Chase Ultimate Rewards Guide: How To Earn, Redeem & Partners

Chase Ultimate Rewards points are some of the most highly prized points out there, because they are extremely flexible and can be redeemed in several ways. Chase also has one of the most extensive selection of transfer partners. More options means more value. In my Chase Ultimate Rewards guide I will go over how to earn these points, how to redeem them, go through all of the available cards and discuss their transfer partners.

Updated 9/9/21

Chase Ultimate Rewards Quick Overview

The Chase Ultimate Rewards program is also home to the Sapphire Reserve, Sapphire Preferred and the Ink Business Preferred–3 of the most popular rewards cards on the market. Each of these credit cards earns Ultimate Rewards Points in lieu of other rewards like cash back or miles. Remember that cash back is one way to redeem these valuable points.

There are different methods available to earn Chase Ultimate Rewards (UR). Most UR earnings opportunities are tied to credit cards, but there are a few other ways, such as shopping through the Ultimate Rewards shopping portal. An interesting way I’ve seen to earn Ultimate Rewards points is to take out a mortgage with Chase, offers can go up to 100k points. You can earn points by referring friends and family and adding authorized users. There are also ways to earn with checking and savings accounts.

The value of Chase Ultimate Rewards varies based on redemption methods. There are several ways to redeem Chase points so your personal valuation will depend on your preferred method of redemption. Check out this post discussing redemption methods. Of course the objective is to get the greatest value out of your points, but it really depends on what makes sense for you. The goal of this guide is to give you all the information you need to understand the ins and outs of this lucrative program and figure out the best redemption methods for yourself.

The absolute minimum value you should get for UR points is $0.01 each since you can redeem them at 1 cent with the cashback option.

Related: Our Complete Chase 5/24 Guide

Chase Ultimate Rewards Credit Cards

Every credit card that is part of the Ultimate Reward Family is subject to Chase’s 5/24 Rule, thus it is very important that you are familiar with it. Check out our Chase 5/24 Guide here for everything you need to know about the rule. Because UR cards are such a prominent factor in rewards decisions, it’s a good idea to read our Beginners Application Strategy so that you have some insights into a successful plan.

The Sapphire cards also have the Sapphire family rule.

The Chase Ultimate Rewards earning lineup:

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- Chase Ink Business Preferred

- Chase Ink Business Unlimited

- Chase Ink Business Cash

- Chase Freedom Unlimited

- Chase Freedom Flex

Cards people still carry but are no longer available for new customers:

Ultimate Rewards Program Rules

Points Transfers

Transfer points to another person: If you have a personal card you may transfer points to the Ultimate Reward Accounts of other members in your household. If you have a business account, the person must be a member of your household or an owner of the business.

Transfer points to another person’s loyalty account: On personal accounts, you can transfer points to someone else’s loyalty program only if they are a member of your household AND an authorized user on your account. For Business cards, the recipient must be an owner of the company AND an authorized user. Read our “how to” guide on transferring points here.

Combining Points: You can combine your points by transferring them to another one of your UR accounts through either Chase.com or the UR site. This can help you maximize your value.

Cash-Back Cards (But Not Exactly)

The Chase Freedom Flex, Chase Freedom Unlimited, Ink Unlimited and Ink Cash are technically cash back cards, but they can actually earn UR Points. You need to have a premium Ultimate Rewards-earning card to fully unlock the value of the points earned by these cards. The premium cards are the ones that come with an annual fee: Sapphire Reserve, Sapphire Preferred, Ink Preferred and Ink Plus.

Ways to Earn Ultimate Rewards

There are several ways to earn Ultimate Rewards, it’s worth noting UR points are not available for purchase, they must be earned.

- Credit card welcome offers

- Credit card earnings from your spend

- Chase Ultimate Rewards Shopping Portal

- Occasional offers on other Chase products (bank accounts, mortgages etc.)

- Referrals: ChaseReferaFriend.com

Credit Card Welcome Offers

Signing up for a new Chase Ultimate Rewards card is the best way to earn a big chunk of Ultimate Rewards Points. Currently, there is an awesome welcome offers on the Sapphire Preferred.

Credit Card Earnings

| Card | Bonus Earning Category |

|---|---|

| Chase Sapphire Reserve | 10x on Chase dining, hotels & car rentals in Chase travel portal 5x airfare in Chase travel portal 3x dining and travel 1x everything else |

| Chase Sapphire Preferred | 5x Chase travel purchases 3x on dining, select streaming, select online grocery 2x on travel 1x everything else |

| Chase Ink Cash | 5x office supplies, cable, internet, phone (on first $25k combined category spend per year) 2x gas and dining (on first $25k combined category spend per year) 1x everything else |

| Chase Ink Business Preferred | 3x on travel, shipping purchases, Internet, cable and phone services, advertising purchases on social media, and search engine optimization 1x everything else |

| Chase Freedom Flex | 5x on rotating categories 5x booking through Chase travel portal 3x drug stores 3x restaurants 1x everything else |

| Chase Freedom Unlimited | 5x on bookings in the Chase travel portal 3x drug stores 3x restaurants 1.5x on everything else |

Check out this post about how to earn 5x Chase Ultimate Rewards Points with the Ink-branded credit cards, plus our bonus categories post, which covers the rotating categories for Chase Freedom products. The Chase Ultimate Rewards Card Strategy Guide can help you understand how to maximum earn points across the cards and transfer them to get the most value.

