My Plans To Max Out Chase Freedom’s 2nd Quarter 5X Categories

The 5% categories were announced for the Chase Freedom Flex and old Chase Freedom cards over the weekend. A lot of people are not overly excited about the categories so I thought I would share some ideas for the quarter. We shared a good tip in our MtM Diamond Group’s spending podcast last week that would work perfectly for some for this quarter as well.

What Are The Chase Freedom 5% 2nd Quarter Categories?

In case you missed it yesterday, here are the just announced bonus categories for Chase Freedom Flex and the discontinued Chase Freedom card for April – June, 2021:

- Gas stations

- Home improvement stores

You will earn 5% back on the first $1500 in spend in either category or a combination of both.

Points or Cash Back?

The Freedom Flex and Freedom card card earns cash back by default. However, the real strength of the Chase Freedom Flex is when you also hold a premium card with Chase. This includes the Chase Sapphire Reserve, Sapphire Preferred, or even the Ink Business Preferred Card. Having one of these premium cards enables converting your cash back into Ultimate Rewards points. In this way, you gain additional options, such as “Pay yourself back” or transferring your points to travel partners.

You can read our assessment here about deciding between the travel portal and transferring points to partners. You also have the option of cashing out your points/cash back at $0.01 each (1 cent per point). Generally it is not a good value to cash in your Ultimate Rewards points. As you can see, multiple options exist for redeeming the cash back/points at a higher value than which you are earning them.

My Plans For The 2nd Quarter

This is a tougher quarter for some, especially for people that don’t drive much. Which is many of us these days with many working from home.

Obvious Choice – Regular Spend

This one is the obvious choice but I need to say it anyway. You can put a dent into the $1500 buying your normal gas and coffee etc. at the gas station. If you have any home improvement projects, think flowers in the spring etc., then you can work the total down with those purchases.

Tip: a tip for regular spend is that many 7-Eleven stores code as a gas station with Visa even if they don’t offer fuel. So if you frequent one for snacks and Slurpees etc. be sure to bust out your Freedom cards starting next month.

