the inconvenience-bar as high as possible so that some cardholders will just let it pass.

That is what they are hoping for in my opinion. That a large majority of the people won’t even read the change in terms and even more will not follow through on it.

I updated the post with a warning. There are reports from people on Facebook saying they read that people who called Chase and asked about this were told their accounts would be closed down. So I would suggest calling them yourself if you were considering it and seeing what they say.