Chase Ultimate Rewards Shopping Portal

The shopping portal is just like any other, except you can earn Ultimate Rewards in lieu of cashback or loyalty points/miles. If you have a Chase Freedom Flex, you can stack the shopping portal rewards from retailer within the rotating 5% bonus categories and earn up to 10% back.

Occasional Offers on Other Chase Products

Chase has offered Ultimate Rewards bonuses for signing up for or using some of its other services. An offer for 100k UR for taking out a mortgage from Chase Bank has been around in the past. There have also been targeted bank Chase Private Client account bonuses offering UR Points in lieu of cash bonuses.

Referrals

Once you have a Chase card, you can refer friends and family members to sign up for cards and you’ll receive a referral bonus on each–up to 100K Chase Ultimate Rewards Points per year. Referrals are available through Chase.com and the mobile app.

Ways to Redeem Ultimate Rewards Points

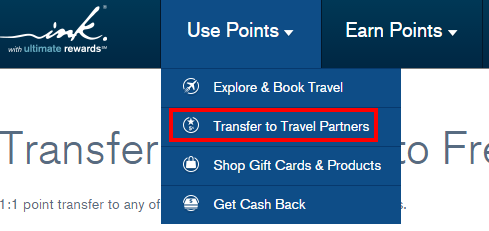

- Transfer to Travel Partners

- Book travel through the chase travel portal

- Redeem for cash back

- Pay Yourself Back

- Gift Cards

- Pay with points on Amazon

Transfer Partners

One of the best ways to maximize the value of Ultimate Rewards Points is to transfer them to Chase’s Travel Partners to book award tickets. In order to be able to transfer points to partners, you must have a premium card from the list above, i.e. Chase Sapphire Reserve, Chase Sapphire Preferred or Chase Ink Preferred.

See also: How To Transfer Chase Points: A “How To” Guide

Airline Transfer Partners (Unique Partners Bolded)

- British Airway Executive Club

- Flying Blue AIR FRANCE KLM

- Singapore Airlines KrisFlyer

- United MileagePlus

- JetBlue

- Southwest Airlines Rapid Rewards

- Virgin Atlantic Flying Club

- Iberia Plus

- Aer Lingus AerClub

- Emirates Skywards

- Aeroplan

Hotel Transfer Partners

- World of Hyatt

- IHG Rewards Club

- Marriott Bonvoy

Book Through the Chase Travel Portal

The Chase travel portal is similar to other online travel booking sites, especially the Citi ThankYou and Amex Travel portals. The amount your Ultimate Rewards are worth when booking travel depends on which cards you have. If you only have the no-fee versions, your points are worth a flat 1 cent each toward your booking. However, if you have either the Ink Business Preferred or the Sapphire Preferred, you can redeem them for a value of 1.25 cents each. The absolute best value you can get from booking through the travel portal is for Chase Sapphire Reserve cardholders: their points are worth 1.5 cents each, which can be a great value if you’re able to find a deal or promotion. We have a comparison guide for consideration: Chase Ultimate Rewards Points: Should I Transfer Points to Travel Partners or Book Through Portal?

One unique feature of the Chase travel portal is that it allows you to book trip extras, like excursions and transportation, using your points.

Cash Back or Statement Credit

Each Ultimate Rewards point is worth $.01 when redeeming for cash. This is a good option if you are not a huge traveler or already have way more points than you need.

Pay Yourself Back

Chase Pay Yourself Back exists on several Ultimate Rewards earning cards. This lets you redeem your points for a statement credit but at a higher than 1 cent per point rate. It only works in certain categories:

- Chase Ink Business Preferred and Plus

- Through September 30, 2021, cardmembers can redeem points worth 25% more on shipping, home improvement, Internet, cable & phone services.

- Chase Ink Business Cash and Unlimited

- Through September 30, 2021, cardmembers can redeem points worth 15% more on Internet, cable & phone services.

- Chase Sapphire Preferred and Chase Sapphire Reserve

- Continuing through April 30, 2021, Sapphire Reserve cardmembers’ points will be worth 50% more, and 25% more for Sapphire Preferred cardmembers, when redeemed for statement credits through Chase towards purchases at grocery and home improvement stores, when dining at restaurants, including takeout and delivery services, as well as contributions to eligible charitable organizations. Sapphire Reserve members can also redeem their points against the annual fee.