Gas Station Rewards

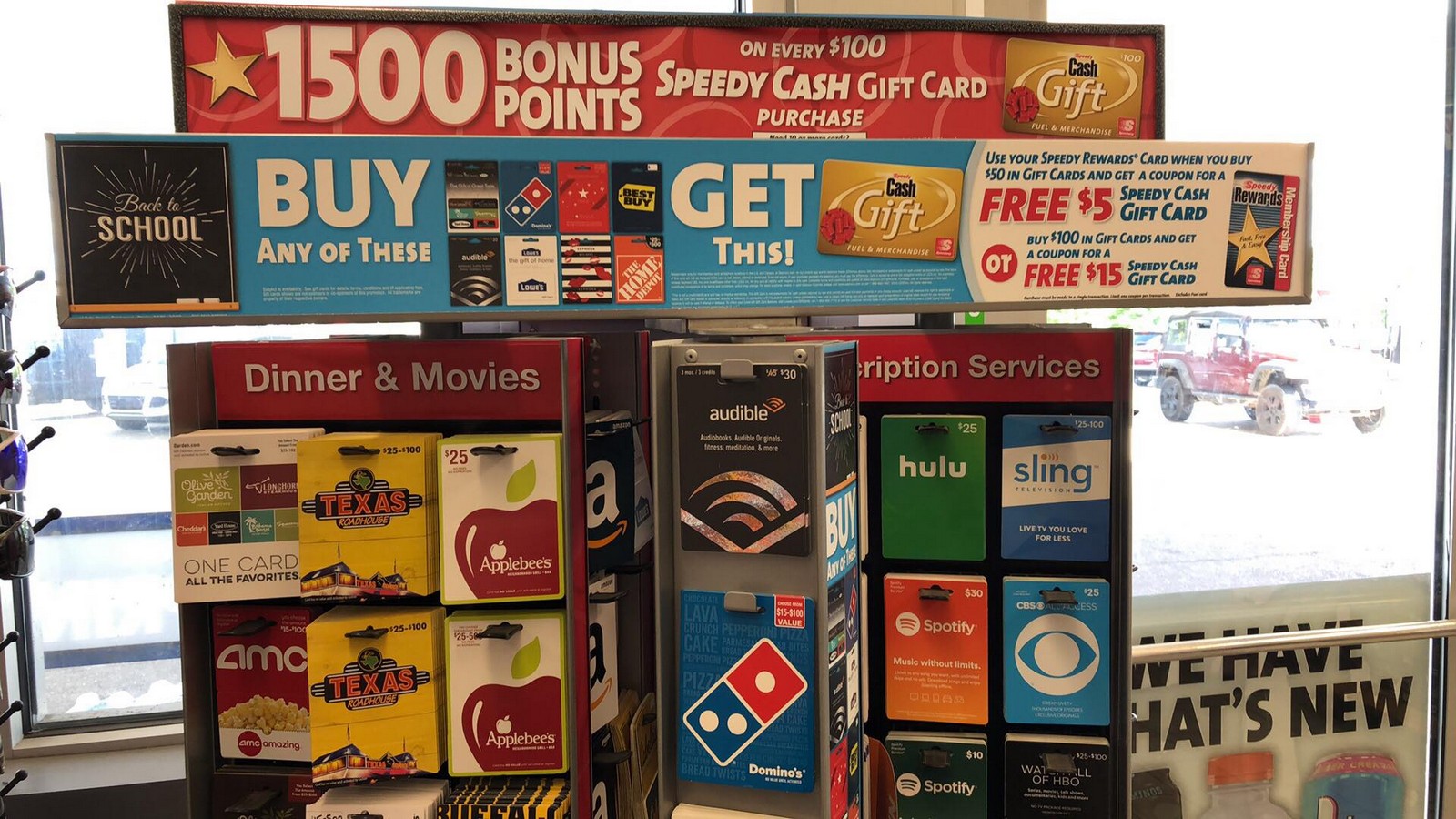

While not as lucrative as many grocery stores some gas stations offer rewards programs. Think Speedway’s Speedy Rewards. These will often offer bonus points for buying 3rd party gift cards. They will sometimes have promos that give you $10 off gift cards etc. so you can use this as a way to earn 5X plus some stacking opportunities on something you were going to buy anyway. Use the 3rd party gift card to make your purchase at 5X earning versus the normal 1X earning you would get.

Tip: If your grocery store has a fuel station as well check and see if they have store brand gift cards. This may earn you 5% on the purchase and then you can use the store gift card to get groceries in the store. Do a smaller purchase first to ensure it codes properly.

Home Improvement

You may not need anything for your place and are completely overlooking this option. The home improvement stores, especially Lowe’s, have gift card racks that rival many grocery store options. So you can use the same trick as listed above for gas stations. I would put this slightly below gas stations because there are no store rewards for the purchase (assuming you have a gas station with a rewards program). If you don’t have that option then this offers more variety vs a gas station.

Tip: The grocery everywhere Visa gift cards sold at Lowe’s are $1 cheaper than the standard Visa Gift Card and will work at most Walmart stores etc. We shared another good tip about these cards in the Diamond Lounge last month as well.

Chase Freedom Flex Welcome Offer

If you don’t currently have the Chase Freedom Flex card (and aren’t over 5/24), it can be a great first card to get with Chase and it has a decent bonus right now.

- The Offer: Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening with no annual fee.

More Info

Max Out Chase Freedom’s 2nd Quarter – Final Thoughts

There you have it, my plan for racking up 5X Ultimate Rewards with my Chase Freedom next quarter. This one should be pretty easy for me to hit. Hopefully I gave you some good tips that will make it easy for you as well.

What is your game plan for next quarter? Share it in the comments below.

Love Speedway. Glad I have both Freedom’s. And will definitely think about buying the everywhere Visa.

Speedway is clutch for these promos for sure.

Lowe’s sells grocery everywhere VGCs with max load of $200 so activation fees of $4.95 are 2.5% (or more for other kinds of VGCs). Better to get $500 VGCs at 7-11 for same $4.95 activation fee. Or other 3rd party GCs with no activation fees.

Does 7-11 code as gas station?

Always has for me.

Going to check on the max for VGC’s at Speedway as well. Thanks

Very true if you have a 7-11 that allows CC for GC purchase (not all do while all Lowe’s do).

I’m buying visa gift cards at Home Depot or lowes. Seems like the easiest method

It is the option most everyone will have for sure.

What’s the largest denomination at Lowe’s? Been a while since I’ve been there.

For a Visa card it is $200

Ugh, thanks.

I dropped by and they’ve got quite a nice stash of cards: Amazon, Visas, Apple cards, even Kroger gift cards (I think Kroger, Amazon, and the Apple cards will be my items). They also have some self checkouts; any idea if I can buy them at the SCOs?