- Chase Freedom Flex and Chase Freedom Unlimited

- Through September 30, 2021, points are worth 10% more when redeemed for dining purchases. There is a cap of $250 worth of dining purchases for these redemptions.

- All other Ultimate Rewards eligible credit cards, including Chase Freedom, Freedom Unlimited, and Freedom Flex

- Through the end of 2021, points will be worth 25% more when redeemed towards donations made to eligible charitable organizations.

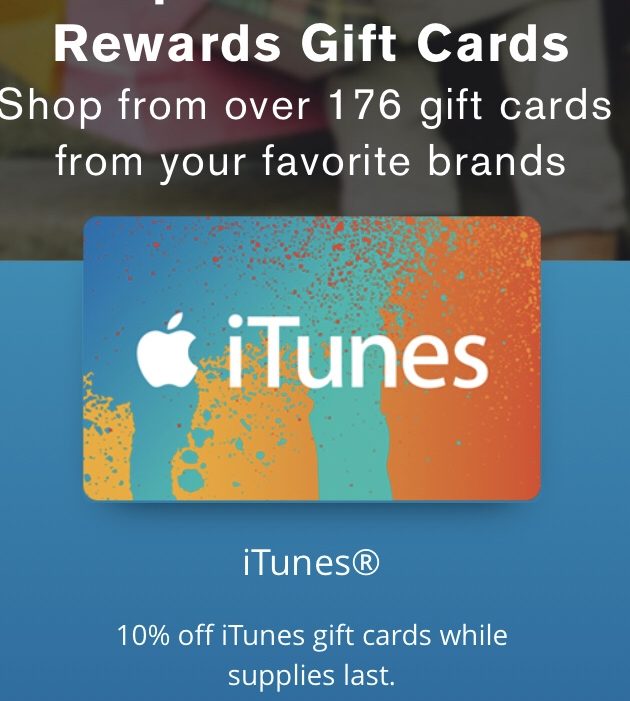

Gift Cards

This is generally not recommended. Each Ultimate Rewards point is worth $.01 when redeeming for gift cards. If you are looking for a gift card, it generally makes sense to redeem your points for cash and then to use a credit card to buy the gift card, so you earn rewards. However, the Ultimate Rewards portal sometimes has sales where you can redeem your points at a higher value towards certain gift cards, such as 10% off.

Amazon Pay with Points

Points are worth 1 cent or less when redeemed this way. Paying in full for your Amazon purchases in this way is not a good option. The best time to use this is when you are eligible for a promotion, such as 30% off if using points for part of your purchase. This tends to work with even just 1 point.

Chase Ultimate Rewards Guide: Final Thoughts

There’s a reason Ultimate Rewards points are so highly regarded. You can earn points on a variety of different cards. You can earn them in a variety of different categories. Plus, you can use those points in a variety of different ways. Instead of earning points one way on one card, you can earn them many ways across many cards. This is incredibly powerful and makes these points highly valuable.

Please share any questions you have in the comments below.

[…] This is really comprehensive: Chase Ultimate Rewards Points Guide: Earning, Redeeming and Card Brands. […]

[…] UR Points Guide: These points are definitely some of the most popular flexible currencies around. They have very appealing transfer partners and their credit card line up covers many popular spending categories. Here’s a good guide to show you the ropes. […]

I find transferring to Southwest to be worth the most, since with Southwest you can book in advance and cancel later as necessary. This is worth a lot to me, since if the flight goes down in price you can rebook, or if it gets way cheaper on another airline you can cancel the southwest flight and book through the Chase portal with the cheaper airline.

Jason,

If you have the Chase Sapphire Preserve and you specifically want to use the points for southwest, you’re better off calling chase and asking them to book a southwest flight using UR points. This way you get 1.5x value instead of ~1.3x and more importantly the fare will count as a cash fare so you get 6x southwest points on the cash rate.

Hi Jeff!

How we can get 6x?

Good advice.

FYI, it’s Chase Sapphire Reserve (not “Preserve”).

🙂

I have Chase Ink Plus, can I refer my same sole proprietorship to the Chase Ink Preferred since I don’t have that? I ask since Chase is allowing us to refer the Chase Ink Preferred even though we only have the Ink Plus.

That’s interesting. My guess would be technically no since it’s the same business entity. Do you have an EIN? You could apply for one and use that, probably increases the chances of getting the referral. If not, you could always use ours 🙂 lol

I don’t have an EIN but I have been told that if it’s an EIN referring another EIN with same owner it will work. I appreciate the referral offer however if I couldn’t refer myself then I was planning to go in branch as they have.a 100k offer. I’m trying to save needing to make a visit though